By Craig Hilsenrath

We are pleased to announce the release of Option Workbench 2.2. This new version of Option Workbench contains several new features that make finding opportunities even easier and assist you in analyzing your risks before you trade.

Parkinson Volatility

Option Workbench now incorporates the Parkinson Historical Volatility calculation into the Option Profiles and Volatility Study. The Parkinson Volatility measures intraday dispersion of the underlying price by using the daily high and low.

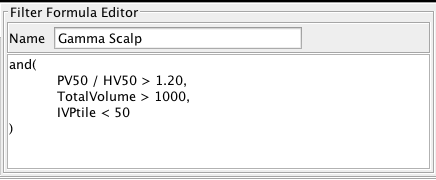

Parkinson Volatility, developed by physicist Michael Parkinson in 1980, can be used to better understand market dynamics by comparing the Parkinson measure to the standard historical volatility. For example, consider a stock that gaps at the open but then moves back to the previous close. The intraday price action is not reflected in the daily volatility but can be seen in the Parkinson volatility. Each Option Profile shows the 20, 50 and 100-Day Parkinson Volatility. Due to data constraints the Parkinson calculation is not available for futures and some equity indices. The Parkinson number is available for all equities and ETFs. One use of the Parkinson volatility in Option Workbench is to help in finding potential gamma scalping opportunities. The image below shows an example of such a filter formula.

This simple formula searches for equities where the 50-Day Parkinson volatility is at a 10% premium to the 50-Day historical volatility. Since liquidity is important for gamma scalping the volume filter is used to exclude low option volume equities. Because a long straddle is typically used in gamma scalping situations, low implied volatility is desirable so that the straddle is relatively inexpensive. An increase in implied volatility will also be beneficial to the position. For more information on gamma scalping see Stan Freifeld’s recorded presentation Gamma Scalping in a Volatile Environment.

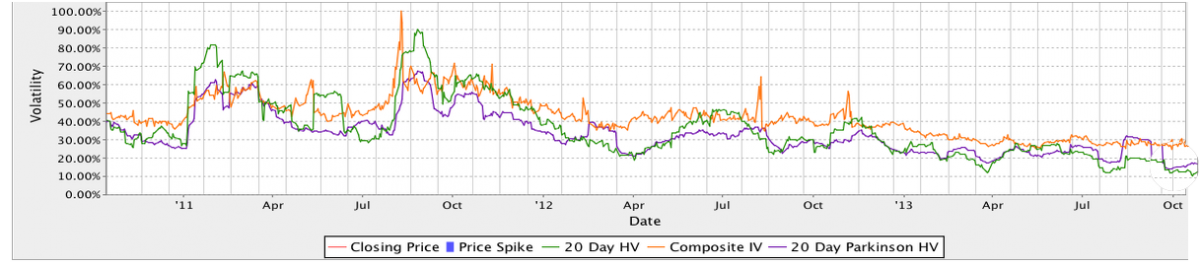

The time series of the Parkinson Volatility is displayed in the Volatility History chart in the Volatility Study. The image below shows the volatility time series for one of the equities that was found using the sample filter. The magnified area shows that the 50-Day Parkinson Volatility, the purple line, has been running higher than the 50-Day historical volatility for the last several months. Additionally, the Composite IV, the orange line, is at a relatively low value for the three year time period under consideration.

Spread Builders

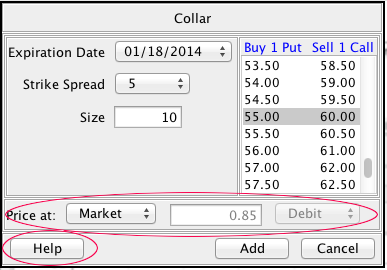

A new Spread Builder has been added that aids in constructing Collars and Fences. The Collar/Fence Editor is used to construct 1x1 collar and fence spreads. The difference between a collar and fence is that a collar has an underlying leg equal to the number of collar contracts multiplied by the number of shares per contract. In the figure below, a long collar, the 10 01/18/2014 55 puts and -10 01/18/2014 60 calls will be accompanied by 1000 shares of stock.

In the image above two new features are highlighted. Each spread builder now has a Help button. Clicking the help button shows a window that explains the usage of the editor. Additionally when building a spread you can now choose to price the spread at the market (i.e. selling at the bid and buying at the ask), the mid price for each leg or you can choose a limit price. Be sure to set the correct execution type (Debit, Credit, or Even) when entering a limit price.

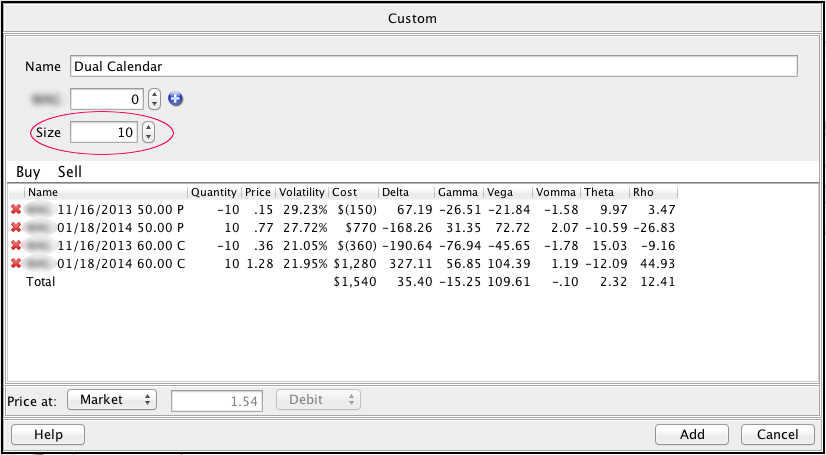

In the Custom Spread Editor, pictured below, or when editing an existing spread, the scaling control has been replaced by a Size control. As in previous versions, you can change the size of individual legs. Now, when the size of the spread is changed, the Custom Spread Editor will automatically calculate the appropriate ratios and scale each leg appropriately.

Option Vomma

Option Workbench now calculates and displays the vomma of individual options and spreads. Vomma measures the second order sensitivity to volatility. Stated another way, vomma measures the rate of change of the vega as the volatility changes. With positive vomma, a position will become long vega as implied volatility increases and short vega as implied volatility decreases.

Other Enhancements and Bug Fixes

- The number of business days to expiration has been added to the Pricing Sheet.

- Two new Naked Put Profile columns have been added:

DBE Sigmas - The number of standard deviations the downside break even price is below the underlying price. Standard deviations are based on the implied volatility of the put option.

Strike Sigmas - The number of standard deviations the strike price is below the underlying price. Standard deviations are based on the implied volatility of the put option. - The help windows available from the profile windows and the spread editors have a Print and Close link.

- When copying a spread in the Spread Analysis section the volatility shifts are copied to the new spread.

- Under some conditions the value of a call option when changing the volatility was below the intrinsic value.

- Data is cleaned up when closing the detail analysis for an asset.

- Some minor changes to the Covered Call and Naked Put profile data loading were made to improve filtering performance.

- Bug fixes were made to the Volatility Study to deal with missing data.

Contact Information

If you have any questions please feel free to contact us Option Worbench support at support@hilcosoftware.com. Please also visit the Option Workbench tutuorials to see the recordings of our previous webinars and instructional vidoes.

© 2023 The Option Strategist | McMillan Analysis Corporation