Feb, 14, 2025

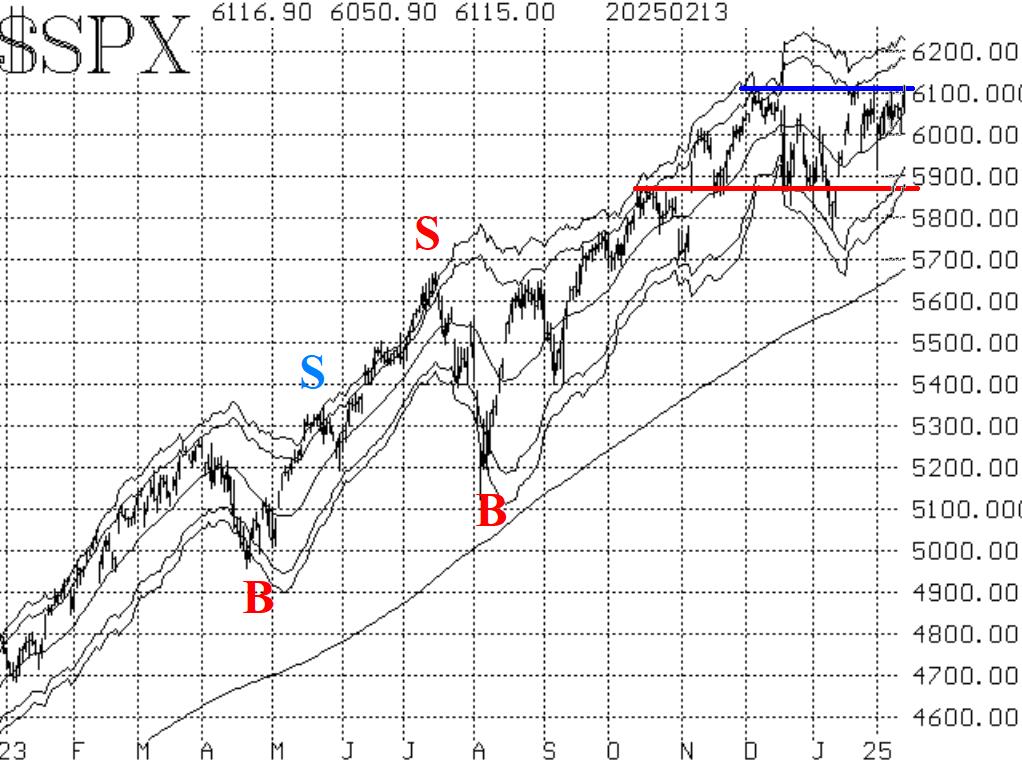

By Lawrence G. McMillanStocks are still in a trading range, but barely. $SPX made a strong move on Thursday, back to the 6100 area and above, which is very near the all-time high. The all-time high...

Feb, 10, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on February 3, 2025.

Feb, 10, 2025

By Lawrence G. McMillanThere are some longer term seasonal patterns that affect the stock market. One is that years ending in ‘5’ have generally been quite bullish since the first one in 1895 (...

