By Lawrence G. McMillan

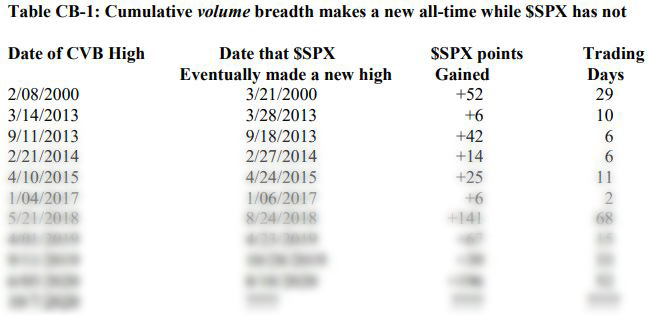

This is a subject that we wrote about in the July 31st, 2020, issue. Cumulative Advance-Decline Volume Breadth (CVB) is determined by 1) calculating the daily difference between volume on advancing issues minus volume on declining issues, and then 2) keeping a running sum of that daily total. We pointed out that there have been a few times in the past where this CVB made a new all-time high while $SPX had yet to do so. Every time, $SPX followed along to a new high of its own.

At the time, there had been nine such “signals” completed between 2000 and 2019. In every case, $SPX eventually moved to a new all-time high. Some required a move of only a few points, so they were “easy.” But, in other cases, CVB made a new high while $SPX still had quite some distance to traverse.

At the time, the tenth occurrence was still open, as CVB had made a new all-time high on June 6, 2020, but $SPX was still far behind...

Read the full article, published on 10/9/2020, by subscribing to The Option Strategist Newsletter now. Existing subscribers can access the article here.

© 2023 The Option Strategist | McMillan Analysis Corporation