The stock market continues to grind higher as the Dow Jones Industrial Average ($DJX) continues to make new all time highs. The S&P 500 ($SPX) is approximately 5 points away from accomplishing the same historic feat. This follows the scenario predicted in The Option Strategist 2013 Stock Market Forecast, where Larry McMillan compared the current market to the 1970's and predicted that the S&P 500 would reach the 1550-1600 level before suffering another severe market downturn. Larry wrote:

"We have been talking for years about the similarities between the current market (since the mid-1990's) and the stock market of 1966 to 1983. The primary feature of that past time period was three bear markets. We have also often talked about the fact that, after an upside explosion – bubble, if you will – such as occurred in the tech boom of the late 1990's,there needs to be a cooling off period of roughly 16 years or so. Since that bull market topped in 2000, we don’t expect the current market malaise to be over until at least 2016. Similar periods existed in 1907-1920 and also 1929-1946.

It is fairly normal for there to be a series of bear markets in those periods of hiatus, and that is why we continue to expect there will be another nasty bear market in the near future. This does not encompass any fundamental reasoning, but usually a full-fledged financial crisis occurs which takes a long time to work off. In effect, the deleveraging that needs to be done simply takes a long time to accomplish.

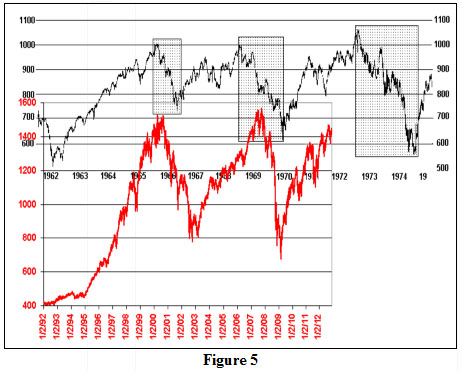

In Figure 5 above, there is one graph that has two long-term stock market charts overlaid – one above the other. The higher graph, drawn in black, shows the Dow-Jones Industrials from 1962 through 1974. The lower graph, in red, shows the S&P 500 ($SPX) from 1992 to the present...

Under the scenario laid out on the upper chart, one would expect $SPX to return to the 1550 highs before yet another bear market sets in. Since each of the three bear markets in 1966-1974 made lower lows, it is possible that the next bear market could do the same. I realize that seems almost unthinkable, but in March, 2009, how reasonable was it to expect that $SPX would retrace all the way back to its highs – which it almost has?

2013 is also the first year of the Presidential Cycle – a year in which many bear markets begin or accelerate. So that only adds to the potential bearish scenario."

If this forecast proves true, one would certainly want to have some protection in place before the market begins to turn. On Saturday, March 14th, Larry McMillan will be giving a 2 hour intentisve option webinar detailing the various ways to hedge entire portfolios and individual stock positions with options and volatility derivatives. Sign up for McMillan's Modern Portfolio Protection Webinar today and learn to protect your stock and option positions.

© 2023 The Option Strategist | McMillan Analysis Corporation