By Lawrence G. McMillan

This article was originally published in The Option Strategist Newsletter Volume 15, No. 7 on April 14, 2006.

Over the years, we have published several articles dealing with the frequency of stock and index options expiring worthless. Generally, they don’t expire worthless nearly as often as (incorrect) conventional wisdom thinks. At a recent seminar, an attendee asked for the same data concerning futures options, and we didn’t have it! So, we’ve begun some research, and it looks like it could be quite interesting. In this article, we’ll look at a few of the futures markets, with the idea of adding more of them, as time for research permits.

It appears that percentages of options expiring worthless vary quite widely among the individual futures markets. Not only that, but the month-to-month comparisons can be quite volatile, as well. In this article, we’ll examine the raw data for three futures option markets – S&P 500, Gold, and Silver.

Then we’ll try to discern whether this data is repeatable enough to be useful in general option strategies.

S&P 500 Futures Options

We looked back at open interest figures for each expiration month over the last six years. On average, 47% of S&P futures options expire “with value.” That is, they had a settlement price of 20 cents or more at the end of their life. That figure – coupled with the fact that about 10% of all options are closed out prior to expiration in trades where both the buyer and seller are executing closing transactions – indicates that about 57% of S&P 500 futures options expire with value.

That is a figure which is somewhat close to the figures we normally see for listed stock options. It should be pointed out, too, that the percentages of listed stocks options that expire worthless have been increasing in recent months. We suspect this is due to the fact that many traders are buying (cheap) out-of-the-money puts to hedge long stock positions.

What makes the futures options data different from the stock option data, though, is how wide the monthly swings are. In some months, only about 30% of S&P 500 options expire worthless, while in others, over 70% do. For example, in January, 2006, 44% expired worthless, while last month (March), 67% expired worthless. Those kinds of monthly swings are not found in the stock options (although we have never conducted research strictly on $SPX or $OEX options, so perhaps index options have slightly different characteristics than stock options do).

Also, since swaps, index arbitrage, and other nonspeculative forms of futures cross-hedging are very prevalent in the S&P 500 contracts, it is possible – even likely – that those are distorting the monthly figures as well. We also know that the condor strategy – buying and selling options that are deeply out-of-the-money – is widely popular these days. Even if one side expires in-themoney, the other will not, so condors contribute an expiration percentage of 0% (if all expire worthless) or 50% if one side expires in the money. This sort of strategy is not particularly prevalent in stock options and therefore contributes very little volume. However, in index options, it is used a great deal, and hence distorts the expiration percentages.

As a result, we don’t see any particular strategy (say, selling naked options) that is justified, based solely on the average percentage of S&P 500 futures options expiring worthless.

Silver Options

The COMEX changed the expiration date (day of the month) for Gold and Silver futures options in December, 2002. So we only used data since that date to construct the percentages for Silver and Gold options.

Silver options are not nearly as liquid as S&P 500 options, so the monthly percentage swings are even more volatile. But, over the 4+ years, about 46% of Silver options have expired with value.

As a result, adding in something along the lines of 10% for positions closed out, where both parties are entering closing trades, slightly more than 50% of Silver options appear to expire with value.

This is heavily dependent, though, on what is actually happening in the futures market. For example, Silver had a strong, steady rally from mid-February through the March expiration date. As a result, nearly all April calls (which expired on 3/28/2006) were in-themoney at expiration. That amounted to open interest of almost 5,000 calls that expired in-the-money. Conversely, there were about 9,000 puts open as expiration occurred, and about 8,000 of those expired worthless. The bottom line was that 60% of silver option open interest expired worthless in March (which was technically the expiration of the April options).

Also, there is a large distortion in Silver option open interest, depending on whether or not the options are serial options or not. Silver futures expire in Jan, March, May, July, Sept, and November – every two months. There are Silver options expiring in those months, as well as in every other month. The in-between months are serial options – for their value is tied to the futures that expire in the next month. The April options that were described in the preceding paragraph had a total open interest of about 16,000 contracts. However, the March options – more liquid because they are not serial options – had open interest of about 55,000 contracts.

These are the vagaries that are common in trying to analyze data for futures options. As a result, we don’t see anything particularly unusual in the Silver option open interest expiration data.

Gold Options

Gold options, on the other hand, might present an opportunity. These have all the same problems as Silver options – serial options every other month, in particular – but they are much more liquid. Gold options generally trade three or four times as many contracts per day than Silver options.

What is surprising in analyzing the Gold open interest at expiration is that, in total since the beginning of 2003, only about 30% of these options have expired with value. In other words, about 70% expire worthless, less the 10% that we allot to closing transactions – still resulting in a whopping 60% of Gold options expiring worthless, on average. This is a much higher percentage than we’ve seen in any of the other markets we’ve studied.

On the surface, there doesn’t seem to be a logical reason for this, but one possible explanation is that “gold bugs” are quite an optimistic group. If you think stock investors are always bullish, they pale in comparison to gold investors. So perhaps, these overly optimistic traders buy call options that are too far out of the money, and they expire worthless.

In any case, if you are looking for a market in which to sell options, figuring that there’s a greater chance they’ll expire worthless, this appears to be the best one of the group. Of course, one needs a better reason than that to embark on a program of selling naked options, but it is one market that might offer above-average chances.

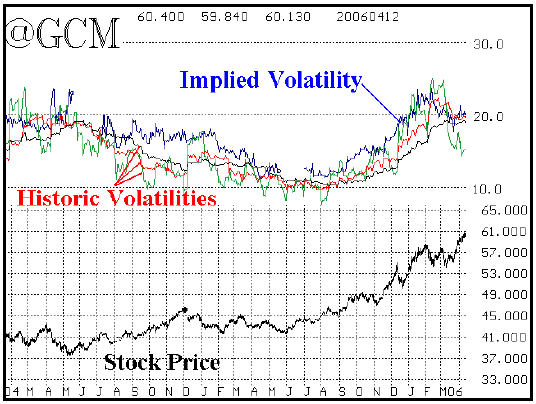

One would think that, if this were a persistent phenomenon in Gold options, that it would be observable in terms of implied volatility. In fact, it is. The graph below shows the two-year history of the June Gold futures contracts (lower portion of chart), with implied and historical volatilities on the upper portion. Note that for the majority of the time, implied volatility (the blue line) is above the others. In other words, these options are routinely expensive – another factor in contributing to their expiring worthless.

Summary

Certain futures markets appear to routinely have a large percentage of options that expire worthless. This is likely due to an underlying bias by the average option buyer to overpay. Gold is likely not the only market where this is true, so we will analyze the other most liquid futures markets for similar characteristics.

This article was originally published in The Option Strategist Newsletter Volume 15, No. 7 on April 14, 2006.

© 2023 The Option Strategist | McMillan Analysis Corporation