By Lawrence G. McMillan

Small cap stocks joined the "party" about a week and a half ago. They were late to do so, but were able to push $SPX and many other indices sharply higher. They brought with them improved breadth figures and new all-time highs for $SPX.

Unfortunately, their inclusion seems to have created such severe overbought conditions that a correction is now underway. Sell signals are beginning to emerge, although it is not clear that the bull market is over.

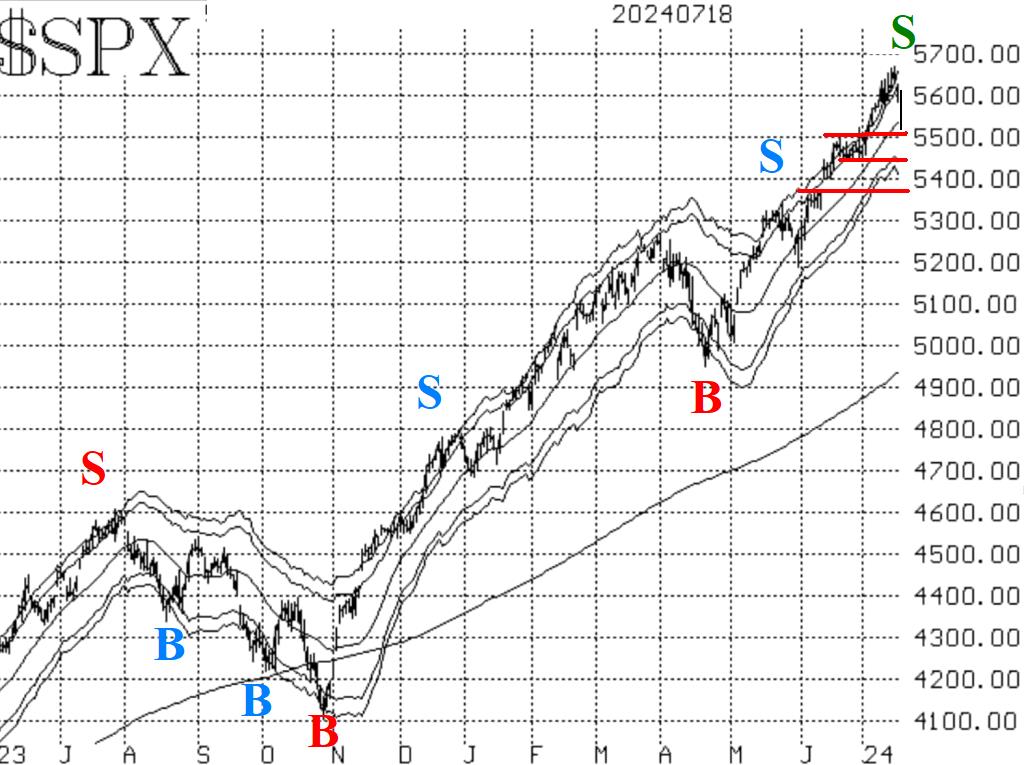

$SPX has pulled back to what should be support in the 5440- 5490 zone. Below that is further support at 5370 (where a gap would be filled). Any pullback below 5370 would definitely be cause for a more bearish outlook for stocks.

Equity-only put-call ratios had moved to their lowest levels since late 2021 (the end of the last bull market). As such, they were in extremely overbought territory. However, sell signals are not confirmed until these ratios begin to rise rapidly. That is now happening for the Weighted ratio, and it is thus on a sell signal, as noted on the chart in Figure 3. The standard ratio has just curled upward for one day, so it is not yet on a confirmed sell signal. These ratios have a long and profitable track record as broad market indicators, and they are turning negative now.

Breadth was a problem for a long time in this bull market, since the action was often dominated by a few tech stocks (NVDA, for example). But when the small caps began to rise, breadth exploded in a positive way. But this action pushed the breadth oscillators into deeply overbought territory. These oscillators are still on but sel signals could occur as soon as today if breadth is significantly negative.

For the first time in a while, we are beginning to see $VIX take notice of a market correction. $VIX jumped higher and closed above its 200-day Moving Average for two consecutive days. That stops out the previous trend of $VIX buy signal. Eventually a $VIX "spike peak" buy signal (for stocks) will emerge when $VIX pulls back down.

In summary, we are still maintaining a "core" bullish position, because the $SPX chart is bullish. We will trade other confirmed signals around that, though, and those are beginning to occur.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation