By Lawrence G. McMillan

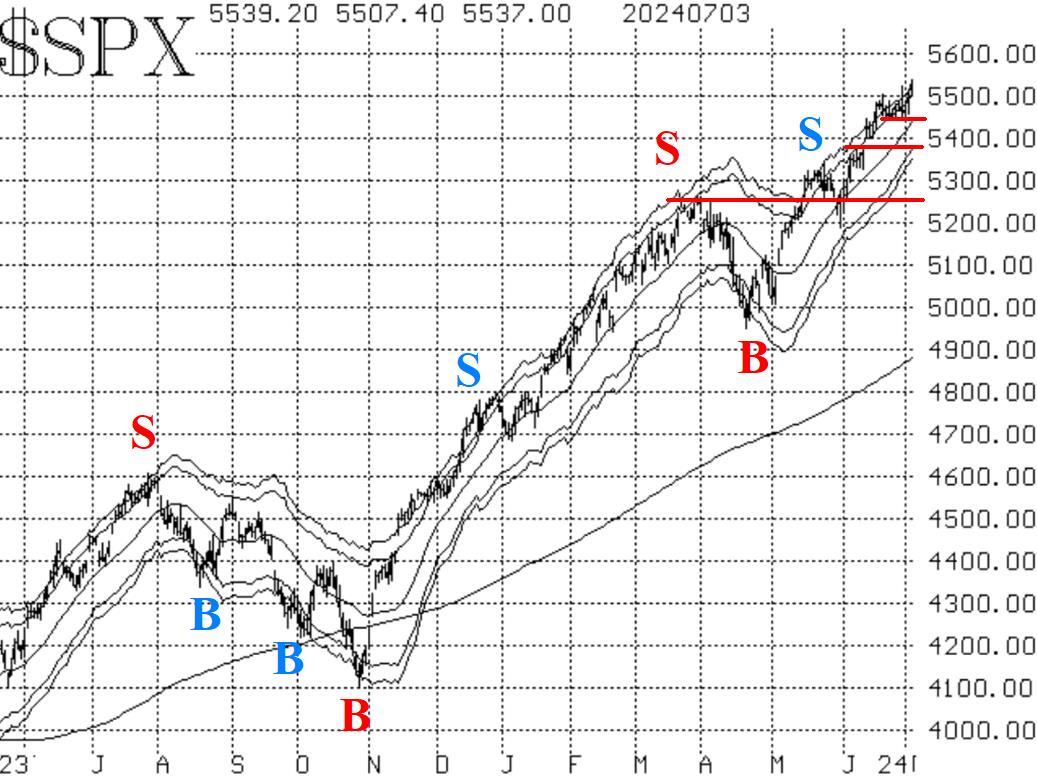

The stock market, as measured by the S&P 500 Index ($SPX), continues to rise, making new all-time highs, both intraday and on a closing basis. This alone makes the $SPX chart bullish and dictates that we continue to hold a "core" bullish position.

There are several support levels beneath the market as it has worked its way up in a stair-step fashion: 5450, 5380, and 5260.

Equity-only put-call ratios are still on buy signals. The ratios are near the lower regions of their charts, meaning that they are overbought, but they would need to begin to rise sharply in order to generate sell signals.

Breadth has been just strong enough to keep the breadth oscillators on buy signals. There is still a negative divergence between $SPX and breadth. However, cumulative volume breadth (CVB) has erased its negative divergence with $SPX, as both CVB and $SPX are making new all-time highs together once again. This is a strong positive development for the overall market.

$VIX is also subdued, which means that the trend of $VIX buy signal remains in place. As long as $VIX remains below its 200-day moving average, it is not a problem for stocks.

In summary, we are maintaining a "core" bullish position and will continue to trade any other confirmed signals around that "core" position.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation