By Lawrence G. McMillan

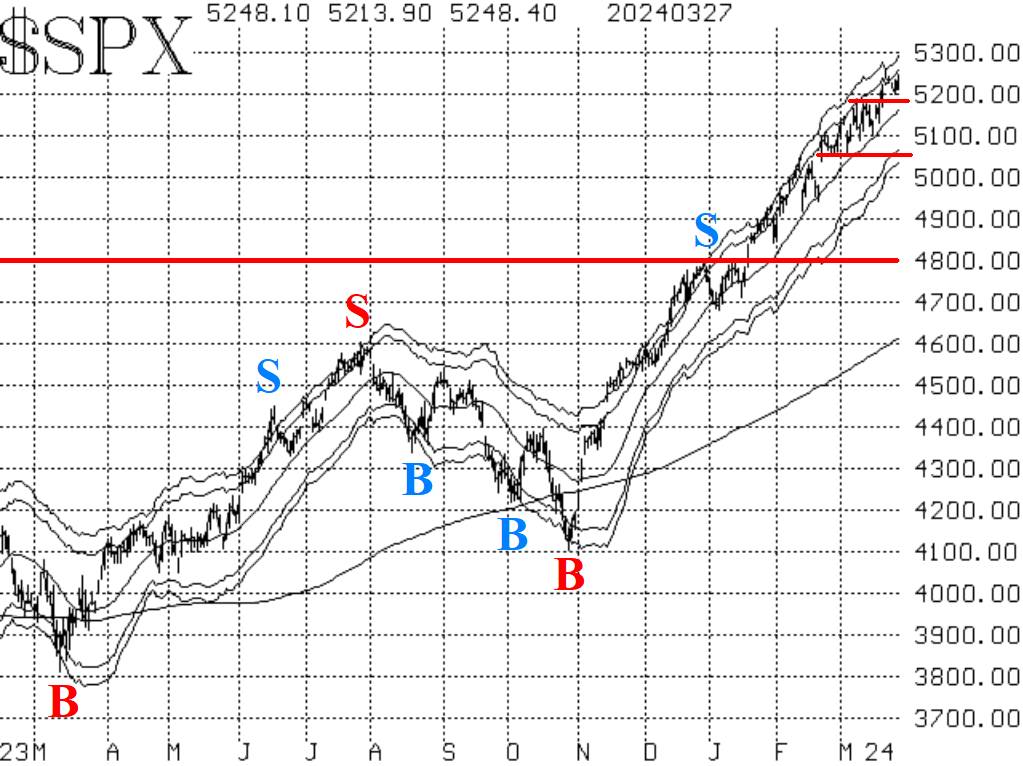

The $SPX Index registered another new all-time closing high yesterday (March 27th) and another new all-time intraday high on March 21st. So, the bull market is still in place. $SPX has a strong support area at 5050-5180, an area where the Index traded in late February and early March. A close below 5050 would be viewed as quite negative by many traders, and we would expect that sell signals would emerge from our indicators if that happened.

Equity-only put-call ratios continue to move more or less sideways at very low levels on their charts. This reflects an overbought state in the stock market but is not a sell signal yet. We would prefer to see these ratios rise sharply in order to confirm a sell signal.

Breadth has been a bit frustrating as well. Three strong days, leading into the March 21st all-time intraday highs, had pushed the breadth oscillators back onto buy signals. But then breadth weakened considerably, nearly generating sell signals, before another strong day of breadth on March 27th kept these breadth oscillators on (weak) buy signals. Breadth has just not been all that strong this year, even though $SPX keeps making new all-time highs.

The entire volatility complex continues to remain bullish on the stock market, to various degrees. $VIX itself remains at a low level, so stocks can continue to advance as long as that is the case. The previous "spike peak" buy signal expired profitably. Now, $VIX and its 20-day moving average (which has turned downward) are both below the 200-day MA once again, meaning that the trend of $VIX is downward. That is bullish for stocks.

In summary, we are still maintaining a "core" bullish position. We will roll calls up to higher strikes when they become deeply in-the-money, and we will trade any confirmed signals around that "core" position.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation