By Lawrence G. McMillan

This article was originally published in The Option Strategist Newsletter Volume 2, No. 7 on April 8, 1993.

Many strategists like to position themselves so that they can make money when the underlying security swings wildly, rather than having to scramble as naked option sellers must during such wild price swings. One strategy that allows the strategist to do this is the "backspread". In general a backspread consists of selling an in-the-money option and then buying a larger quantity of out-of-the-money options, all on the same underlying instrument. Some traders even use a broader definition, preferring to use the term "backspread" to refer to any strategy in which one can make money on large price moves; by this alternate definition, straddle purchases and combination purchases would qualify as backspreads as well. For the purposes of this article, we will stick with the first, more restrictive definition.

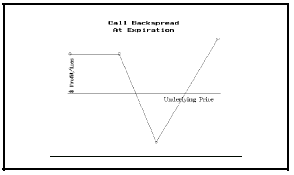

Example: The following prices exist: XYZ: 50 June 45 call: 7 June 50 call: 3 A backspread can be constructed by selling the June 45 call and buying two of the June 50 calls. The resultant position has a profit potential as shown in the above box. There is unlimited upside profit potential due to the presence of the extra long call. Moreover, there is some profit potential on the downside since the overall position was established for a credit (1 option sold at 7, 2 options bought at 3, for a total credit of 1 point). If the stock declines and all the options expire worthless, the strategist will make a profit equal to his initial credit — one point. The danger, of course, lies in the fact that if the stock does not move away from 50, then there will be losses with the maximum loss point being right at 50. Of course, these losses are limited (as are the losses from buying a straddle), but they could be substantial in percentage terms. The maximum loss in this example would occur if XYZ were at 50 at expiration. In that case, the long options would expire worthless and the June 45 call would have to be bought back at a price of 5. Thus, the overall loss would be 4 points (the cost of the final purchase at 5 less the initial credit of 1 point).

Of course a similar position can be constructed with puts. In the context of the above example, one would sell a June 55 put (which is an in-the-money put) and then buy 2 June 50 puts to construct a backspread with puts. Obviously, one could buy options farther out-of-the-money if he wanted to construct the backspread in that manner.

There are other nuances which can be added. Some strategists prefer to buy a slightly longer-term call in order to combat the ravages of time decay on the long side of their position. Another position that is often constructed is to establish both a put and a call backspread simultaneously. This gives unlimited profit potential in either direction, although it increases the overall maximum risk level. This latter position can also be thought of as selling a straddle and then buying both out-of-the-money calls and out-of-themoney puts as protection for the straddle sale.

In any case, these positions have one thing in common: limited maximum risk (which always occurs at the strike price of the purchased options) and unlimited profit potential to one side or the other (upside for call backspreads; downside for put backspreads). This is an attractive scenario to many investors. However, the strategy is not an automatic money maker (nor is any other strategy) because the underlying instrument must be volatile in order for the position to profit. If the stock remains relatively docile, then losses are sure to result. In addition, one must be careful about evaluating the options in the strategy. One would not want to be buying out-of-the-money options which are expensive with respect to the options that he is selling; that is, one does not want the out-of-the-money option to have a higher implied volatility than the in-the-money option that he is selling. If fact, one would want the opposite to be true. This might lead one to look for situations where options at different strikes have different implied volatilities — which is essentially the definition of volatility skewing.

Volatility Skewing Means Backspread Candidates

Whenever volatility skewing is present, the strategist has a candidate for a backspread. Whether one establishes a call backspread or a put backspread depends on the direction of the volatility skewing.

Example: OEX options and soybean options usually have a certain amount of volatility

skewing present. Suppose the following prices exist.

OEX Soybeans

Underlying price 410 600

One strike lower implied vol. 15% 15%

At-the money option implied vol.13% 17%

One strike higher implied vol. 12% 20%

OEX options display volatility skewing, with a downside bias. That is, out-of-the-money OEX

puts have the highest implied

volatilities, and out-of-the-money calls have the lowest. Since a backspread involves

buying the out-of-the-money option, the backspreader wants to purchase the option with the

lowest implied volatility. For OEX then, he would buy some of the out-of-the-money calls

and sell an at- or in-the-money call against them in order to establish the backspread.

Grain futures options display volatility skewing with a positive bias. That is, implied

volatilities increase for out-of-themoney calls. Therefore one would want to establish

backspreads with puts: buy some out-of-the-money puts and sell an at- or in-the-money put

against them.

By establishing backspreads where volatility skewing is present, one adds an attractive bias to his backspread, for he is buying an

option that is cheaper than the option that he is selling. In addition, if the technical picture is attractive, the position may take on

even more significance. For this reason, we are recommending the following backspread in OEX calls.

Current Prices

Position I28: Buy 7 OEX May 415 calls May 415 call: 4e

and sell 4 OEX May 400 calls May 400 call: 14¼

for a total credit of 24¾ or more OEX: 410.25

Risk Rating: Below Average Risk

Profitability: This position satisfies all of the criteria that we described for an attractive backspread. First the implied volatility of the call that is being purchased (OEX May 415) is 11.6%, while the implied volatility of the call that is being sold (OEX May 400) is 14.7%. Note: these are not the same as the implied volatilities in the table on page 5 since they were computed at different times. Second, since we are generally bullish on OEX via our put-call ratios, the unlimited profit potential to the upside is an attractive feature as well. Finally, a point not previously made: if OEX moves up, this position will benefit since long straddles (which this resembles) benefit from the volatility skewing. That is, if OEX moves up to 415, the implied volatility of the May 415 call will increase since it will then be the at-the-money call. For a more detailed description of how volatility skewing biases an existing position see the article on page 7 of Volume 2, Issue 5.

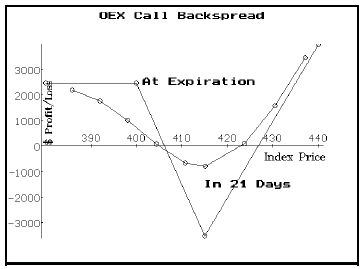

The profit graph above shows the profitability of this position. Notice the shape of the profits at expiration (straight lines) agree with the general shape of a call backspread. There are 43 days remaining until May expiration, so there is not an extraordinary amount of time for OEX to become volatile. However, the curved line shows the potential profit and losses in 21 days. Notice that even if OEX is between 410 and 415 at that time, the losses are still relatively small as there will still be a good deal of time value premium in the long options. Of course, if OEX is at 415 at May expiration, the losses will mount substantially. Investment: The margin requirement for a backspread is the difference in the strikes (4 times $1500, or $6000, in this spread) less the net credit ($2375 after commissions at the above prices) for a net requirement of $3625. This number happens to be the maximum risk if OEX were to close at 415 at May expiration. Follow-Up Action: Since the position has limited risk, our follow-up action is limited to adjustments to take profits after OEX moves. Call the HOTLINE if OEX trades at 397, or if it trades at 420. Additionally, there is the risk of early assignment of the May 400 calls if they are in-the-money as expiration approaches. We will make HOTLINE and newsletter comments on this possibility. However, in the absence of a specific follow-up recommendation, if you are assigned on any May 400 calls, then remove the entire position the next morning. There is no danger of early assignment as long as the option has some time value premium remaining in it; thus there is no worry of early assignment at the present time.

© 2023 The Option Strategist | McMillan Analysis Corporation