By Lawrence G. McMillan

Everyone seems enamored with zero day to expiration (0DTE) options. Trading volume has been huge, and no one exactly seems to know why. The conventional wisdom is that market makers are sellers of these same-day options, while institutional and retail traders are buyers. There have been several articles written on that subject, and certain podcasts have dealt with it as well. The reason that “institutional” and “retail” are lumped together is that institutional traders using bot trading algorithms are easily able to split large orders into many small pieces, to disguise their real size and to make it look like retail. However, since hundreds of thousands of contracts are trading in a single day, there is almost certain to be a large institutional presence among that volume. Regardless, we want to see for ourselves what is going on.

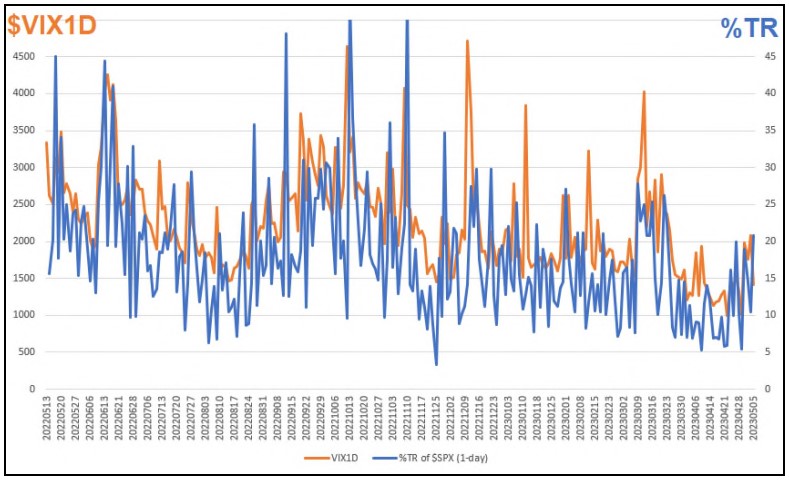

So, the first thing I wanted to see was how $VIX1D lines up with actual one-day volatility. The CBOE has published back data going back to May 2022, so that is all we have to work with at this point in time. Our first estimate of 1-day volatility is to use True Range:

TR = max(high – low, abs(high – prev. close), abs( low – prev. close) )

So, TR includes the gap left by any overnight move – a frequent occurrence in $SPX, for example. To somewhat further normalize things, we computed “Percent TR” ($TR), which is merely 10xTR/$SPX and then multiplied by 10 so that the results lined up with $VIX1D.

The graph above compares the values of $VIX1D (orange line; left-hand axis) with that of a single day Percent True Range (blue line; right-hand axis). One can see that they line up rather well, with $VIX1D generally being a little higher than TR. This, to me, is akin to the relationship between $VIX and the 20-day Historical Volatility (HV20) – where they track fairly well, but $VIX is generally a bit higher than HV20.

So, one simple thing traders of 0DTE options could watch for is a) buyers should be careful about buying when VIX1D is “far above” TR, and b) sellers should likely not be aggressive if VIX1D falls below TR...

Read the full article, published on 5/5/2023, by subscribing to The Option Strategist Newsletter now. Existing subscribers can access the article here.

© 2023 The Option Strategist | McMillan Analysis Corporation