By Lawrence G. McMillan

This article was originally published in The Option Strategist Newsletter Volume 2, No. 9 on May 13, 1993.

Covered call writing is not one of our normally recommended strategies, because we prefer ratio writing or the equivalent, since it is a more neutral strategy. However, covered writing is a strategy practiced by many option investors and therefore is a topic worthy of discussion. In this article, we will approach this subject from a slightly different, more sophisticated viewpoint: we will compare the covered call write with the sale of a naked put. In addition, we'll see how this comparison leads us to conclusions regarding neutral strategies such as ratio call writing or straddle and combination selling.

First, the basics: A covered call write is nothing more than the sale of a call option and simultaneously being long 100 shares of the underlying stock. It makes no difference whether the stock is bought for the express purpose of the covered writing strategy, or if the call is sold against stock already owned. The strategy is generally considered to be a conservative one since it involves less risk than owning stock (but whoever said stock ownership wasn't risky?).

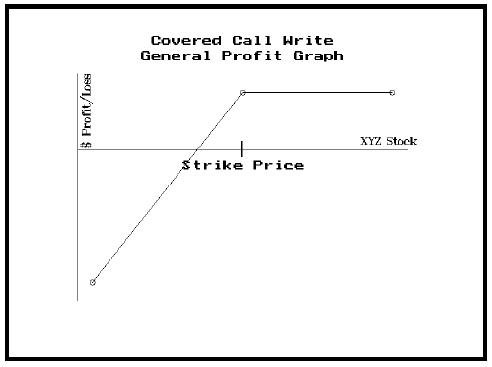

The graph below depicts the general profitability of this strategy at the expiration date of the written call option: if the stock is above the striking price at expiration, the profit potential is limited since the stock can be called away. Below the strike, the covered writer gets to keep the call premium that he received when he sold the option originally. This premium may be viewed either as downside protection against a decline in price by the underlying stock, or as income — an addition to the dividend of the common stock.

The overall profit picture from this strategy is therefore one in which there are limited rewards (if the stock rises above the striking price) and large potential losses (if the stock should decline in price by a great deal). On the surface, that type of profit picture might not be attractive to many individuals; stockowners generally realize that they have risk if the stock declines, but at least they can make large profits in the stock rises. However, one needs to look at covered call writing a little more closely in order to evaluate it fairly. First of all, the call write will provide a better return than owning stock if the stock price is relatively unchanged over a short period of time. That is, if the stock does not decline in price by more than the premium received from selling the call, or if the stock does not advance too far beyond the striking price, then the covered call write is a better strategy than owning stock. In fact, notice the shaded area on the above graph; the covered call write outperforms the ownership of stock all through that area. Of course, the drawback is that if the stock rises substantially, one will not participate if he has sold a call. The other advantage to writing call against stock that is owned is that it reduces the overall volatility of the portfolio of stocks: that is, the portfolio will not decline in price as much as a portfolio of stocks in a bear market, nor will it advance as much during a bull market. This reduction in volatility is often an attractive feature, especially if one is looking for more stable returns on his portfolio. Thus, if one is constantly writing calls during a large bull market, he will underperform the "market", but will outperform it during a bear market.

One of the problems with covered call writing is that investors don't like underperforming the market when it rises. A case in point was illustrated by Jim Yates, of DYR Associates, who recently wrote that one of the "option income" funds was disbanding. The "option income" funds practice the covered call writing strategy exclusively. Over the past 10 years, the fund "only" rose about 10% per year as opposed to the market average of about 15% over that time. Thus, the fund was being shut down due to "underperformance". However, Jim points out that no one bothered to mention that over those ten years, the fund had less volatility than the stock market and also had less risk than the market. This is a common complaint when covered writing is viewed over the long run. A similar situation existed and probably still does exist in PERCS. A PERCS is a Preferred stock with an extra dividend; the PERCS can be called away by the company at a fixed price. Thus a PERCS is really a covered call write all rolled up into one security. Many fund managers and investors who originally bought them were disappointed that they didn't perform better on the upside when the underlying stocks rose in price. Again, the same complaint about the same strategy. The bottom line is that one must understand an option strategy in terms of both risk and reward before he can evaluate its performance.

Selling Naked Puts

Is there any way to improve on the strategy? Yes, there is. That is simply to write uncovered (naked) puts instead of writing covered calls against stock. Most people's reaction to that statement is one of slight disbelief: how can a strategy which is considered to be conservative (covered call writing) be directly compared to the naked sale of an option, which everyone knows is extremely risky since one's losses could be several times the amount of the premium that he originally sold the naked option for. In fact, these two strategies are equivalent — that is, they have exactly the same risk and reward characteristics in terms of dollars.

Example: XYZ is selling for 50 dollars per share. The October 50 call is

selling for 3 points and the October 50 put is selling for 3 as well.

Compare the covered write — buying the stock at 50 and selling the call

for 3 — with the naked sale of the put at 3. The following table shows

that the dollars of profit are exactly the same for either the covered

write or the naked sale of the put.

Stock Call Stock Call Covered Write Put Price Naked Put Sale

Price Price Profit Profit Profit Profit

40 0 –$1000 +$300 –$700 10 –$700

45 0 –$ 500 +$300 –$200 5 –$200

47 0 –$ 300 +$300 0 3 0

50 0 0 +$300 +$300 0 +$300

55 5 +$ 500 –$200 +$300 0 +$300

60 10 +$1000 –$700 +$300 0 +$300

The column entitled "Covered Write Profit" is the sum of the two columns to its left ("Stock Profit" and "Call Profit"). Note

that the "Covered Write Profit" is exactly the same as the "Naked Put Sale Profit". This means that the two strategies

are equivalent; that is, they are essentially the same.The above example was a simple one in that it showed the put and call as being the same price when the stock price is the same as the striking price. This is a little unrealistic, but does not change the fact that the strategies are equivalent. Notice that equivalent means they have the same dollars of profit or loss, not necessarily the same return. That is where the naked put strategy actually excels. The covered writer has to pay for the stock in full and then receives the call sale proceeds, so the above example would require an investment of $4700 to buy stock at 50 and sell the call for 3. He could also buy the stock on 50% margin, which would reduce his investment to $2200, but would entail paying margin interest charges. Finally, the naked put sale requires that one put up collateral of 20% of the stock price, plus the option premium. This would be $1300 initially (20% of $5000 plus the put price of $300). This requirement varies as the stock price changes, so if the stock were to drop to 40, the naked put requirement would grow to $1800 (20% of $4000 plus the assumed put price of $1000 with the stock at 40). In either case, the original $300 of proceeds from selling the put could be used to reduce the requirement. In order to make a relatively similar comparison, let us assume that we are allowing $1500 for the sale of the naked put, although that amount would not be necessary unless the stock fell to 40. Then we can make the following comparisons, assuming that one uses T-Bills or some other interest-bearing instrument as collateral for the sale of the naked put:

Cash Covered Write Margin Covered Write Naked Put Sale Investment Required $4700 $2200 $1500 Dividends Earned Yes Yes No Interest None Charged Earned Commissions Two Two One Return on Investment Lowest Uncertain Highest

Note that the naked put sale only involves one commission, while the covered call write involves two (if the stock is bought). One can see that the naked put sale is a superior strategy to the covered call write, from a rate of return standpoint. Thus, traders interested in covered writing should really be selling naked puts instead. Sophisticated traders who utilize this strategy will often allow a little extra collateral for the naked put sale, but that does not alter the attractiveness of the put sale over the covered call write.

Neutral Strategies

Covered call writing is a bullish strategy (albeit a modestly bullish one). The logical neutral strategy that is akin to covered writing is ratio writing: the purchase of stock and the sale of more than one call against that stock. This increases the downside protection, but creates the possibility of upside losses — a more neutral strategy. Longer-term subscribers know that we don't recommend ratio writes, either. Instead we usually recommend straddle or combination sales, for they are equivalent strategies. Moreover, these equivalent strategies are a more efficient use of money, as evidenced by the above table. Consider the following equalities:

Ratio Write: is equivalent to: which is a Straddle Sale

Covered call write Naked Put Sale Naked put sale

+ + +

Sale of additional call Sale of additional call Naked call saleThus, it is more efficient to use the equivalent strategy than it is to use either the covered call write or the ratio write. We do sometimes, however, recommend using stock to hedge naked strategies since it is easy for subscribers to place buy and sell stop orders in the stock. Moreover, using the stock for defensive purposes can be advantageous as expiration nears since one does not have to pay the time value premium as he would in order to buy back the naked short options.

This article was originally published in The Option Strategist Newsletter Volume 2, No. 9 on May 13, 1993.

© 2023 The Option Strategist | McMillan Analysis Corporation