By Lawrence G. McMillan

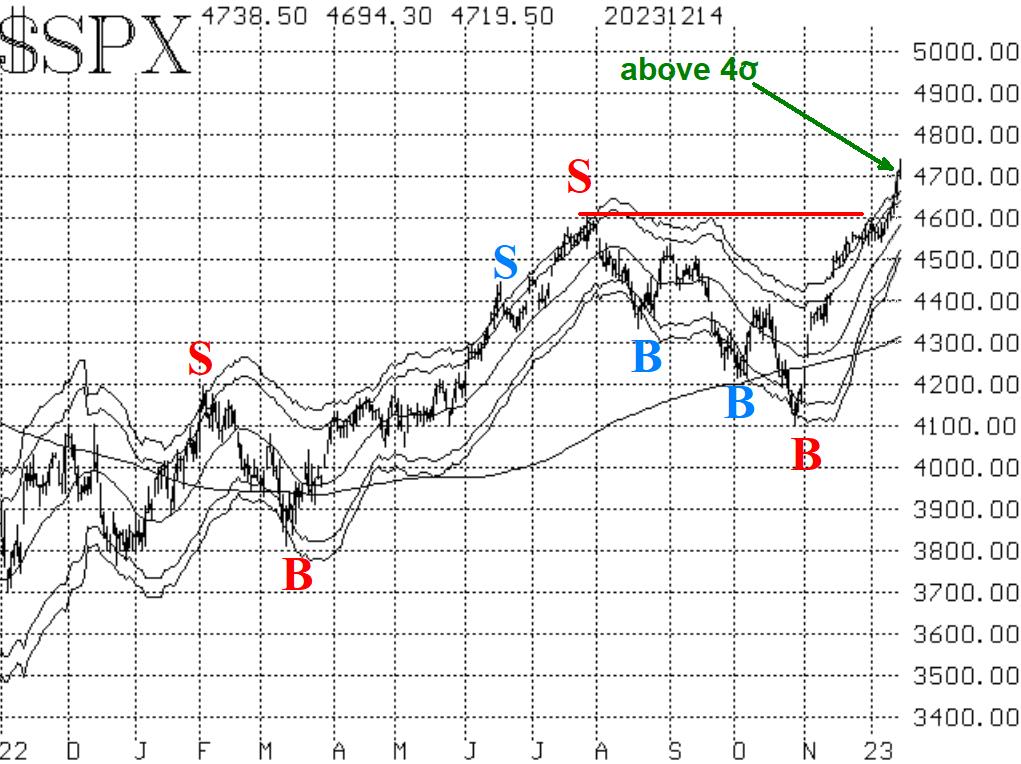

The stock market has blasted off. The most recent catalyst was some dovish commentary after the end of the FOMC meeting this past Wednesday. $SPX is trading at new highs for 2023. Moreover, it has broken out over 4640, which was the high of March 2022 and was a minor resistance area. Now the all-time highs just above 4800 (from January 2022) are the next target. Momentum is strong and seasonality is positive, but this market is getting very overbought. So far, though, we don't have any confirmed sell signals. Overbought does not mean "sell."

As for support, there should be some in the 4550-4660 area, where $SPX traded in early December. A drop below there would likely cause a more severe correction.

Equity-only put-call ratios have continued to plunge, confirming the strength of the stock market. These ratios will remain bullish for stocks until they roll over and begin to rise.

Breadth has expanded considerably. December 13th was a "90% day" in terms of "stocks only" data (but not NYSE). Small caps are doing much better than large caps right now (the "January effect" -- which has been taking place in December for a number of years), and that piece of data shows it. Both breadth oscillators are on buy signals and are in overbought territory. It would take at least two days of negative breadth to even think about generating a sell signal.

$VIX continues to trade at very low levels. This keeps the trend of $VIX buy signal in place A low $VIX is not a problem for the market. The problem comes when $VIX begins to rise. So, while the media is excited about a low $VIX and thinks it is "predicting" a market downturn, that is not the case. A rising $VIX would be predicting trouble, but not a low $VIX.

We continue to hold a "core" bullish position and will trade other confirmed signals around that. With the strength of the market this week, bullish spreads and outright long calls in both SPY and IWM were rolled up. That is a recommended strategy for everyone. because it brings in a credit, reduces downside risk, but keeps upside profit potential in place.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation