By Lawrence G. McMillan

The bears are now paying for their failure to seize control last week. Yesterday’s rally was strong and was assuredly due to a number of bears “throwing in the towel.” Yes, I know there was a favorable housing report, but that certainly wasn’t enough to justify a rally of that magnitude. So, can the bulls seize control? They have not been able to engineer a follow-through to strong up days, either. Today is their chance. S&P futures are up 6 points in overnight trading. If there is a strong follow-through on the upside to this higher opening, then the bulls will be in charge once again.

$SPX rose above 2076, which is a slight probe through the downtrend line. A close above 2085 would be a more constructive level to break through – for that was the early-May high.

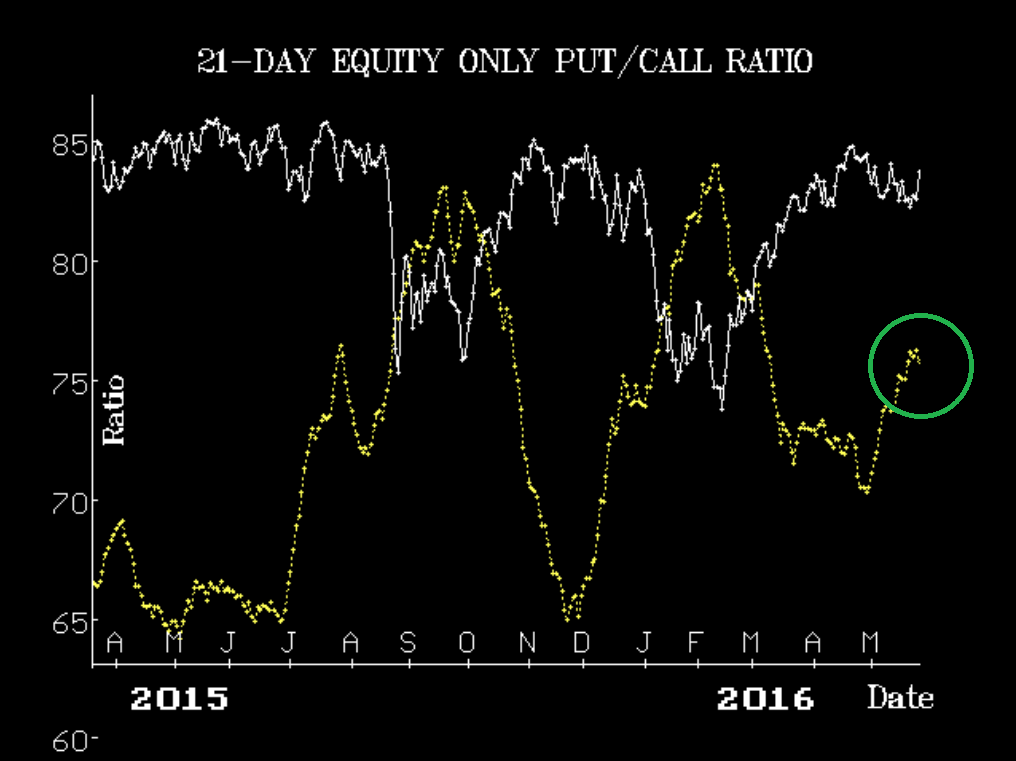

The standard equity-only put-call ratio rolled over to a buy signal yesterday, but the weighted has not. That is a change of pace, and it reflects the fact that put buying is finally subsiding a bit. The Total put-call ratio barely edged downward, though, so its pending buy signal does not appear imminent...

This excerpt was part of the market commentary featured in this morning's edition of The Daily Strategist. Sign up for a free 7-day trial today to read the article in its entirety.

© 2023 The Option Strategist | McMillan Analysis Corporation