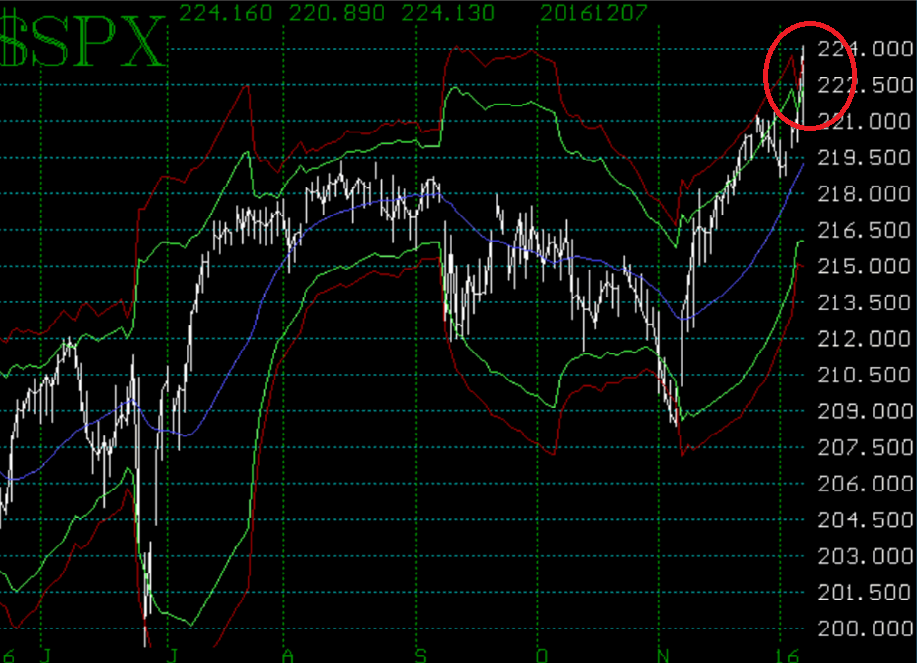

The bulls finally took total control for a day as nearly every major average broke out to an all-time high (the one exception – the NASDAQ Composite – is within a mere 5 points of a an all-time closing high). $SPX advanced so swiftly that it is now above the +4σ “modified Bollinger Band.” As such, a sell signal will definitely occur in the near future, when $SPX closes back below the +3σ Band. Today, that would require $SPX to fall to 2227 – a drop of 14 points. The +3σ Band is moving higher daily, though, so that number will change as the days go by. An mBB sell signal will be a significant negative, but it is not necessarily an immediate sign of the top of the market. The last two mBB sell signals were in November 2014 and October 2015. In both cases, the first mBB sell signal was a false one. $SPX subsequently moved back above the +4σ Band, stopping out those signals for a loss. The second sell signal in each sequence was the one that was the eventual top of that leg of the market. Of course, at the time, we won’t know if there will be another sell signal, so we have to respect each one...

This commentary was excerpted from this morning's edition of The Daily Strategist. Read the full article by subscribing now. Sign up for a free 7-day trial today.

© 2023 The Option Strategist | McMillan Analysis Corporation