By Lawrence G. McMillan

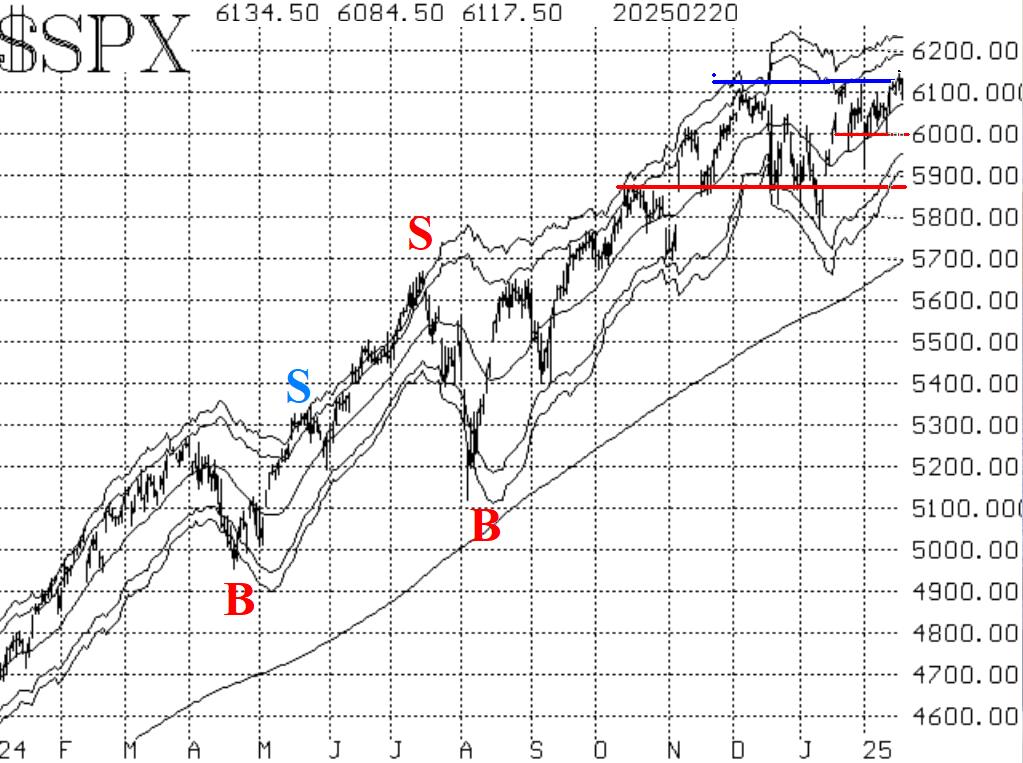

The long-awaited upside breakout to new all-time highs seemed to be in the offing, but then $SPX fell back again. The accompanying chart in Figure 1 shows that the resistance line near 6100 is still in place. The futile probes above that line (and below the red line at 5870, too) have shown that this market is reluctant to give up the trading-range scenario that has been its custom since last November. We are still looking for consecutive closes above 6130 in order to declare an upside breakout as confirmed, and even that may not be enough.

Meanwhile, inside the trading range, there is some support near 6000, and then major support at the bottom of the range, from 5870 down to 5770.

Equity-only put-call ratios are still bullish. They have continued to rather steadily decline this past week. They are near the lower regions of their charts, which means they are somewhat overbought.

Breadth has been reluctant to join in on days when $SPX is making new all-time highs. That is not what one would normally want to see. Rather, what has happened, is that the NYSE breadth oscillator has remained on a sell signal all week. "Stocks only" breadth has been a little stronger than NYSE breadth, so that oscillator canceled out its early February sell signal, but is now slipping again as well.

$VIX has remained subdued over the past week. It has not dropped much below 15, indicating that is the level of implied volatility where large traders are willing to buy $SPX puts presumably for protection (they may simultaneously be buying stock). So, the "spike peak" buy signal of January 27th remains in place (green "B" on the chart in Figure 4).

In summary, we are willing to take a new "core" bullish positive, but only if $SPX confirms an upside breakout by closing above 6130 on consecutive days. In any case, we will trade new signals as they occur, and we will continue to roll deeply in-the- money options.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation