By Lawrence G. McMillan

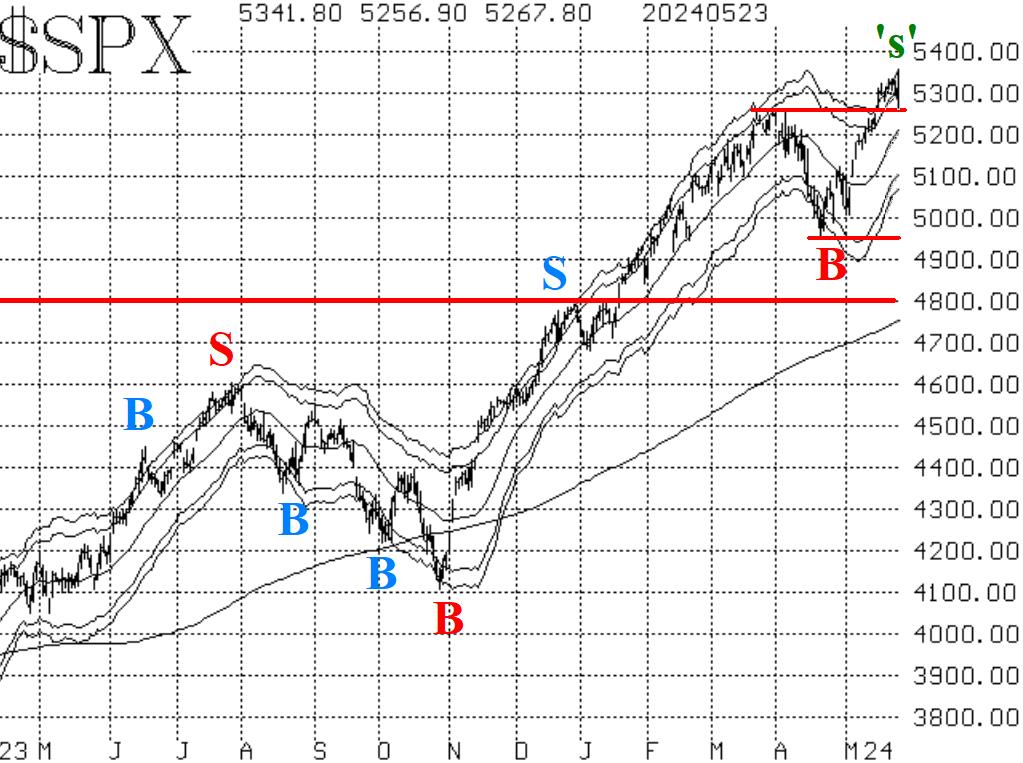

The broad stock market, as represented by $SPX, held at new highs for most of this week while a number of fundamental events took place: bond auction (a yawner), Fed minutes (caused a sharp but brief decline), NVDA earnings (were good for NVDA, but only briefly good for $SPX), but once those were out of the way, it seems that traders were eager to sell. That selling, on Thursday, pushed $SPX right down to the support at 5260 (the previous highs from late March), and so far that support has held. There is now resistance in the 5330-5340 area, the highs of this week.

Equity-only put-call ratios continue to decline, and thus they remain bullish for stocks. They are once again nearing the lower regions of their charts, but they won't generate sell signals until they roll over and begin to trend higher.

Market breadth has weakened considerably this week, and as a result, the breadth oscillators are now on sell signals, as of the close of Thursday May 23rd. The oscillators are our most "flighty" indicators, often times whipsawing back and forth.

$VIX has given a big yawn to the recent market action, though. It is trading near 12, and on May 21st closed at its lowest level since November 2019 -- just before the pandemic disaster. A low $VIX by itself is not a sell signal; it is merely an overbought condition. $VIX only becomes a bearish indicator for stocks if it starts to rise sharply.

We are still maintaining a "core" bullish stance, because $SPX remains above support at 5260. Regardless, we will trade all confirmed signals that are generated.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation