By Lawrence G. McMillan

Things were rolling along pretty smoothly, with $SPX having made new all-time closing and intraday highs on March 28th. There was a little pullback at the beginning of this week, with a modest deterioration in some of the market internals, but it did not appear to be significant. In fact, by noon on Thursday April 4th, $SPX was well on its way to challenging those highs once again. Then, a Fed Governor (Neel Kashkari) made some hawkish statements and selling swamped the market.

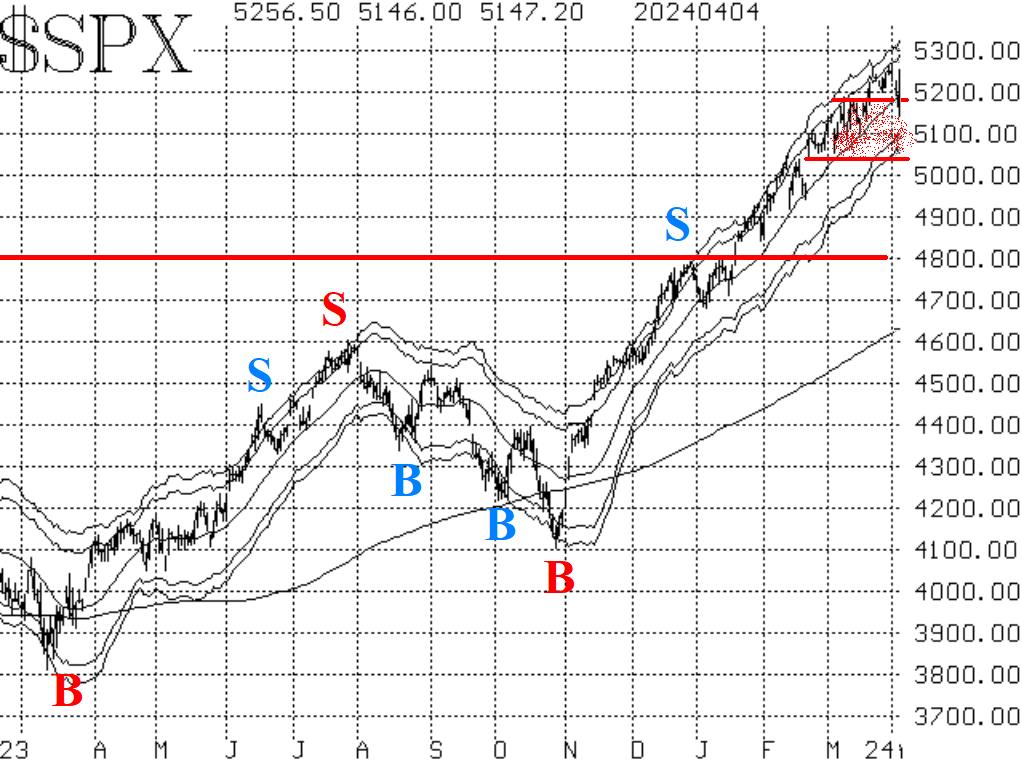

$SPX has now fallen back below the first support level at 5180, but there is an entire support zone that extends down to 5050 which should provide the bulls some comfort. It is marked with a scatter pattern on the chart in Figure 1. If $SPX should fall below 5050, then I think some much heavier technical selling will enter the marketplace. But for now, $SPX has merely pulled back to its rising 20-day moving average, which is a normal correction in a bullish market. To me, the $SPX chart remains positive and so we are retaining our "core" bullish positions (perhaps with a slightly smaller delta than before).

Both the standard and weighted put-call ratios are now accelerating to the upside, and that confirms sell signals there.

Breadth hasn't been in the best of shape for quite some time at least breadth in terms of issues traded. Now the breadth oscillators have generated sell signals and confirmed it with a 3-day close.

$VIX is important to watch in an environment like this. So far, it is still mostly supporting a bullish case for stocks. Even though $VIX has risen slightly this week, it has not even gone into "spiking" mode.

A perhaps more serious bearish condition would exist if the trend of $VIX were to turn upward. That would require both $VIX and its 20-day Moving Average to cross above the 200-day Moving Average. As one can see from Figure 4, $VIX is already above the 200-day, but the 20-day is still about 0.70 below the 200-day, so any sell signal is not imminent.

In summary, we are maintaining our "core" bullish position, but we are going to add a bearish component based on the equity- only and breadth sell signals. As usual, we will continue to trade confirmed signals as they appear.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation