By Lawrence G. McMillan

This article was originally published in The Option Strategist Newsletter Volume 4, No. 13 on July 13, 1995.

Most option traders quickly realize that time is a very heavy factor weighing on the price of an option. This lesson often is driven home after buying an option and losing money.

Losing money by owning options sometimes leads option traders to consider selling naked options. Some option analysts have even likened selling options to being "the house" in the casino-gambler matchup. Unfortunately, that's not really an apt description. Selling overpriced options theoretically puts the odds in your favor, but merely selling options because they are a wasting asset does not create any statistical "edge" for the option seller. There is more than just time decay involved in the price of an option.

In any case, naked option writers usually understand that there is a danger in selling naked options: that the underlying stock, index, or futures contract can explode on a gap opening. Such an explosion leaves the option writer with losses, with no chance to cover at limited losses due to the trading gap.

For many option traders, selling naked puts is more "acceptable" than selling naked calls, at least from a psychological standpoint. Some have the attitude that they wouldn't mind owning a stock if it declined and were put to them. However, losing money on the upside is a difficult concept for many to overcome.

We are now in a period that has caused many losses for writers of naked calls and naked straddles. The recent broad advance by the market has decimated many of these accounts. This has happened in the past, too. One of the first such occurrences came in the spring of 1978, shortly after puts were first listed by the option exchanges. At that time, Congress' willingness to discuss reducing the capital gains tax caused the market to explode one Friday, bringing ruin to many straddle writers. IBM, which at the time was selling for about 225 dollars per share, jumped over 30 dollars in one day.

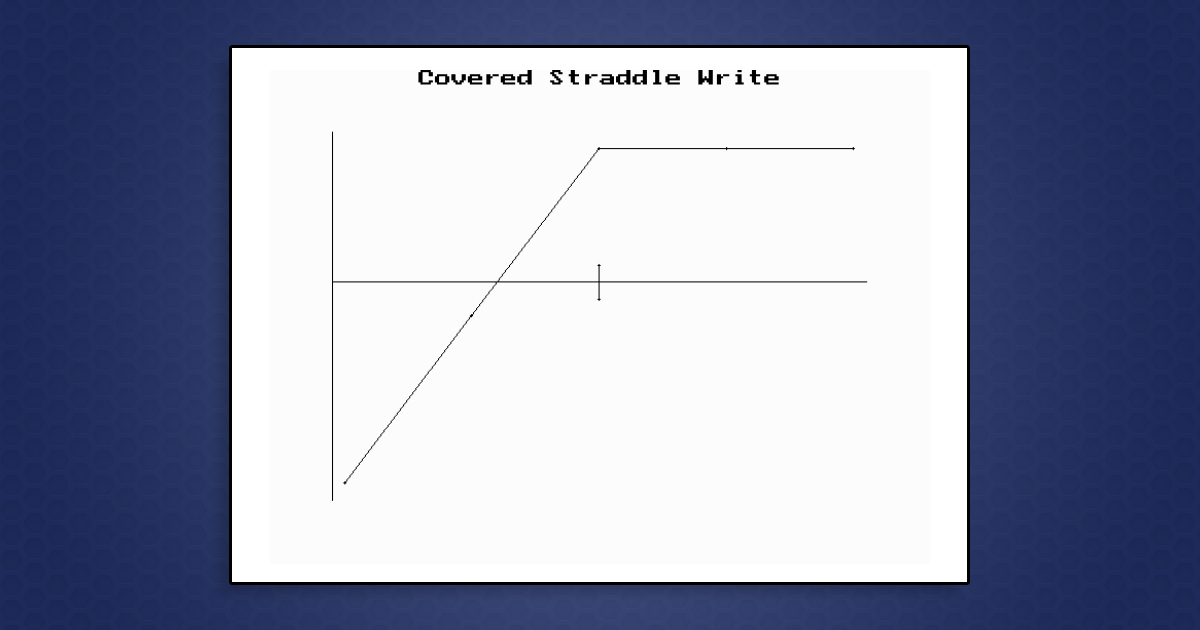

In the wake of the debacle that naked straddle writers suffered, another approach to straddle writing became a little more popular, but it has never really captured the fancy of large quantities of option traders. It is the covered straddle, in which one buys 100 shares of the underlying stock and also sells a straddle at the same time. The call from the straddle sale is covered by the ownership of the stock, so what one really has is a covered call write plus a naked put. The attractiveness of this strategy is that you are capturing the time decay of both the put and the call, without any upside risk. This is a fairly bullish position because, if the price of the underlying falls dramatically, you will lose money on both the long stock and the short put. It has limited upside profit potential, although if the stock remains relatively unchanged, the covered straddle writer would capture a fair amount of decaying time value premium.

You may recall that naked put selling and covered call writing are equivalent; that is, they have the same profit potential: limited upside profits and large downside risk. So a covered straddle — which is a covered write and a naked put — is equivalent to selling two naked puts. The profit graph, above, shows that the shape of the profit graph is the same as the shape of both a covered write's profit graph and a naked put's profit graph.

It would be more efficient to just sell two naked puts rather than bother with the covered straddle write. It is more efficient not only in terms of collateral requirements, but also from the viewpoint that a covered straddle involves three separate securities (underlying, call, and put), while the naked put involves only one. Using solely naked puts would lower commission costs and would also avoid your having to deal with three bid-asked spreads.

This article was originally published in The Option Strategist Newsletter Volume 4, No. 13 on July 13, 1995.

© 2023 The Option Strategist | McMillan Analysis Corporation