By Lawrence G. McMillan

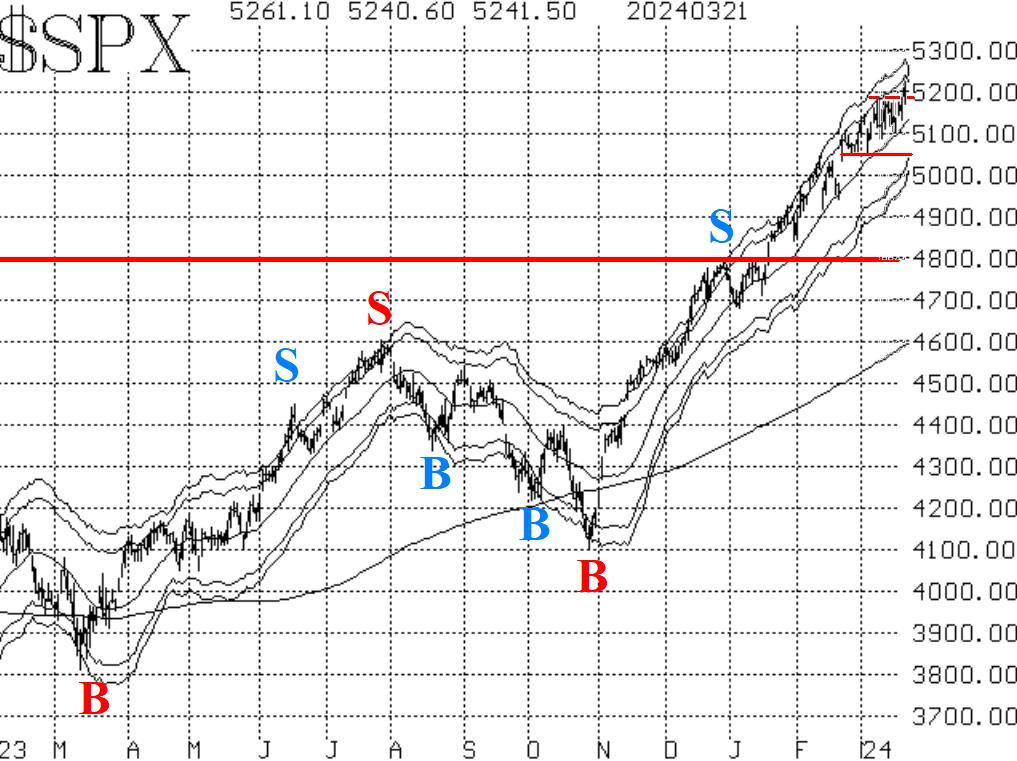

This market continues to show an amazing amount of bullish strength. After having trouble at the 5180 level for about a week, $SPX broke on through after the FOMC meeting and is trading at new all-time highs once again. The 5180 levels is now support. There is further support at 5050, and since $SPX did some "work" in that 5050-5180 area for a few weeks, it is a solid support area throughout as well as the launch pad for this new leg of the rally.

$SPX has now made a new all-time high on 20 separate trading days since first achieving that status back on January 19th (the previous all-time high, near 4800, had been registered at the beginning of the 2022 bear market, in January 2022).

Equity-only put-call ratios continue to hover near the bottom of their charts. That means they are overbought. However, as far as generating tradeable sell signals, they have not confirmed that. Yes, there has been a slight rise over the past couple of weeks from both ratios, but a gentle rise is not a sell signal in my opinion.

Breadth rebounded strongly this week after the oscillators were hovering on the verge of sell signals a week ago.

$VIX didn't really even get very excited about the CPI numbers or the FOMC announcement. So, $VIX remains at low levels, and that is benign -- meaning that stocks can continue to rise while that is the case.

In summary, we are maintaining our "core" bullish position, because of the strongly positive nature of the $SPX chart. We are rolling SPY calls up as they become deeply in-the-money (all of our positions were rolled up this week after the breakout to new highs). We will trade other confirmed signals around that "core" position, but so far there have not been any confirmed sell signals.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation