By Lawrence G. McMillan

We follow four main indicators, and they usually guide us in the correct direction of the markets. As noted elsewhere in this issue, price is the most important indicator of all (in this case, the price of the Standard & Poors 500 Index [$SPX]). However, the others – equity-only put-call ratios, market breadth, and volatility indices – are important, too. Usually, we want confirmation from price before acting on opposing signals from the other areas. In fact, all that was lacking for a major sell signal last week was confirmation from price. It never came, as $SPX has continued to hold above support.

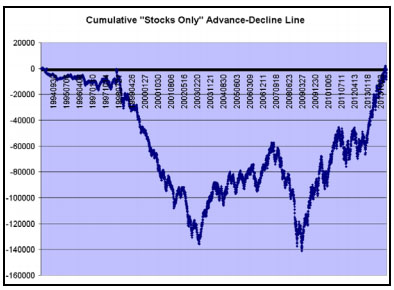

However, we are now seeing some potential negative divergence between price action and market breadth. It could be that this divergence will turn out to be nothing. But many major tops are marked by a divergence between breadth and price action, and so we want to present some history of this phenomenon before something bad happens...

Read the full article (published on 7/25/14) by subscribing to The Option Strategist Newsletter today. Introductory 3 month trial subscriptions are available for only $29.

© 2023 The Option Strategist | McMillan Analysis Corporation