By Lawrence G. McMillan

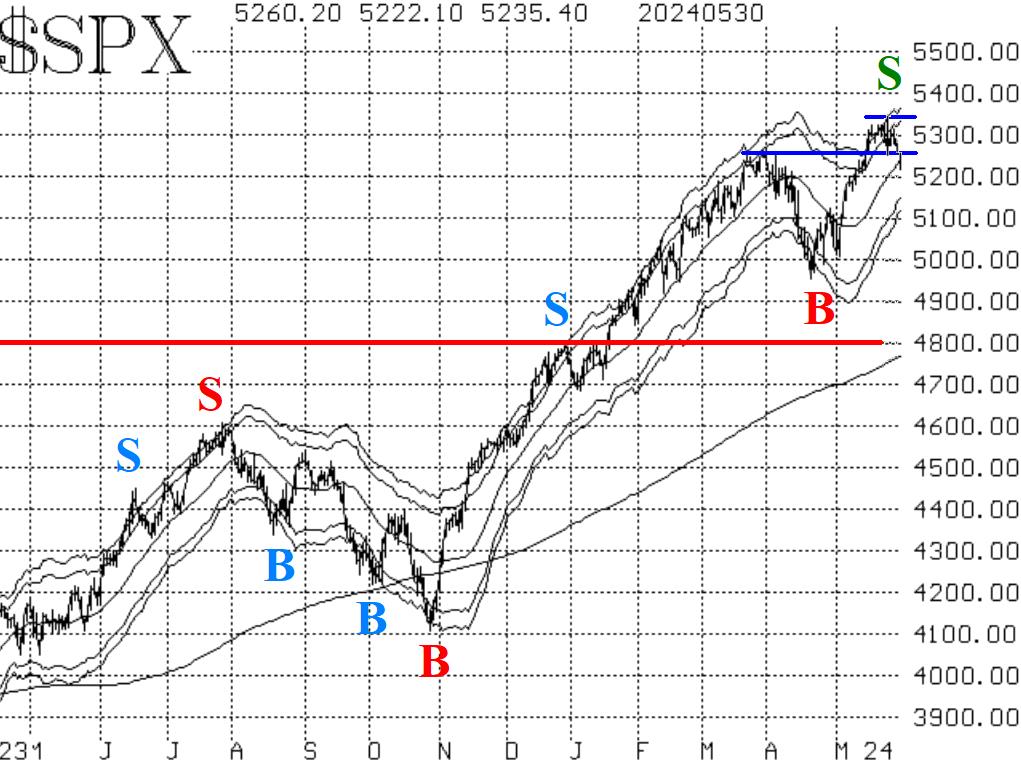

Stocks seemed a little "tired" after making new all-time highs earlier in May. $SPX traded in a fairly tight trading range between 5260 and 5340 for two weeks. The support at 5260 was important because that's where the old highs were (from late March). $SPX has now broken to the downside, triggering an MVB sell signal among other things, and that breakdown should be respected.

There is resistance at or near the all-time highs (5325-5340). The next support level is likely to be the gap down to 5070, which is a fair distance from here. There is strong support at 4960, which is the April low.

Equity-only put-call ratios have continued to decline. Thus, they remain on buy signals for the stock market. Their rate of descent has slowed, but the computer analysis programs are still "saying" that these ratios will continue to decline. Eventually, they will generate sell signals for stocks when they roll over and begin to trend higher.

Market breadth deteriorated quite a bit recently, and there were breadth oscillator sell signals a week ago. Those were the first confirmed sell signals that we had up to that time. Despite the selling in $SPX over the past two days, breadth has improved greatly since small caps are doing much better. As a result, these breadth oscillators may roll over to buy signals soon.

$VIX has, for the most part, remained subdued, even as $SPX has been having trouble of late. Yes, it rose from its lows near 12 to touch its 200-day Moving Average (which is at 14.75 and moving sideways). But until $VIX can close above that 200-day Moving Average, it will not present a worry for the stock market. The "spike peak" buy signal expired a week ago. The trend of $VIX buy signal is still in place, and it would be stopped out if $VIX closes above its 200-day MA for two consecutive days.

In summary, sell signals are beginning to appear, and the solid uptrend of $SPX has been broken. Regardless, we will trade any confirmed signals as they appear.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation