By Lawrence G. McMillan

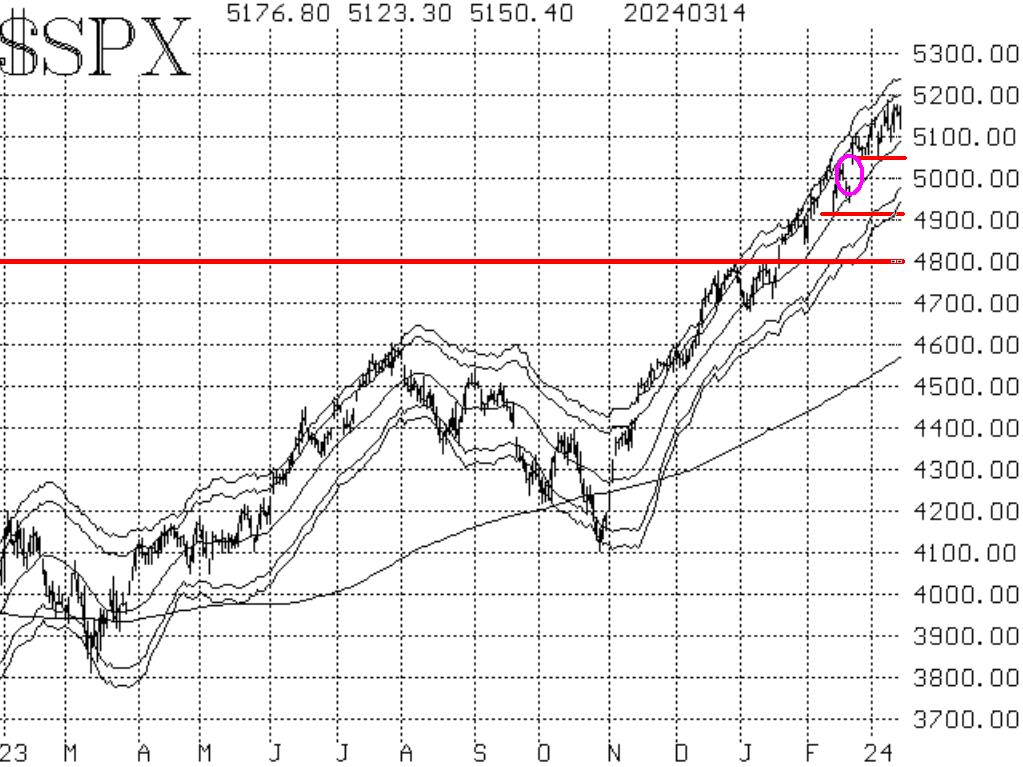

A week ago, on Friday March 8th, $SPX blasted to a new all- time intraday high at 5189 but then reversed down sharply over 60 points that same day. That led a lot of weekend pundits to declare that the market top was in. To prove them wrong, $SPX staged a strong rally midweek and closed at a new all-time high on March 12th but did not exceed that 5189 high. Now, the Index seems to be on the defensive a bit after those efforts. There are multiple daily highs in the 5180-5190 range, just as there were multiple daily lows in the 5050 area at the end of February. So, those two levels are containing the market right now.

Below that support at 5050, we see support at 4983 (which would close the gap on the chart -- circled in Figure 1), and at several other levels on down to 4800. They are marked with red horizontal lines in the chart in Figure 1.

Equity-only put-call ratios remain near the lower levels on their charts. Thus, they are in an overbought state. Sell signals for the stock market are confirmed when these ratios roll over and begin to rise sharply. As one can see, they have started to rise in the last week or so. The problem is that they are not rising sharply. In my opinion, these are not yet confirmed sell signals until we see the ratio begin to accelerate upward.

Market breadth has weakened since March 7th. However, the breadth oscillators managed to cling to their buy signals during most of that time. Breadth didn't get really nasty until March 14th. If breadth is negative again on March 15th, these oscillator sell signals will be confirmed.

$VIX has mostly been yawning its way through recent market gyrations. The "spike peak" buy signal that was generated back on February 14th is still in place, but there is no trend of $VIX signal at this time.

In summary, we are maintaining our "core" position at this time. In-the-money calls have been rolled up numerous times, so our remaining downside exposure is relatively small. We will trade other confirmed signals around this "core" position.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation