By Lawrence G. McMillan

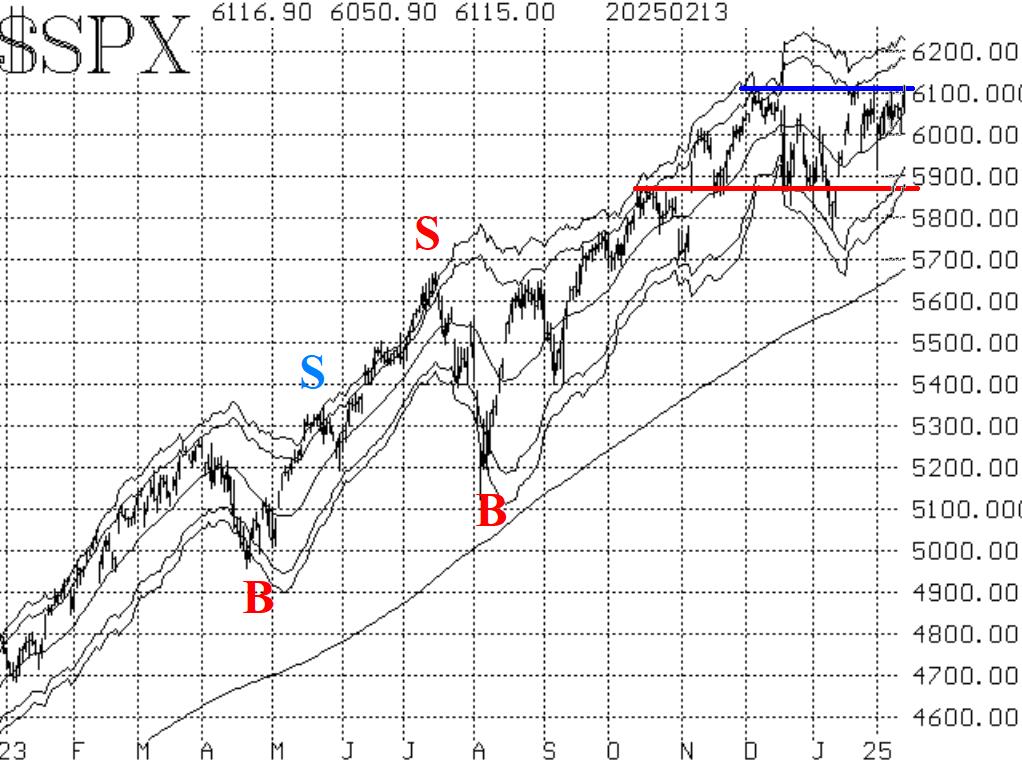

Stocks are still in a trading range, but barely. $SPX made a strong move on Thursday, back to the 6100 area and above, which is very near the all-time high. The all-time high is 6128 intraday and 6118 closing. The last time that $SPX tried to break out on the upside, it proved to be a false breakout, and the Index declined 200 points quickly. For the most part, $SPX has been trading between 6000 and 6100 since then, but this morning it has traded at 6127.

At this time, we'd require $SPX to close above 6130 for two consecutive days in order to verify a new upside breakout. If that does occur, $SPX probably would have a target of 6350 or so on such a breakout. Conversely, a close back below 6070 would negate any chance of a breakout and would place $SPX right back in the trading range.

The equity-only put-call ratios are both on buy signals once again. The weighted ratio has been declining since mid-January, and that is bullish for stocks. The standard ratio, though, had peaked but was then merely moving sideways. However, in the last week, it has begun to decline also, and thus is more solidly on a buy signal as well.

Breadth has been flipping back and forth between strong days and bearish days for $SPX. This is typical trading range behavior. At the current time, both breadth oscillators are on sell signals, but with breadth being positive yesterday and again today, those sell signals could well be canceled out.

$VIX has continued to remain very subdued. On the $VIX chart in Figure 4, one can see that the last two "events" that got the media so excited, and did cause stocks to sell off sharply -- the announcement of tariffs and the CPI report, on February 3rd and February 12th, respectively -- were met with a big yawn from $VIX. It barely rose, even intraday. So the most recent "spike peak" buy signal of January 27th remains in effect.

In summary, the indicators are mixed-to-bullish, but could be much more bullish if an upside breakout occurs. Continue to roll deeply in-the-money options.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation