By Lawrence G. McMillan

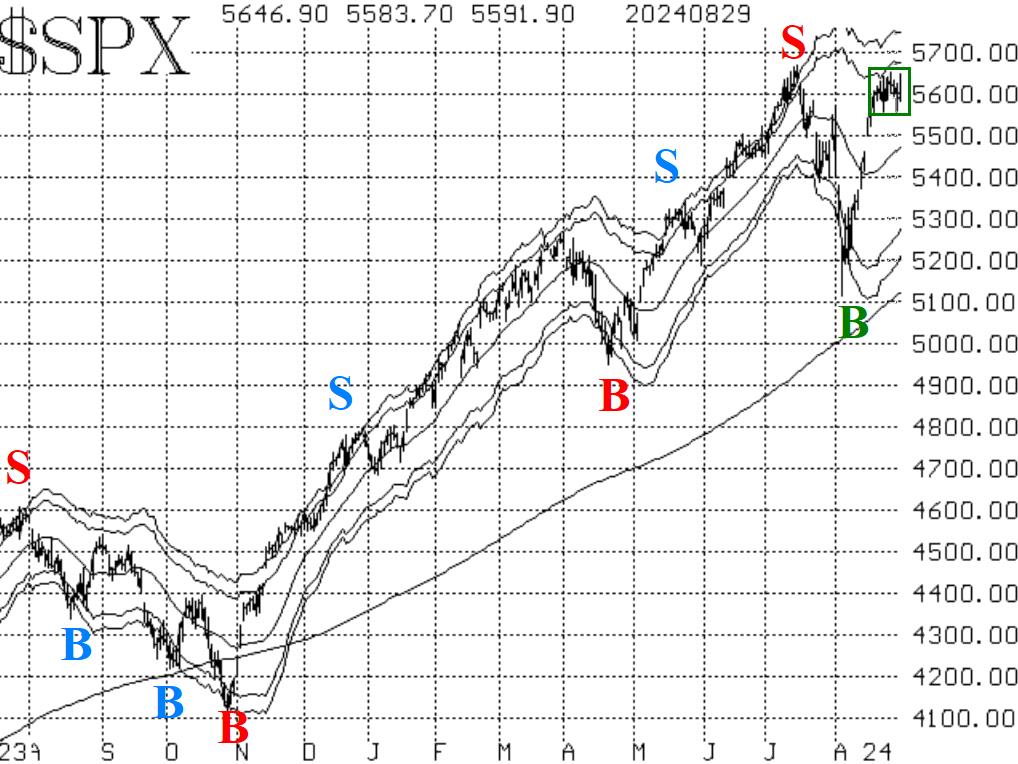

The "new all-time highs" party on Wall Street is all set, except for one nagging problem: $SPX has attempted to move to new all-time highs several times, but has not been able to do so. It's not that $SPX is declining, either (see the green box on the chart in Figure 1), but a breakout from that box on the downside is probably going to instigate a good deal of selling. The same can be said of the upside: a breakout of the top end of that box and a move to new all-time highs would generate strong upward momentum.

Specifically, the box ranges from 5560 to 5650. New all-time highs would be achieved with a close above 5670, although we always prefer to see a two-day close for a new all-time high to be verified. On the downside, there would be some support at various levels, but a close below 5370 would be very negative.

Equity-only put-call ratios have officially rolled over to buy signals, belatedly. They will remain bullish for stocks as long as they are declining.

Breadth has been somewhat mixed. Even though there have been some days of negative breadth, the breadth oscillators have remained on buy signals throughout, since they were so far into overbought territory that a few days of negative breadth sprinkled in amongst the positive days were not enough to deter these indicators from their bullish status.

One lingering bearish indicator is the trend of $VIX sell signal that continues to remain in place. It would be stopped out if $VIX were to close below its 200-day Moving Average, but so far that has not been the case (Figure 4). That 200-day MA is at 14.40 and moving sideways.

The other $VIX indicator is still bullish, though: the "spike peak" buy signal.

So, the indicators are mostly bullish and we are probably going to get an upside breakout. However, that is not certain. In any case, we will trade confirmed signals as they appear and we will continue to roll deeply in-the-money options.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation