By Lawrence G. McMillan

Okay, there are new products that are not exactly the return of those two very popular ETN’s representing volatility trading (TVIX was double the price/speed of $VIX, and XIV was the inverse of $VIX), but two new ETF’s are attempting to do the same thing.

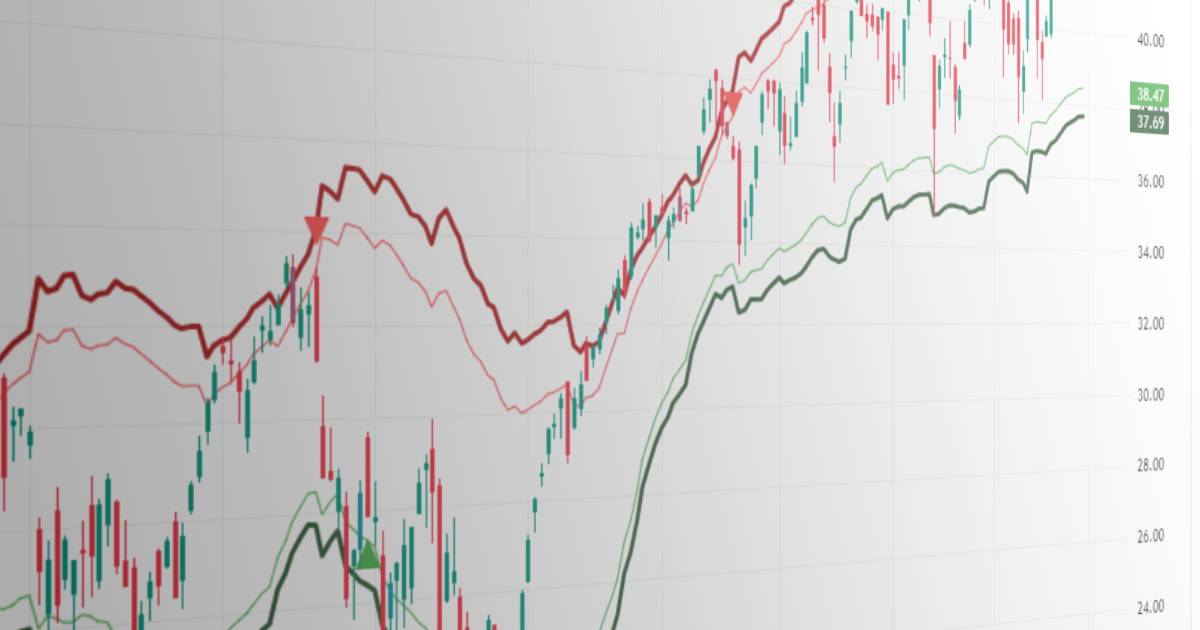

UVIX is double $VIX, and SVIX is the inverse of $VIX. These are at the same speed that the old ones were. Currently the only products that are similar are UVXY (1.5 times the speed of $VIX) and SVXY (half the speed of the inverse of $VIX). Both of those used to have higher multiples (2 and 1, instead of the current 1.5 and 0.5), but the frailties that were exposed in the volatility explosion of February 2018 caused those constants to be reduced and also caused the previous popular and heavily traded TVIX and XIV to be delisted.

Both of these new products, UVIX and SVIX, have listed options. We will continue to monitor their progress, but they seem to be a welcome addition to the array of products available in the volatility space. I would encourage readers to go to the Volatility Shares website and download the prospectus of each ETF, so that you have a full understanding of how they are calculated and priced.

These two new ETF’s are based on two of the many indices that the CBOE calculates daily – SHORTVOL and LONGVOL in this case. Those indices are calculated using the price of $VIX futures. In fact, all of the volatility based ETNs’ and ETF’s use $VIX futures as their underlying. As a result, there is a wasting away over time in a bull market, when the term structure of the $VIX futures slopes upwards.

The pertinent information can be found at:

https://www.volatilityshares.com.

There is also a blog post about these products on the “The Option Insider Radio Network,” with the topic: Volatility Views: XIV Rides Again.

Of course, we all remember what happened in early Feb 2018, when the price of the $VIX futures doubled in one day. That made XIV worthless, and it appears that it could happen with SVIX (the “short $VIX” ETF). So, understand what you’re doing if you trade these products. They are certainly viable, but require your understanding before you trade. #

This article was published in the 4/8/2022 editioin of The Option Strategist Newsletter now. Existing subscribers can access the article here.

© 2023 The Option Strategist | McMillan Analysis Corporation