By Lawrence G. McMillan

We have had a proprietary volatility premium indicator in place for some time. Now, we are going to begin to use it in a trading system that we have developed.

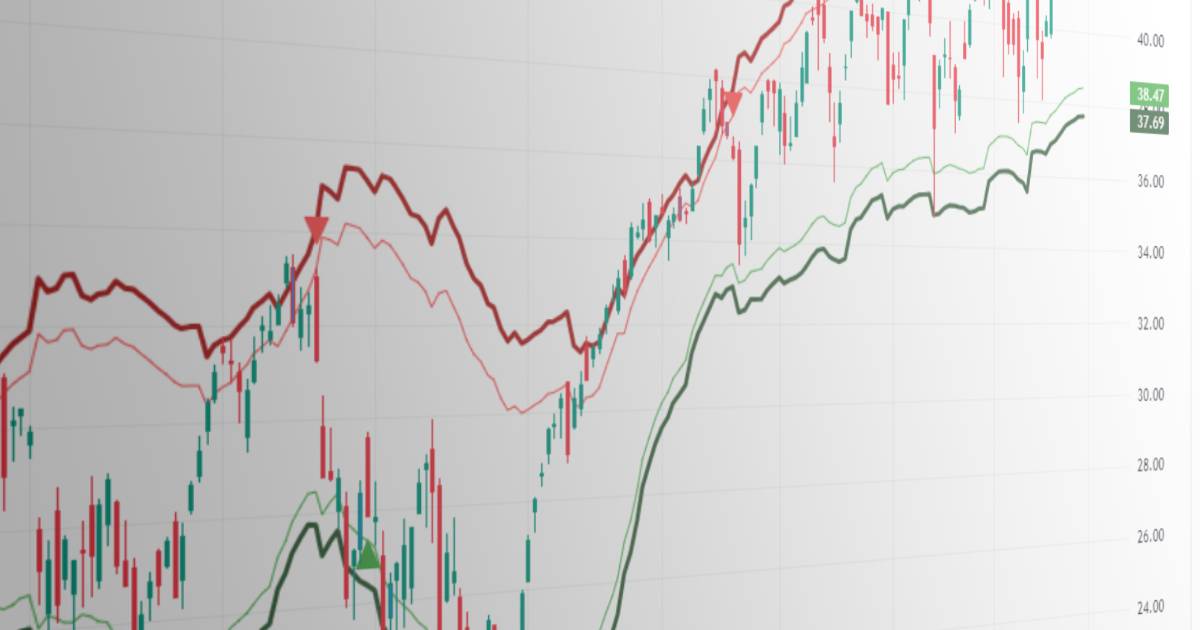

$VIX continues to hover at a low level. When we talk about the construct of volatility derivatives, we often mention the term structure of the $VIX futures, but it’s less often that we mention the futures premium – that is, the price of the $VIX futures contract minus the price of $VIX. That premium decays as time passes, and when the premium is large, it is possible to “short volatility” hoping to capture that decay. In reality, we are not “shorting volatility” as much as we are trying to short the time value premium. We have a measure for that premium, around which we have built a trading system, and late last week it moved to a large enough premium to consider a trade....

Read the full article by subscribing to The Option Strategist Newsletter now. Existing subscribers can access the article here.

© 2023 The Option Strategist | McMillan Analysis Corporation