By Lawrence G. McMillan

Stocks did an abrupt about face this week and have rallied strongly every day. At first, this rally was propelled by some strong oversold conditions and the fact that $SPX had bounced off its lower downtrend line. But as the week wore on, reports from the FOMC meeting and the Unemployment statistics emboldened investors who care about such things. This was all taking place during what is arguably the strongest seasonal pattern of the year.

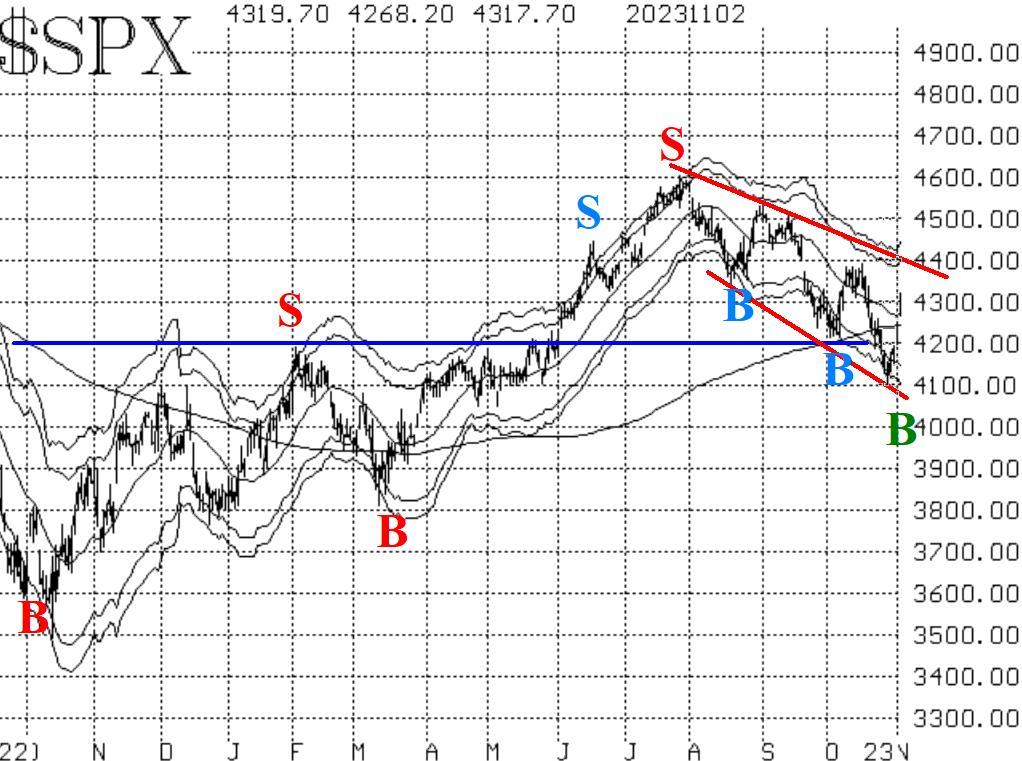

Some of those things are out of the way now, especially the oversold conditions and the seasonal pattern (it ended at the close of November 2nd). So, what remains is the downtrend line on the $SPX chart. The red lines in Figure 1 still show that the pattern of lower highs and lower lows is intact. There are several factors near the 4400 level that may be important in the coming days. So, if $SPX can break out decisively above 4400 and hold that breakout for a couple of days, that would be very bullish. In fact, it would warrant taking a "core" bullish position and abandoning the bearish one.

Put-call ratios are still somewhat split in their outlooks. First, the standard equity-only put-call ratio (Figure 2) remains on the buy signal it generated in early October. That buy signal was certainly premature, at best, and just downright wrong at worst. Meanwhile, the weighted equity-only ratio (Figure 3) has correctly remained bearish. Of these ratios, we usually value the weighted ratio the most, so we are watching that carefully. A rollover to a buy signal by that ratio accompanied by an $SPX breakout over 4400 would be a very bullish combination.

Market breadth is just the most fickle indicator there is, often being subject to whipsaws. Both breadth oscillators were deeply oversold and took some time getting to buy signals, but they are on buy signals now.

The indicators surrounding $VIX have been interesting to watch. The $VIX "spike peak" buy signal, which occurred on October 24th. It is still in place.

For the time being, we are continuing to carry a "core" bearish position, but would relinquish that if $SPX can decisively break out over 4400. Meanwhile, we will other confirmed signals around that "core."

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation