By Lawrence G. McMillan

After opening lower on Monday, $SPX put on a strong rally, and closed near the highs of the day. Some of the internals did not follow as strongly, but for now the picture remains a more positive one. The downtrend line in $SPX has been broken, and the Index is pushing towards all-time highs at 4545. There are still a couple of gaps below current prices, and it would be a trend-changer if $SPX were to fill the lower one and close below 4372.

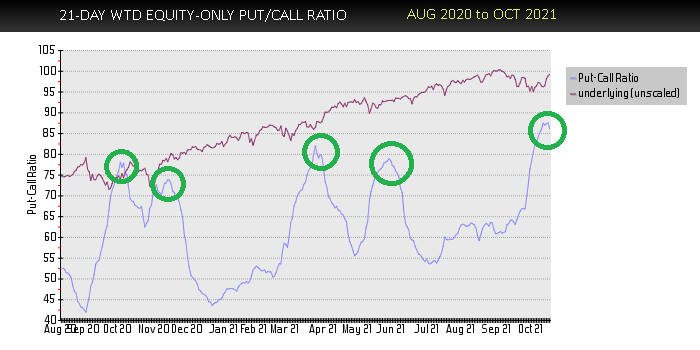

Call buying was fairly heavy yesterday, and both equity-only putcall ratios dropped sharply. In fact, the weighted ratio has now rolled over to a buy signal, according to our computer analysis programs. The standard ratio also dropped, but not by enough to be considered a buy signal. This is a distinct change from the last few weeks and months. From sometime in August onward, traders were buying a considerable number of puts in stocks, but now have switched back to calls after driving put-call ratios to extreme heights. In individual stocks yesterday, nearly 50 put-call ratios gave buy signals from extremely high points on their put-call ratio charts. That is an unusually large number, and it is contributing strongly to the overall weighted equity-only put-call ratio buy signal that has now been generated....

This Market Commentary was excerpted from this morning's edition of McMillan's Daily Volume Alerts Newsletter. To read the full article, subscibe today.

© 2023 The Option Strategist | McMillan Analysis Corporation