By Lawrence G. McMillan

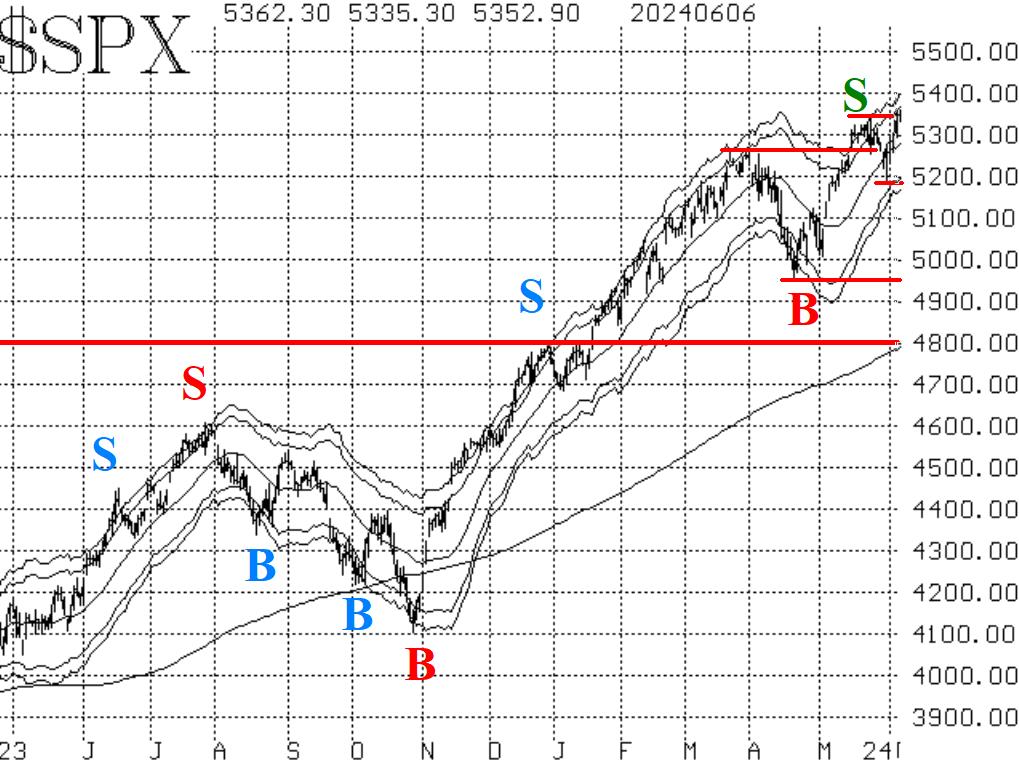

At the current time, $SPX is making new all-time highs daily (four days in a row and five of the last seven). Hence, the $SPX chart is very bullish. There is a support zone, originally created by the trading range in mid-May, from 5260 to 5325. This week's daily lows quickly bounced from the 5330 area. A close back below 5260 would be negative, but that is certainly not imminent.

The indicators remain bullish, although there are some that might roll over to sell signals soon. A case in point is the standard equity-only put-call ratio. One can see, from Figure 2, that it curled upward yesterday, and the computer analysis programs are calling this a sell signal (green "S" on the chart). The weighted ratio is still declining, but it is at its lowest levels since late 2021 (near the end of that bull market), so it could easily roll over to a sell signal soon.

Breadth has not been nearly as strong as one would expect with $SPX making a series of new all-time highs. So, the breadth oscillators are clinging to buy signals, but are not moving swiftly into overbought territory. In the past, that has been a warning sign that the upside breakout might not be sustainable. We shall have to wait and see, though, since the breadth oscillators have not generated confirmed sell signals yet.

$VIX has remained at low levels as $SPX has rallied. A low $VIX is an overbought condition, but is not a sell signal. Thus, the trend of $VIX buy signal remains in place for stocks. It began at the circled area on the chart in Figure 4. The first sign of trouble would be if $VIX closed above its 200-day Moving Average. That MA is currently nearing 14.50 and is slowly declining.

So, we are maintaining a "core" bullish position, in line with the positive $SPX chart. Some of these other indicators may begin to generate sell signals soon, and we would trade any confirmed signal around the "core" position.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation