By Lawrence G. McMillan

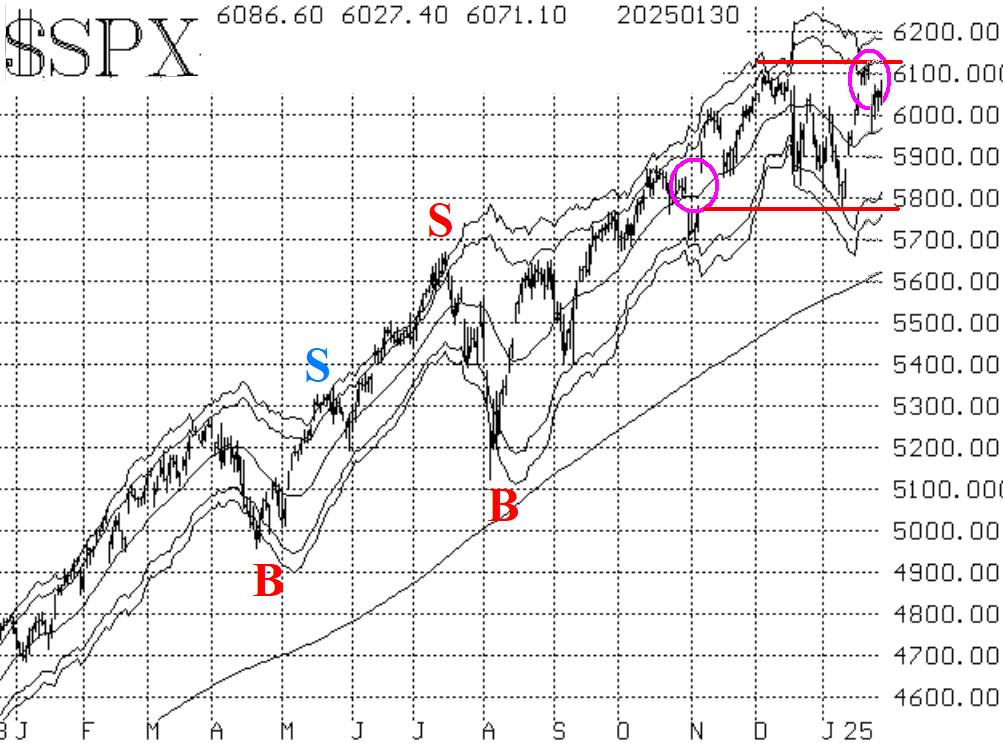

A week ago, $SPX was trading at new all-time highs for two consecutive days. While the breakout wasn't all that strong, it was a breakout. However, on Monday, January 27th, the market panicked over a Chinese AI platform, and the major averages and stocks related to AI took a beating. Internally, many other stocks ignored that news. In any case, $SPX -- which has heavy weightings of AI stocks -- plunged back inside the trading range. That raises the possibility that it was a false breakout. It's probably too soon to say that for sure, because if $SPX now goes on to new highs, no one will remember that it pulled back for a week.

$SPX now has resistance at 6100. The bottom end of the trading range is in the zone between 5760 and 5870, where declines have terminated in the last couple of months.

Equity-only put-call ratios have been drifting sideways for a couple of weeks. By definition, a peak or trough that lasts for 10 trading days is a signal. Hence, they are now "officially" both on buy signals at low levels on their charts, for that reason.

Breadth has not been real strong this week, but it did have to deal with a sharply falling market last Monday. Ironically, breadth was not that bad on the day of the big AI selloff. And now, breadth has become more positive again. As a result, the breadth oscillators remain on buy signals that were generated in mid-January.

$VIX, meanwhile, spiked up on the big AI selloff last Monday, and then immediately retreated. That resulted in yet another "spike peak" buy signal -- marked with a green "B" on the chart in Figure 4.

In summary, we are not holding a "core" position at this time, because $SPX is still within its trading range. Meanwhile, we are trading individual signals as they occur. Also important: be sure to roll options that become deeply in-the-money.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation