By Lawrence G. McMillan

Early this year, we noted that some longer-term indicators had given bullish signals. One was when $SPX advanced by more than 1% for three consecutive days. That occurred in early March. Another bullish sign was when $SPX remained above its 20-day moving average for at least 30 days. That occurred during March as well. In both of those cases, the short-term gains were “meh,” but the longer-term ramifications (one year out, say) were quite positive.

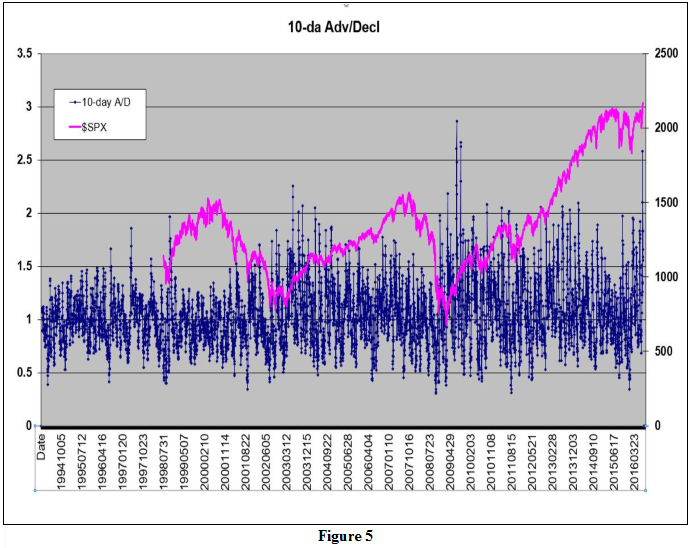

Now another long-term indicator has given a very bullish signal. When I first read about this, it was called the “2-to-1 Advance/Decline buy signal.” The article that alerted me to this indicator appeared as an excerpt in the Advisor Sentiment newsletter (published by Investors Intelligence), and it was written by Dave Harder (of HDR Market Timing, Abbotsford, BC, Canada)...

Read the full feature article (published 7/22/16) by subscribing to The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation