By Lawrence G. McMillan

This article was originally published in The Option Strategist Newsletter Volume 16, No. 21 on November 8, 2007.

In the past couple of weeks, I’ve read articles and heard options traders talking about a strategy that is apparently becoming more widespread: the use of long-term options in a position as the preferred hedge when selling near-term premium. These types of strategies generally fall into the category of “diagonal spreads.” While this isn’t exactly revolutionary thinking, it is a new era in the popularity of diagonals. As with any strategy, there are nuances that may not always be obvious to those inexperienced with using it. So, we thought we’d go over some of the benefits and drawbacks of using these strategies.

Some Definitions

In general, if one sells a near-term option at one striking price and buys a longer-term option at a different strike, a diagonal spread has been established. The opposite can be done – selling long-term options and buying near-term ones, but those are usually termed reverse (diagonal) spreads. We’re going to concentrate on the “regular” type of diagonal in this article – where the long-term option is bought. The term “diagonal” is generic in the sense that the nearterm options being sold may have higher or lower strikes than the long-term options being bought. It doesn’t make any difference. Typically one uses the “regular” name for a strategy – say, a bull spread – and then adds the term “diagonal” to it if the long options are moved out in time. Consider a diagonal bull spread.

Example: a “regular” bull spread might be:

Buy 10 XYZ Dec 30 calls

Sell 10 XYZ Dec 35 calls

As an alternative bullish spread, a diagonal bull

spread would then be:

Buy 10 XYZ March 30 calls

Sell 10 XYZ Dec 35 callsWhy Are Diagonals Suddenly Popular?

Before getting into individual strategies, let’s discuss why the diagonal approach may be gaining a foothold with traders. It is likely due to the fact that volatility has increased so much, across the board, and traders are looking for ways to sell it without taking overly large risks. That is, they want a hedge for the premium sale of nearterm options.

Options with the least exposure to time decay are, of course, long-term options, so traders would want to buy those to hedge the sale of expensive, short-term options. However, those long-term options can be rather expensive – strictly in terms of price, not necessarily implied volatility. So, to mitigate that, traders often buy the longterm options a little farther out-of-the-money than the options they’re selling, thus creating a diagonal spread.

In its latest issue, Futures Magazine featured a Commodity Pool Operator who is using diagonal condors. Meanwhile, while I was at the OptionsXpo in Chicago last week, the single topic that I was asked the most about was using diagonals. As a final piece of evidence regarding the newfound popularity of this strategy, the lead instructor of The Options Institute, Jim Bittman, commented to me, that the strategy that is being pursued the most is buying longterm LEAPS and selling near-term calls against them; sort of a covered write substitute.

We sometimes use diagonals in this newsletter. There are currently three – or the remnants thereof – in place, as noted on page 4. They are all diagonal backspreads (Positions E719, E723, and E724 – and Position E721 was just closed out). We have had some success, but I’m not ready to make every spread a diagonal spread. Let’s see why.

Does That Extra Time Really Help?

In analyzing whether or not diagonals really aid a particular strategy, let’s try to isolate the effect that buying that extra time value has on a position. One simple way to illustrate this is with a calendar spread. First, we’ll look at a more or less “normal” calendar spread, where there is a slight skew in our favor, and there are two months between the expiration of the long-term and short-term options:

Example: simple calendar spread: XYZ: 49 Buy 1 XYZ Feb 50 call @ 5.5 (55.2% IV) Sell 1 XYZ Dec 50 call @ 4.0 (63.5% IV)

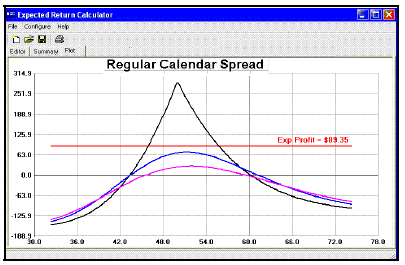

This spread has the typical profit graph as shown below, with an expected profit1 of $89 (assuming that XYZ has a volatility of 40%). Expected return: 89/150 = 59%.

You can see from the above graph that profits build slowly (the pink and blue curved lines are 2 and 4 weeks hence), and then can increase rapidly to the black line at December expiration. The absolute risk is limited to $150 – the debit (cost) of the initial spread. At December expiration, the position makes money between 43.30 and 60.25.

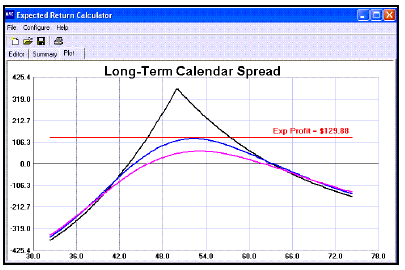

What happens if we buy more time? Suppose that we buy the XYZ August 50 calls instead of the Feb 50's? Suppose that we can buy the Aug 50 call for a price of 9 (50.4% IV). This August call is trading with a slightly lower implied volatility than the Feb 50, and it obviously decays more slowly. So the XYZ Aug 50 - Dec 50 calendar has a profit graph that looks like this:

At first glance, this looks like a big improvement. The expected profit jumps to $130, and the maximum potential profit (at December expiration) is about $350, as compared to about $275 for the “regular” calendar. The profit range is slightly wider, extending from 43.30 to 63.50 (note that only the upper end of the profit range moves – a “quirk” of the lognormal distribution assumed for these evaluations). It is at this point that many people end their analysis – figuring that the purchase of the longer-term option has definitely improved the position.

But has it really? The investment for this longerterm spread is 5 points, or $500, so the expected return drops to 130/500 = 26%. Moreover, the risk is now $500 per spread if a large stock price change takes place. These numbers compare with 50% expected return and risk of $150 per spread for the “regular” calendar spread.

I find that this is what diagonalization often does for a strategy: it increases both the expected dollar profit and the absolute dollar risk, while perhaps creating a bit wider profit range. Most of these are positive – but the larger absolute dollar risk is what usually proves to be one’s undoing. A surprising, large gap move by the underlying can be very detrimental, for the extra money spent for the long-term options is lost – or at least the extra time value that was purchased can be lost on such a big stock move. Moreover, a decrease in implied volatility proves costlier in a diagonal spread.

Diagonal Strategies

In any diagonal strategy, one of the benefits is that the near-term calls can sometimes be rolled month after month, as long as the longer-term call has not yet expired. This is not something that one can count on, but it can often add some potential to the strategy. However, it is still best to analyze a diagonal position at the expiration date of the near-term options. This is the proper way to assess expected returns.

Covered Call Writing

As noted earlier, a popular strategy is buying LEAPS calls (in-the-money) and selling near-term at-the-money calls against them. This can also be thought of as a diagonal bull call spread. This is an inferior strategy, and it’s disappointing that so many people seem to think it’s attractive. I would generally have to classify these practitioners as novices. There is a lengthy example of why this strategy doesn’t work in my book, McMillan On Options, so I won’t go into a lot of detail here. But suffice it to say that this strategy runs into trouble when the stock either rises or falls too far, too fast. It works great if the stock remains relatively unchanged, so that one can keep rolling the near-term option for credits. But to expect a stock to remain relatively stationary during a majority of the life of a LEAPS options is unrealistic, especially in an environment as volatile as the current one.

Jim Bittman pointed out that some traders – disappointed in the results using LEAPS – have modified the strategy to the point where they buy a two-or-three month in the money call and sell near-term at-the-money calls against it. That approach is much more reasonable and is one that I could tolerate, if not necessarily espouse.

Diagonal Strangle Sales

Rather than trying to diagonalize something like covered call writing, most of the strategies I was questioned about in Chicago were more neutral. They had to do with traders trying to sell straddles or strangles and hedge those sales with longer-term options farther out of the money. Such strategies are arguably more sophisticated than merely trying to diagonalize a covered write.

First let’s look at the (iron) condor, which is really an attempt to sell a near-term strangle (out of the money call and out of the money put) to capture its premium, but to also hedge it. In an iron condor, the hedge is to buy a farther out of the money call and a farther out of the money put.

Example Condor: XYZ: 50

Buy XYZ Dec 60 call and Sell XYZ Dec 55 call

and Sell XYZ Dec 45 put and Buy XYZ Dec 40 put

The problem with condors is that one can lose his entire investment if either spread finishes at its maximum loss. There are ways to mitigate this (which we wrote about in Volume 16, issues 7 and 9 this year), but there is still considerable percentage risk.

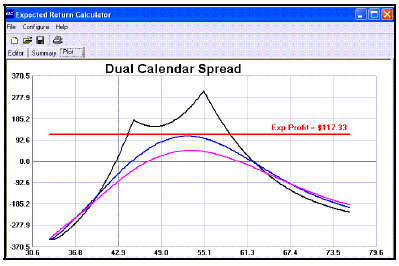

Therefore traders look at other ways to sell a nearterm expensive strangle and hedge it. We use the dual calendar spread quite a bit – especially when there is a horizontal skew – and it is really just a way to sell the nearterm strangle and hedge it with a longer-term strangle, using the same strikes for the long-term and short-term options at both the higher (call) strikes and the lower (put) strikes. A typical dual calendar spread and its profit graph look:

Example Dual Calendar: XYZ: 50 Buy 1 Mar 55 call: 4.00 (46% IV) Sell 1 Dec 55 call: 2.00 (54% IV) Buy 1 Mar 45 put: 3.00 (48% IV) Sell 1 Dec 45 put: 1.75 (58% IV)

As you know, we usually even out the peaks by establishing a few more put spreads than call spreads. The breakeven points, at Dec expiration, are approximately 42.5 and 62. The expected profit is $117 on an investment of $325, or a substantial expected return of 36%. The entire debit of $325 is at risk, if the stock moves well beyond either strike.

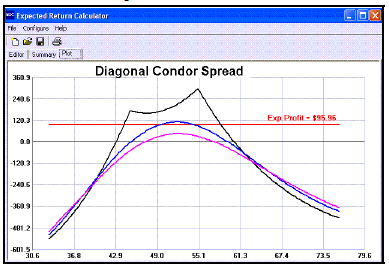

Some traders feel the dual calendar has too much money invested in the longer-term options, and thus they diagonalize the position. It is generally call a diagonal condor and looks like this:

Example Diagonal Condor: XYZ: 50 Buy 1 Mar 60 call: 3.00 (49% IV) Sell 1 Dec 55 call: 2.00 (54% IV) Buy 1 Mar 40 put: 2.00 (55% IV) Sell 1 Dec 45 put: 1.75 (58% IV)

Again, there is a skew working in favor of this position, although not as great as the skew in the dual calendar. The breakevens are about 42.8 and 60.3 – actually worse than the dual calendar. The expected profit is $96 and the investment is only $125, so the expected return is a whopping 77%.

So, on the basis of expected return, the diagonal condor is better than the dual calendar spread. However, both strategies have a similar potential problem: if the implied volatility of the long-term (March) options declines (presumably, after the “event” takes place which caused the implied volatility skew in the first place), the position could lose money. In the above examples, if the implieds of the March options were to drop to 40%, say, then the expected profits might be wiped out.

And in both strategies, if XYZ is still near 50 when the Dec options expire, it might be feasible to sell a Jan or Feb strangle while continuing to hold the longer-term March strangle.

Other strategies can be diagonalized as well. As noted earlier, we often use a diagonal call backspread instead of a “regular” backspread.

Summary

It is possible – and perhaps preferable – for a diagonal strategy to be “tweaked” so that it has an appropriate delta and gamma. This can often be accomplished by buying additional diagonal spreads. For example, if one is establishing diagonal condors on the $SPX Index, he might worry that a swift downside move could be his undoing, so additional puts could be bought to impart a larger gamma and a negative delta to the position. That might cost a little in a bull move, but could provide substantial rewards during a sharp broad market decline.

Diagonals shouldn’t be used routinely, though, because of the risk of an implied volatility decrease in the longer-term options. So, one should analyze the potential diagonalization of any strategy by valuing that risk. If it does occur, one would almost surely have been better off in a non-diagonal spread. Hence, like any strategy, diagonal spreads can’t be used in all situations.

This article was originally published in The Option Strategist Newsletter Volume 16, No. 21 on November 8, 2007.

© 2023 The Option Strategist | McMillan Analysis Corporation