By Lawrence G. McMillan

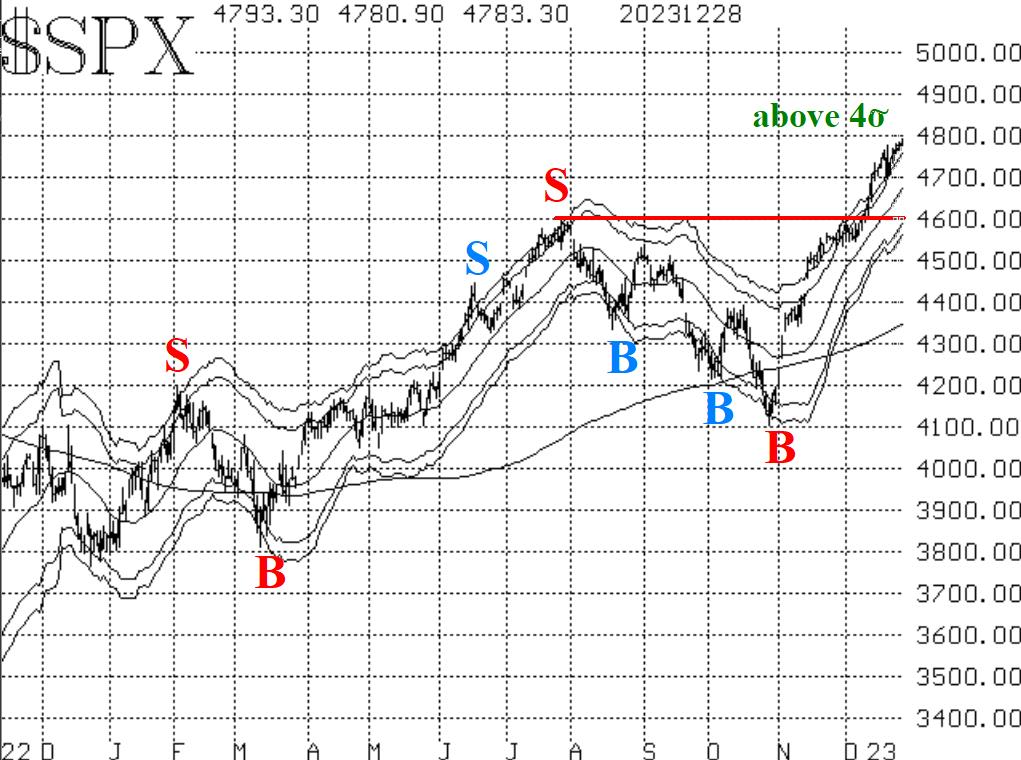

Stocks continue to plow higher, with most major indices making new highs for 2023 just as the year is coming to an end. Furthermore, $SPX is just a short distance from its all-time highs, set in January 2022, so new all-time highs seem certain to be attained early in 2024.

The market is overbought by many measures, but confirmed sell signals are not to be had -- at least, not among our indicators. The advance has been swift, so that the nearest support area is just below 4600, where there was some backing and filling in late November and early December. A pullback to there would still be within the confines of a bullish $SPX chart. However, if the December lows at 4550 are broken, then that would have severe bearish implications.

Equity-only put-call ratios are both making new relative lows. That means they are both still bullish for the stock market. The weighted ratio had "wiggled" higher last week, but any potential sell signal has been quashed by the ratio now moving lower. These ratios will turn bearish for the stock market when they roll over and begin to trend higher.

Breadth has been exceedingly strong. The "stocks only" breadth oscillator made a new all-time high on December 26th, when it reached +1192. That is the most overbought reading in history. The NYSE breadth oscillator is nowhere near that high, but it is also quite overbought. Both breadth oscillators remain on buy signals. It is going to take at least two, and probably three, days of negative breadth in order to generate sell signals.

$VIX had a small "blip" upwards a week ago, when $SPX sold off 70 points in a couple of hours. But $VIX is once again near its lows, so it is in a bullish mode for stocks. The mere fact that $VIX is near its 3-year lows is not a sell signal. $VIX can remain at these low levels for long periods of time, and stocks can continue to advance while that is the case. Trouble for stocks only begins when $VIX begins to rise sharply.

So, there is a lot going on. We continue to maintain our "core" bullish position for now, since the $SPX chart is bullish. We will trade other confirmed signals around that "core" position, and so far those have all been buy signals. But sell signals will certainly be coming, and we will trade those as well.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation