By Lawrence G. McMillan

The “collar” is an interesting and useful strategy – at times. This might be one of those times. With many high-yielding stocks having risen to dizzying heights, holders of those stocks may be somewhat leery of the gains that have taken place, but might also not be willing to sell the stocks because of the capital gains taxes that might be due on long-term holdings at low cost bases.

We have written about this strategy before, and it was a major topic in the recent webinar on “portfolio protection,” but many people gloss over the subject until it’s too late. So, with the stock market near all-time highs and with many large-cap stocks in the same state, it is certainly time for a review of the strategy, using current data.

Background

Collars are a protective strategy that falls into the category of what we call “micro protection” – protection whereby one employs options on each individual stock that he is interested in protecting. That’s as opposed to “macro protection,” whereby one uses index options to hedge his entire portfolio at one time. Macro protection is likely to have “tracking error” (the index utilized does not perform exactly like one’s stock portfolio); micro protection has no tracking problem.

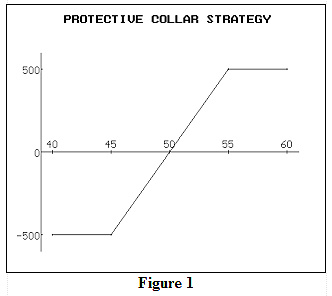

A collar consists of selling an out-of-the-money call and simultaneously purchasing an out-of-the-money put, on the stock that you want to protect. If the call can be sold for a price equal to or larger than the price of the purchase put, it is called a “no-cost” collar.

A collar consists of selling an out-of-the-money call and simultaneously purchasing an out-of-the-money put, on the stock that you want to protect. If the call can be sold for a price equal to or larger than the price of the purchase put, it is called a “no-cost” collar.

Employing a collar both limits risk and reward. There is no further risk below the striking price of the put, and there is no further gain above the striking price of the written call. In fact, the entire strategy – long stock, long out-of-the-money put, and short out-of-the-money call – is equivalent to a bull spread. It has a profit potential as shown in Figure 1...

Read the entire Is It Finally Time To Collar? article (published 5/31/13) including a list of potential collars in BMY, JNJ, VZ, PFE, LMT, WAG, PG, ABT by subscribing to The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation