By Lawrence G. McMillan

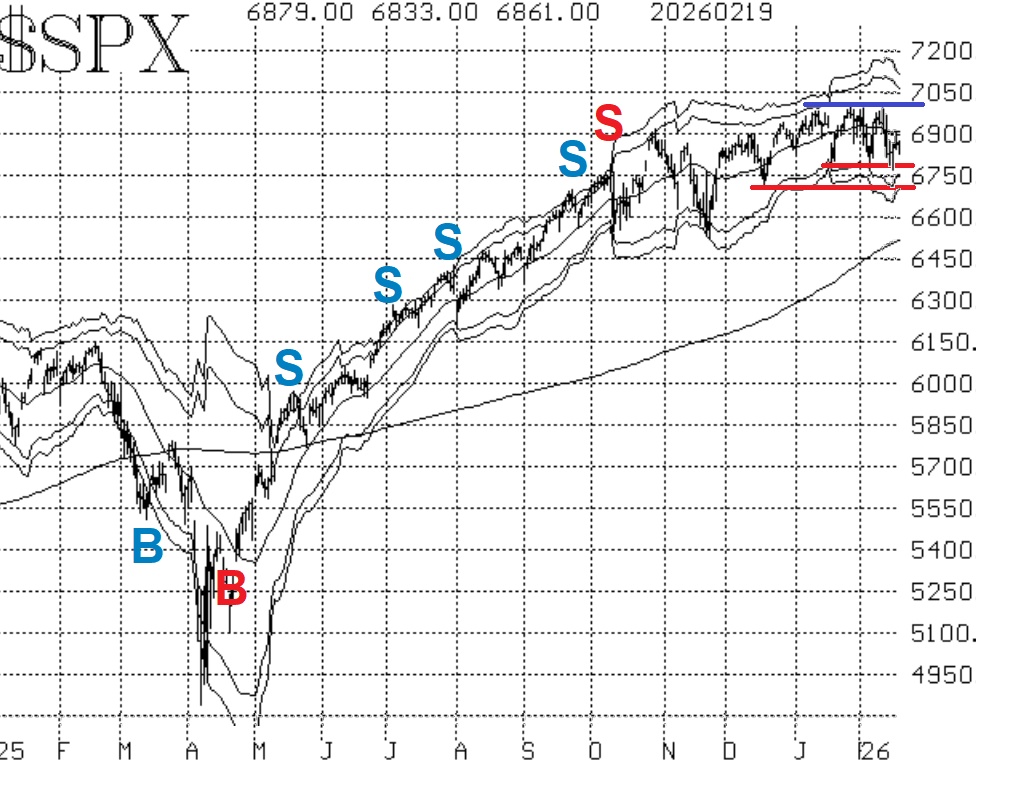

Stocks continue to trade in a tight range, with a ceiling near 7000 and strong support in the 6720-6800 range. Eventually a breakout will occur, but until it does, expect more of the same.

Equity-only put-call ratios remain quite bearish, in that they have steadily risen since late January. Even on up days, put buying is relatively heavy. This is by far our most bearish indicator at the current time.

Market breadth has been mixed. As long as these two oscillator signals are mixed, we don't have an actionable signal from this indicator.

This brings us to the implied volatility $VIX space. The "spike peak" buy signal that was generated on February 6th remains in place, although it was nearly stopped this week.

The trend of $VIX indicator, however, is more of a question mark. It could generate a sell signal as soon as today.

As one might expect with $SPX in a lengthy trading range, the indicators are mixed. It seems that the best tactic is to wait for the breakout, since it has been so long in coming.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation