By Lawrence G. McMillan

This article was originally published in The Option Strategist Newsletter Volume 4, No. 8 on April 27, 1995.

Since we are currently recommending a "backspread" strategy in OEX options (and have been for a while), we though it might be beneficial to define and review the strategy for subscribers who are not familiar with the term.

When listed options first began trading in 1973, only call options were listed (listed puts didn't exist until 1977). Moreover, there were only a few stocks that had listed options, in comparison to the more than 1300 equities, 75 indices, and 600 futures that underly listed options today (there were no listed index or futures options back then).

Because there were so few listed options and because investors were less sophisticated about option strategies, outof- the-money call options were quite expensive. Thus, the "sophisticated" preferred strategy of that time was the call ratio spread.

Example: Assume XYZ is at 50 and the July 50 call is selling for 5 while the July 60 call is selling for 2. A call ratio spread would be:

Buy 1 July 50 call

and Sell 2 July 60 calls

The debit of this position is 1 point (5 – 2×2) and that is the most that can be lost if the stock falls in price. To the upside, the maximum profit would occur at 60 at expiration, and profits would exist up to the upside breakeven point of 69. Above that price, theoretically unlimited losses could occur.

The attractiveness of the strategy was that the profit range was so wide that it was quite probable that the stock would end up in that range at expiration, thereby resulting in profits. This strategy was extremely popular among professionals and sophisticated investors, who had plenty of collateral at their disposal in order to finance the naked options in the position.

As time passed, the out-of-the-money calls grew less expensive and the markets grew more volatile. These two conditions lessened the profitability of the ratio spread strategy to the point where ratio spreads were often losing money. Sophisticated traders then began to think of trading the opposite position. That "opposite" position was at first called a reverse ratio spread, but then was tagged with the shorter and "sexier" moniker, backspread. Its characteristics are just the opposite of those of the ratio spread: it has unlimited profit potential and limited risk. The backspread is normally constructed so that one takes in an initial credit when he establishes the spread. This provides some profitability in either direction.

Example: Using OEX, suppose the index is at 485, the June 490 call is 6 and the June 475 call is 16. Then a backspread can be constructed as follows:

Buy 2 June 490 calls

and sell 1 June 475 call

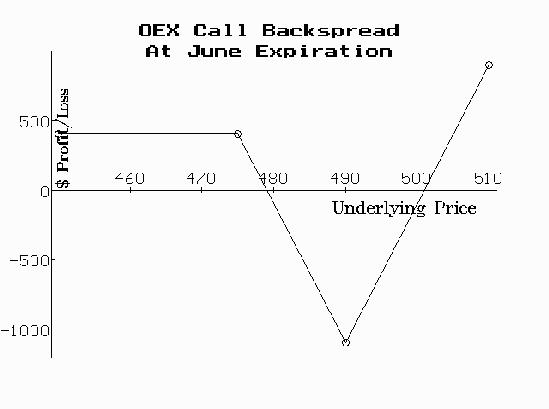

This transaction initially brings in a credit of 4 points (16 — 2×6). Thus, if OEX falls in price and all the options expire worthless, the trader will still be left with a 4-point profit. Moreover, since two options are owned versus only one short option, there are theoretically unlimited upside profits available if OEX rises far enough by June expiration. In fact, on the upside OEX would have to rise above 501 in order for the position to profit. Between 479 and 501, a loss would result at expiration, with the worst result occurring if OEX were right at 490. The profit graph below shows the properties of this spread.

In today's more sophisticated environment, both ratio spreads and backspreads have their place. When options are "cheap" when compared with their historical norms, then backspreads are the favored strategy. This is true because it is likely that the underlying will become volatile, and the backspread is more successful with large price movements by the underlying. Specifically, this is the case with OEX options today; they are quite cheap and, should OEX begin to experience large price swings in either direction, the backspread strategy would profit. In fact, OEX has risen over 30 points since we first began recommending this strategy back in late February.

However, at other times or in other markets (gold or cattle, for example), out-of-the money options are relatively expensive so ratio spreads are favored. As always, no one strategy is applicable all of the time. Finally, it should be noted that similar strategies can be constructed with puts, so that put backspreads have unlimited downside profit potential and put ratio spreads have downside risk.

This article was originally published in The Option Strategist Newsletter Volume 4, No. 8 on April 27, 1995.

© 2023 The Option Strategist | McMillan Analysis Corporation