By Ryan Brennan

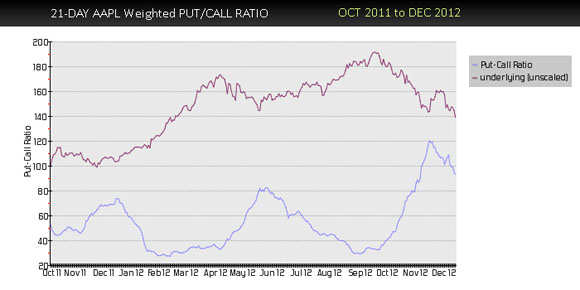

As we all know, Apple (AAPL) is down roughly 25% since its high in September. As one may expect, volatility has subsequently increased, resulting in various option trading opportunities. AAPL recently gave a confirmed put-call ratio buy signal. However one may be hesitant to "catch the falling knife" by purchasing the stock, or even going long calls outright. Instead, he could set up a hedged position and trade the volatility.

The software and hardware giant's stock, which has a 100-day historical volatility of 31%, currently has options implying future volatility of 40%, as measured by its composite implied volatility. As investors pay up for puts to protect their stock positions and traders look to "hit home runs" by purchasing inexpensive (in dollar terms) options, deeply out-of-the-money puts have become the most expensive contracts, resulting in a vertical skew in the options. In other words, the out-of-the-money puts get more expensive (in volatility terms) the further away from the strike-price they are. For example, the January 450 puts are trading with an implied volatility of 44.93, while the 440 and 430 puts have implieds of 46.15 and 47.00 respectively. As subscribers of The Daily Strategist know, this skew presents an opportunity to employ one of our favorite strategies: the put-ratio spread.

AAPL Implied Volatility

AAPL Jan 450 Put: 44.93 %

AAPL Jan 440 Put: 46.15 %

AAPL Jan 430 Put: 47.00 %

In this trade we want to buy the lowest volatility (through the purchase of the 450 puts) and sell the two higher volatilities (through the sale of the 440 and 430 puts) for a significant credit. When the skew doesn't exist, this position may not be able to be established for a credit at all.

AAPL Jan 450/440/430 put-ratio spread

Stock: AAPL

Price: 518.83

Buy AAPL Jan 450 Put: 4.50

Sell AAPL Jan 440 Put: 3.30

Sell AAPL Jan 430 Put: 2.55

For a Net Credit of 1.35 or higher

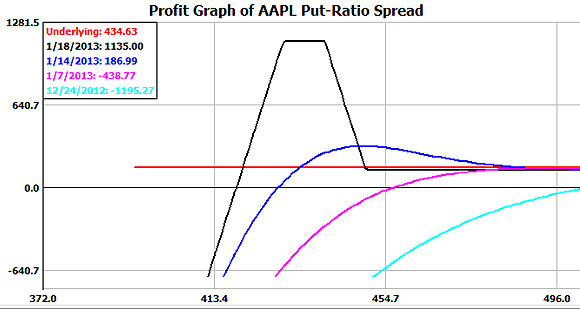

The margin requirement for the put-ratio spread position is roughly $10,750 on margin, per three-way spread (25% of the naked 430 strike). If AAPL remains above 460 come expiration your options would expire worthless. No action would be needed and the initial credit of $135 would be realized, resulting in a 1.25% gain in 31 calendar days (an annualized return of 15.8%).

The position has the opportunity to make a maximum profit of $1,135 if AAPL were to be between 440 and 430 at Jan expiration. In other words, if Apple were to drop another $88, or 16.9%, our trade would actually make significantly more money (10.6% in a month!).

The down-side break-even point for our position would be all the way down at 418.65. If AAPL were to trade down to that level at any time before January 18th, we would close out the position for a loss. If AAPL is between 430 and 418.65, the position would need to be closed on expiration day, most likely for a small to moderate profit depending on the exact level.

In summary, even though we have received confirmed put-call ratio buy signals in AAPL, we feel more comfortable trading the volatility and establishing a deeply out-of-the-money put-ratio credit spread. This position allows us the opportunity to make money if the stock goes up, down significantly or even nowhere at all. More importantly, the position allows us to sleep at night.

Put-Ratio spread trading positions are recommended in both The Daily Strategist and Option Strategist Newsletters. Volatility data, including implied volatility, composite implied volatility and volatility skew rankings, is avaiable daily on The Strategy Zone.

© 2023 The Option Strategist | McMillan Analysis Corporation