By Lawrence G. McMillan

In past issues of The Option Strategist Newsletter, we have stated that we mainly utilize naked put sales rather than covered call writes in its traditional form – even for cash accounts. Several readers have asked not only how this works, but why we do this. So let us explain.

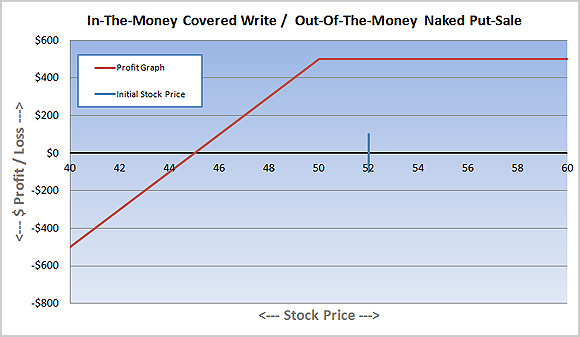

First of all, it should be understood that the two strategies – naked put writing and covered call writing – are equivalent. Both have fixed, limited upside profit potential above the striking price of the written option, and both have downside risk below the striking price of the written option.

One very compelling, yet simple reason in favor of naked put writing is this: commission costs are much lower. A covered write entails two commissions (one for the stock, the other for the written call). A naked put requires only one. Furthermore, if the position attains its maximum profitability – as we would hope that it always does – there is another commission to sell the stock when it is called away. There is no such additional commission for the naked put; it merely expires worthless.

Now, commission costs are small in deeply discounted accounts, but not everyone trades with deep discount brokers. Moreover, even there, it doesn’t hurt to save a few dollars here and there.

So, a naked put sale will have a higher expected return than a covered call write, merely because of reduced commission costs.

Another factor in utilizing naked puts is that it is easier to take a (partial) profit if one desires. This would normally happen with the stock well above the striking price and with a few days to a few weeks remaining before expiration. At that time, the put is (deeply) out of the money and will generally be trading actively, with a fairly tight market – a nickel wide or so. In a covered call write, however, the call would be deeply in-the-money. Such calls have wide markets and virtually no trading volume.Hence, it might be easy to buy back a written for a nickel or a dime, to close down a position and eliminate further risk. But at the same time, it would be almost impossible to remove the deeply in-the-money covered call write for 5 or 10 cents over parity.

The same thinking applies to establishing the position. The call is in the money – often fairly deeply – while the put is out-of the money. Thus the put market is often tighter and more liquid and might more easily be “middled” (i.e.,traded between the bid and ask). Again, this potentially improves returns.

Cash-based Naked Put Writing

The above facts regarding naked put writing are generally known to most investors. However, many are writing in IRA or other retirement accounts, or they just feel more comfortable owning stock, and so they have been doing traditional covered call writing – buying stock and selling calls against it.

But it isn’t necessary, and it certainly isn’t efficient, to do so. A cash-based account (retirement account or merely a cash account) can write naked puts, as long as one has enough cash in the account to allow for potential assignment of the written put. Simply stated, one must have cash equal to the striking price times the number of puts sold (times $100, of course). Technically, the put premium can be applied against that requirement.

Most brokerage firms do allow cash-based naked put writing, however some may not. Some firms may require that you obtain “level 2" option approval before doing so, but that is usually a simple matter of filling out some simple paperwork. If your brokerage does not allow cash-based put-selling, you can always move the account to one that does like Fidelity or Interactive Brokers.

Once you write a naked put in a cash account, your broker will “set aside” the appropriate amount of cash. You can’t withdraw that cash or use it to buy other securities – even money market funds.

One of the other advantages of writing naked puts on margin is that the writer can gain a fair amount of leverage and thus increase returns if he feels comfortable with the risk (as a result, we have long held that naked put writing on margin makes covered call writing on margin obsolete). That is not the case with cash-based naked put writing, though. The returns are more in line with traditional covered call writing.

It is a simple matter to convert expected returns from selling puts on margin to cash-based returns.

Example: suppose a margin-based put sale of the XYZ Jan 30 put (trading for 1.25) has an expected return of 45% and an expected investment of $800. To convert to cash-based returns, multiple the expected return by the expected investment and divide by (striking price – put premium).

Cash-based return = 0.45 * 800 / (3000 – 125)

= 12.52%

One should still require 12% annualized returns on cash (or even slightly higher in the current volatile environment) as a minimum for a viable cash-based put sale, just as he would with a regular cash covered write. So this write would be marginally acceptable.

Note that “broad-based” margin is not applicable to cash-based put-selling. So the sale of index options may not be viable on cash.

In summary, put writing is our strategy of choice in most cases – whether cash-based or on margin.

Source: The Option Strategist Newsletter Volume 17, Number 6

For naked put-selling recommendations on a daily basis, subscribe to The Daily Put-Writer or The Daily Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation