By Lawrence G. McMillan

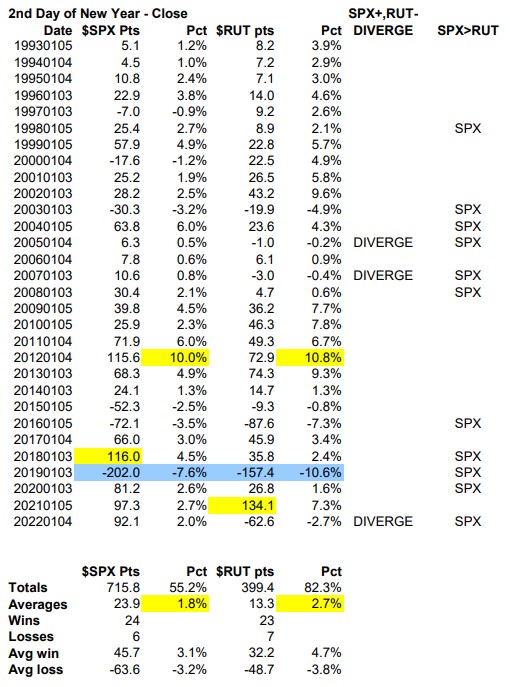

There are actually three different positive (bullish) seasonal systems that occur between Thanksgiving and the start of the new year. In short, they are 1) the post-Thanksgiving rally, 2) the “January effect,” and 3) the “Santa Claus rally.” These encompass the entire period between the close of trading on the day before Thanksgiving through the second trading day of the new year. Moreover, small caps stocks (as measured by the Russell 2000 Index [$RUT, IWM]) normally outperform large-cap stocks over that time frame. We will describe the system below, but if you want more background, you might refer to the November 14, 2014, issue of TOS (Volume 23, No. 21), although there are other articles scattered over the years that discuss this system.

In our trading system, we buy IWM calls at the close of trading on...

Read the full article, published on 11/18/2022, by subscribing to The Option Strategist Newsletter now. Existing subscribers can access the article here.

© 2023 The Option Strategist | McMillan Analysis Corporation