By Lawrence G. McMillan

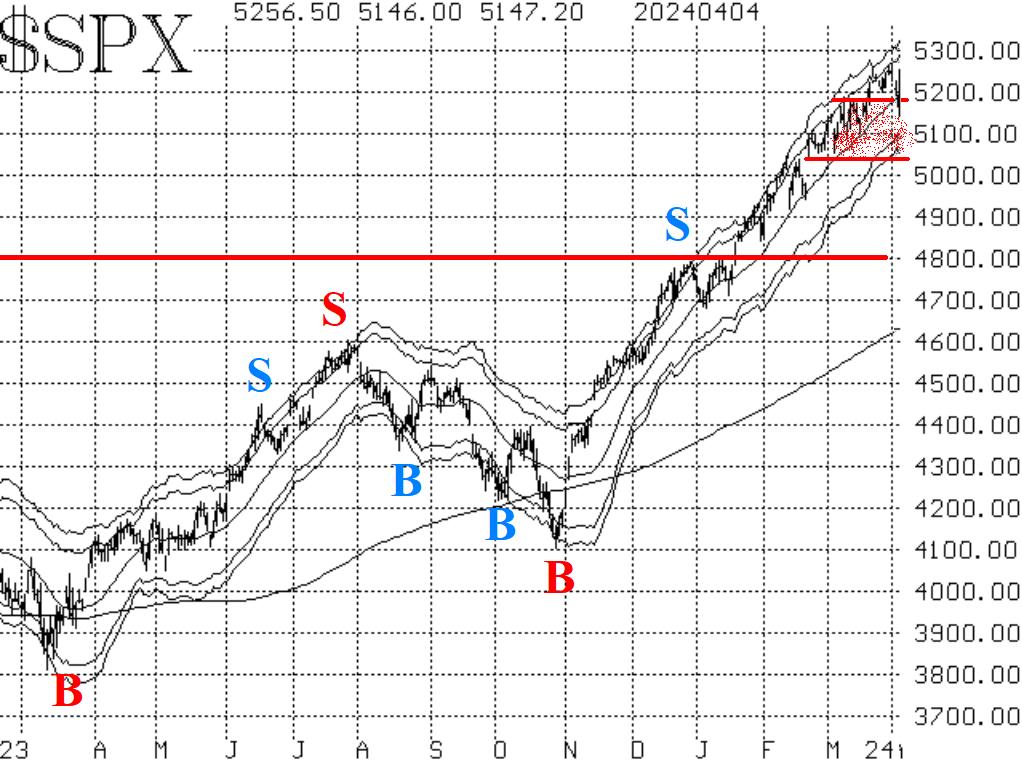

Last week, $SPX had pulled back to support at 4200 and also to its rising 200-day Moving Average. A rally has taken place since, verifying the worth of those items as support for the market. However, $SPX is still in a downtrend (red lines in Figure 1), and that makes it a bearish chart by definition.

But the question remains, "Is this just a mere oversold rally, or is it a new leg in a bull market?" That question cannot be answered for certain at this time, but there are a few clues that we can look for.

First of all, an oversold rally usually dies out after reaching and slightly exceeding its declining 20-day Moving Average. That is about all the further this rally has gotten, and now it seems to have run into some trouble in the 4385 area.

However, a better clue will be provided by the gap on the chart in Figure 1 (circled area). If $SPX can close that gap and move higher, that will be a very positive sign. In fact, in my opinion, that would be a very bullish sign. So far, that hasn't happened. $SPX would need to close above 4401.60 to close the gap.

Equity-only put-call ratios are telling two different stories right now. The standard ratio (Figure 2) has rolled over to a buy signal, and that is confirmed both by the computer analysis programs and the naked eye. However, the weighted ratio remains on a sell signal, for it has not rolled over and begun to decline. The computer still grades this as a "sell signal" as well.

Breadth improved greatly earlier this week, and both breadth oscillators generated new buy signals and were able to retain them for two days. The breadth oscillator signals have been much better in the last couple of weeks than they were earlier in the year. But then a very negative breadth day on October 12th has put these buy signals right on the brink of whipsawing back the other way. So, breadth over the next couple of days is going to be important to this indicator.

Volatility-based indicators are struggling to gain a coherent identity. The $VIX "spike peak" buy signal took place on October 6th. That will remain in effect for 22 trading days unless stopped out. It would be stopped out by a $VIX close about 20.88 its most recent high. However, the trend of $VIX signal is very much in doubt right now.

We are still maintaining our "core" bearish position, but would relinquish it if $SPX were to close above 4401.60 (i.e., if it were to fill the gap on its chart). Regardless, we will trade other confirmed signals as they occur.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation