By Lawrence G. McMillan

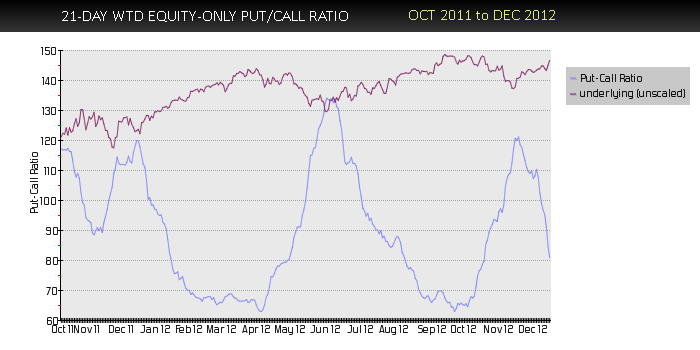

Stocks continue to work higher. The main cause is the unwinding of previous pessimism (see put-call ratio charts, for example), although the media won’t believe that. They are certain it all has to do with the fiscal cliff. Regardless, we are beginning to see overbought conditions again, and a short-lived pullback might be in order. However, with the holiday period approaching, it is unlikely that there will be much activity after tomorrow, for much of the remainder of this year.

$SPX has cleared resistance and should now be able to make its way towards the yearly highs above 1460. Equity-only put-call ratios remain bullish, but they are plunging on their charts and will soon be in overbought territory, if they aren’t already. Market breadth was extremely strong...

To read Larry's full market commentary from this morning, subscribe to McMillan's Daily Volume Alerts.

© 2023 The Option Strategist | McMillan Analysis Corporation