By Lawrence G. McMillan

Bulls took charge early yesterday and kept the upward pressure on all day long. The strength of the rally changed the status of several indicators as well. So the 2040 area is reinforced as the major support level of $SPX once again. The brief probe below that level, for a few cents and for a few minutes last Friday, was not enough to qualify as a break of that support level. It’s unclear if the bears are going to get another chance for that breakout anytime soon. The overhead resistance at 2110 may be tested first.

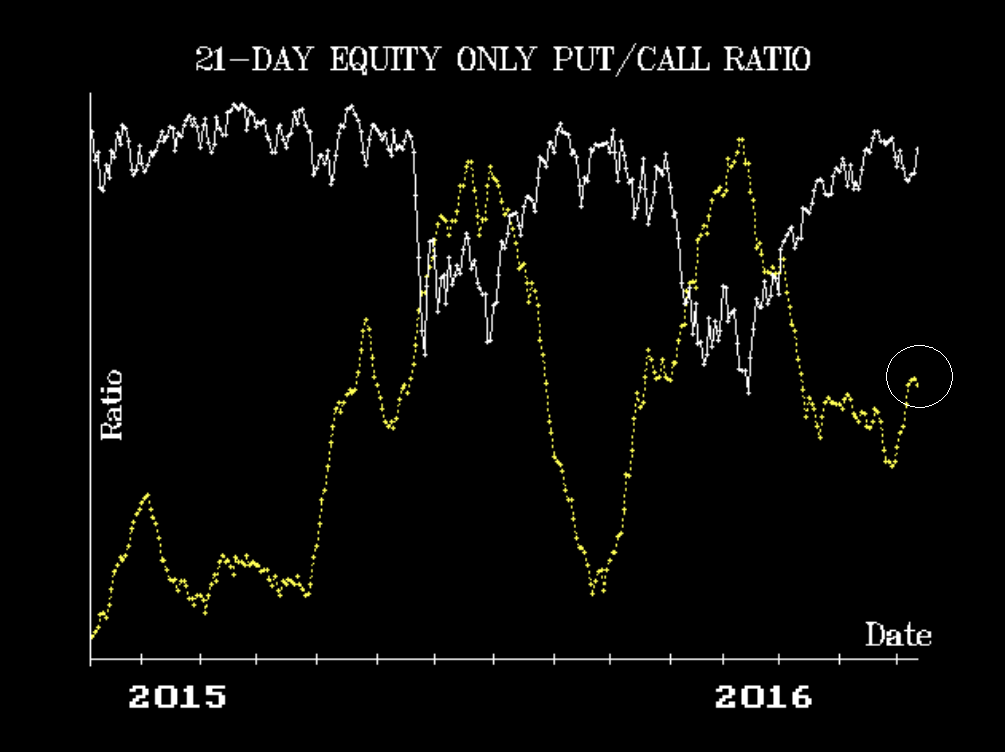

Equity-only put-call ratios are now mixed. The standard ratio has rolled back to a buy signal! There is a visible curl downwards, and that is confirmed by the computer analysis programs. The weighted ratio also curled over slightly, but it is still graded as “sell” at this point.

Meanwhile, breadth was very strong – strong enough to cancel out the NYSE oscillator sell signal...

This excerpt was part of the market commentary featured in this morning's edition of The Daily Strategist. Sign up for a free 7-day trial today to read the article in its entirety.

© 2023 The Option Strategist | McMillan Analysis Corporation