Feb, 07, 2025

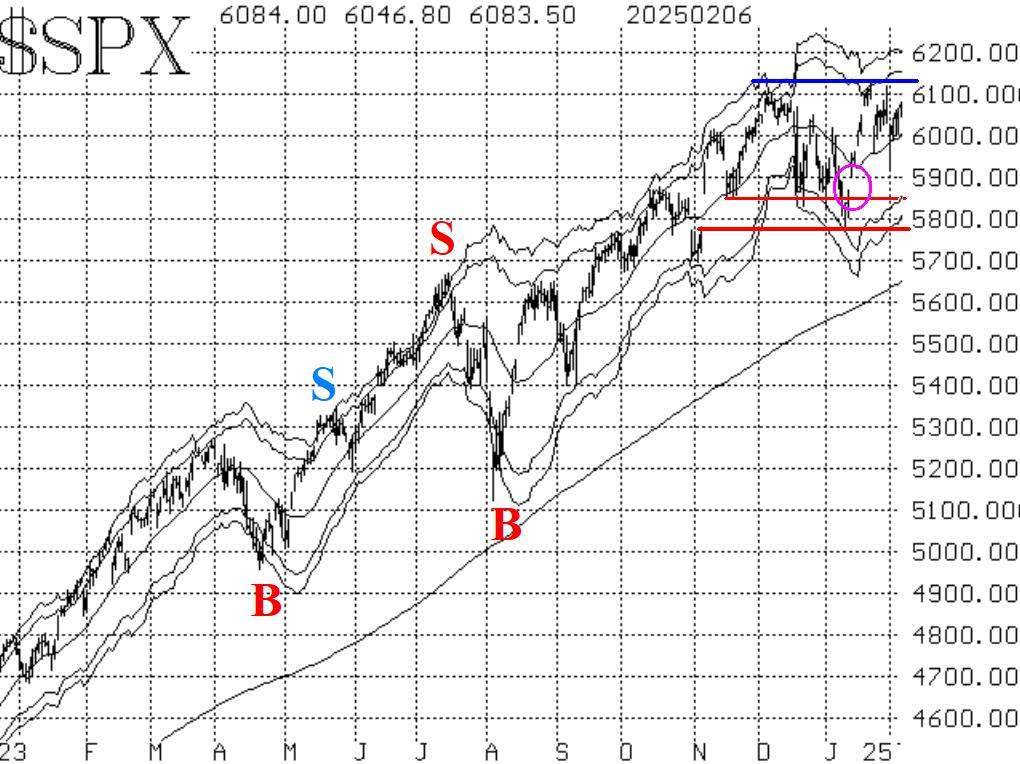

By Lawrence G. McMillanWhen the government announced that they were going to begin instituting tariffs, the market went into a quick nosedive, from which it has mostly recovered. But the fact is that...

Feb, 06, 2025

By Lawrence G. McMillanThis article was originally published in The Option Strategist Newsletter Volume 23, No. 22 on December 1, 2014. This is a subject that we will likely be writing...

Feb, 03, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on February 3, 2025.

Jan, 31, 2025

By Lawrence G. McMillanHere’s a table that was printed on Bloomberg this week. It shows the percentage of equity options and index options (and total) that each U. S. Option exchange trades....

Jan, 31, 2025

By Lawrence G. McMillanI thought we’d take a look at one of these covered writing ETFs that did not have to do with such volatile things as Bitcoin or AI. TSLY, the one on Tesla (TSLA)...

Jan, 31, 2025

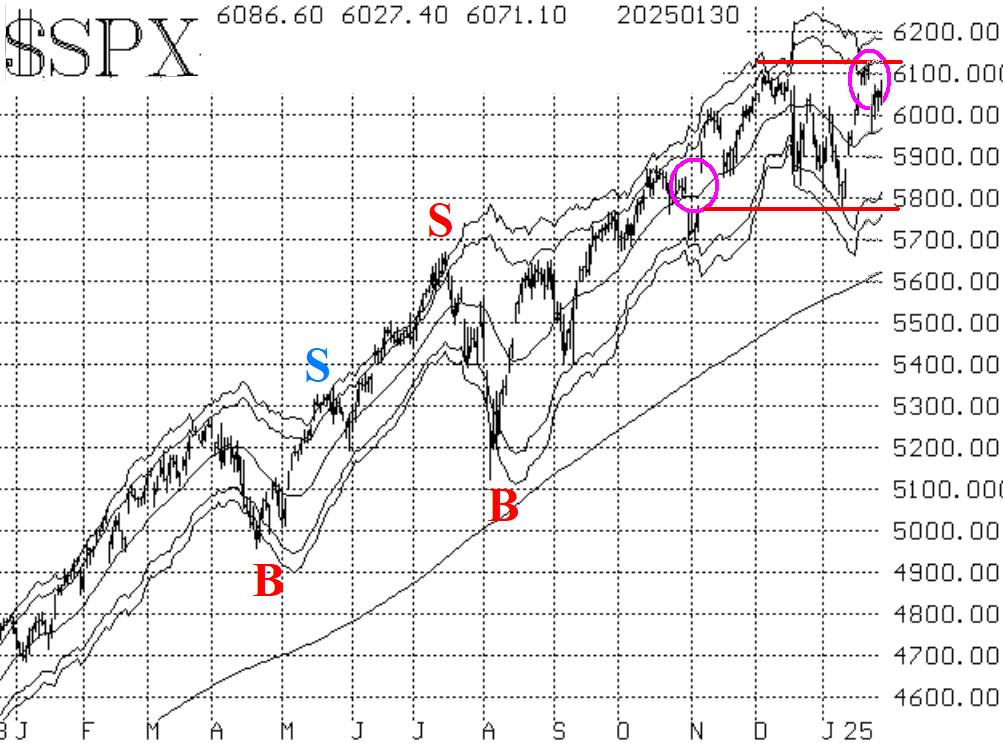

By Lawrence G. McMillanA week ago, $SPX was trading at new all-time highs for two consecutive days. While the breakout wasn't all that strong, it was a breakout. However, on Monday, January 27th, the...

Jan, 27, 2025

By Lawrence G. McMillanWe wrote an article last week regarding the Microstrategy (MSTR) covered writing ETF (MSTY). The only addition there is to that information right now is that we observed...

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation