By Lawrence G. McMillan

This article was originally published in The Option Strategist Newsletter Volume 10, No. 22 on November 21, 2001.

This is not really a year-end tax strategy, but it is something that covered writers who are writing calls against low-cost-basis stock should consider.

It has often been stated in this newsletter and in our other publications that one must be willing to let his stock be called away if he is practicing the strategy of covered writing. (If one owns stock that he is not willing to sell and yet decides to write covered calls against that stock, he is essentially selling naked calls because he is going to treat the calls the same way that a naked call writer would). Sometimes, though, it makes sense for tax purposes to unwind a covered write rather than let the stock be called away.

Let’s assume that an investor owns XYZ stock at a very low cost basis (perhaps $1 per share or less). When the stock is trading at 45, he sells Dec 50 calls at a price of 3 – covered – against his stock. He understands that he might have to let the stock be called away at December expiration – especially if there is no reasonable alternative at that time such as rolling the December 50 calls up and/or out to another striking price.

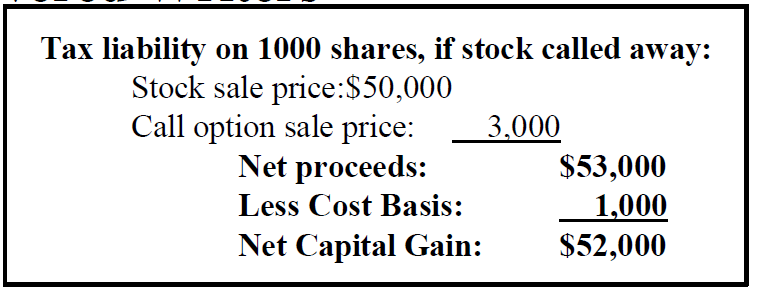

Furthermore, assume that the stock has rallied strongly since the calls were sold and is now trading at 70. The calls that he sold are now trading for 20 (parity) and in all likelihood the stock will be called away. If he does nothing, his tax liability will be assessed on $52 per share of capital gains (the 50 he receives for selling the stock at the strike price, plus the 3 he received for selling the call, less his cost basis of 1). See the box, above right, for verification of these figures for a 1000-share position.

There is a way in which the investor can reduce his tax liability and still retain ownership of some of his stock. Essentially that requires buying back the written calls in the open market and selling off enough stock to pay for the purchase of the calls.

Here’s how it works: Suppose the Dec 50 calls are trading at 20, with the stock at 70 as expiration draws near. In order for the next computation to make sense, we need to make an assumption about how many shares are owned – say it’s 1000 shares (and 10 calls were written against it).

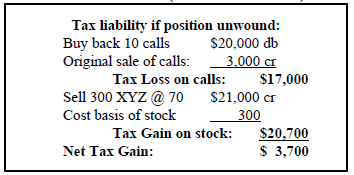

If one were to buy back the 10 calls at a price of 20, having sold them at 3, that would cost $20,000 and would entail a tax loss of $17,000. Since the stock is now selling at 70, he could sell off 300 shares of the stock to bring in $21,000 – enough to pay for the calls. Of course, he would have a tax liability on the sale of that stock, but it would be largely offset by the tax loss on the calls. The box below summarizes the exact details. The net effect is that his tax liability is greatly reduced, he does not have to pay any money out of pocket, and he still owns 700 shares of his low-cost-basis stock (albeit now uncovered).

This article was originally published in The Option Strategist Newsletter Volume 10, No. 22 on November 21, 2001.

© 2023 The Option Strategist | McMillan Analysis Corporation