By Lawrence G. McMillan

This article was originally published in The Option Strategist Newsletter Volume 12, No. 10 on May 22, 2003.

Most people think of covered call writing as at least partial protection against a downside move by their stocks. Of course, buying a put as protection for a stock position affords a lot more protection – in fact, complete protection below the striking price. But call writing is generally more popular because it involves taking in option premium rather than paying it out. Still, there are times when one strategy is clearly superior to the other. This is one of those times. So, in this article, we’ll compare how stock owners should view the two in any environment and then specifically address the current environment.

The Basics

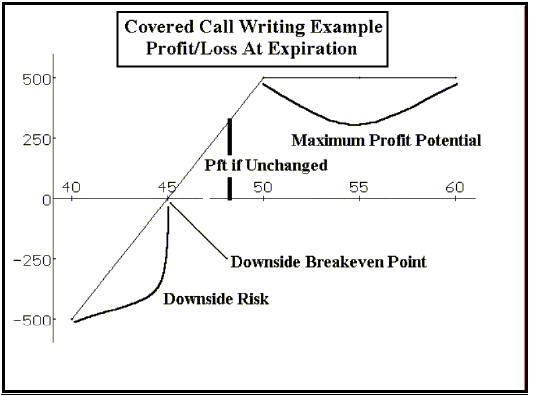

Let’s begin by reviewing the basics of the two strategies, just to make sure everyone is on the same page. Covered call writing involves selling a call option against a long stock position. The stock is sometimes purchased at the same time the call is sold (a covered call write) or, alternatively, the call can be sold against stock that is already in the account (still a covered call write, but sometimes called an “overwrite”). In either case, what results is a position that has less risk than the outright ownership of the stock (because of the call premium received), but the sale of the call limits upside profit potential above the striking price of the written call. These points are illustrated in the chart below, for the following covered call write:

Buy XYZ at 48

Sell the July 50 call at 3.

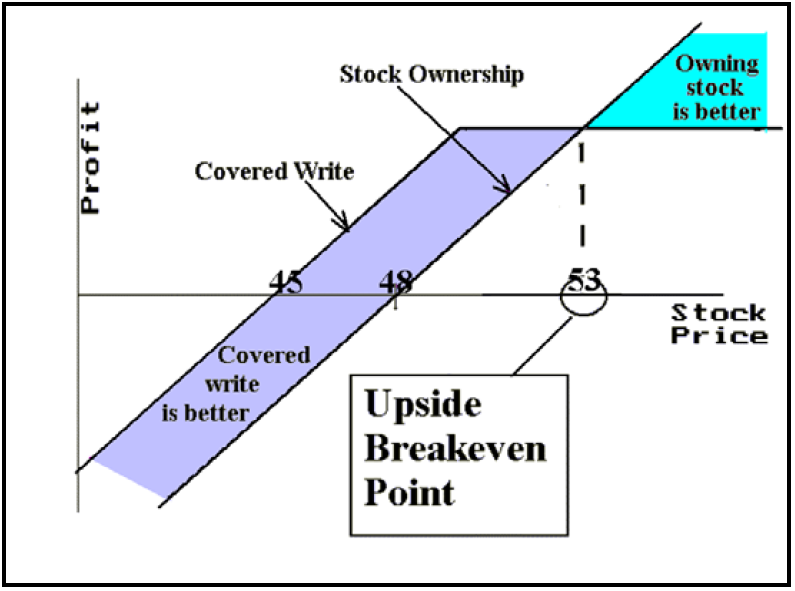

Another price point that traders should be aware of, but most covered writers are not, is the point at which outright ownership of the stock outperforms the covered call write on the upside. I call this the “upside breakeven point.” Simply stated, if one feels that the stock has a good chance of exceeding this price during the life of the option, then he should not establish a covered call write. One can often get a better handle on the probabilities of such an event occurring by using a probability calculator. The “upside breakeven point” for this covered call write is shown in the second graph on the right. The breakeven price for this example is 53. At prices higher than the “upside breakeven,” stock ownership is superior; at prices below the “upside breakeven,” the covered write is superior – but only by the amount of premium from the call sale.

One other point about the covered call write: the position is equivalent to the sale of a naked put option. That is, both strategies have limited upside profit potential, make money if the stock remains unchanged, and could experience fairly large losses if the stock declines substantially.

While there are a number of reasons why a stock owner would write a covered call, one of them is that it provides a modicum of downside protection. Writers who feel this way often sell covered calls when they expect the market – or more specifically, the stock in question – to stagnate or fall. Obviously, this strategy would be more theoretically attractive if the call were expensive when it was sold.

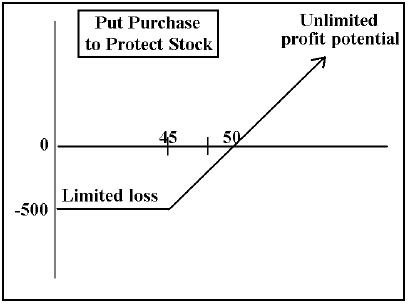

Now, let’s address the other protective strategy – the purchase of a put against the stock that one owns. The profit graph of this strategy is shown on the right, for this example position:

Buy XYZ at 48

Buy the July 45 put at 2

This strategy has somewhat opposite qualities from the covered call write. It has unlimited upside profit potential, as opposed to the limited profit potential of a covered call write. In the case of the put purchase for protection, one expends premium, which means that if the stock remains relatively unchanged, the strategy will lose money. On the other hand, one of the most attractive features about a covered call write is that it will make money if the stock remains relatively unchanged – in fact, that’s what most covered call writers hope for. Finally, if the stock falls, the put purchase for protection is far superior to the covered call write.

The above paragraph defines – in words – the comparison between the two strategies. However, with options, one is generally able to construct a more well-defined measure for almost any situation.

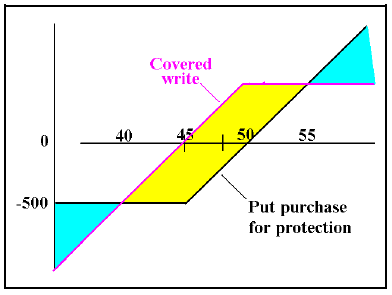

Thus, in the comparison of these two strategies, we can overlay them on the same graph and see which is more likely to be the better one. Not only that, we can see how that outcome might change if options were cheap or expensive – for, with these two strategies, the comparison changes greatly when the “expensiveness” of options is considered – that is, when we factor in implied volatility.

The graph on the right directly compares the two previous examples. The blue shaded areas on the ends (above a stock price of 55, and below a stock price of 40) extend out much farther than shown in the graph, and they describe where the “put purchase for protection” outperforms the covered call write. If one thinks about just how far a stock could rise or fall during the life of the option, the blue area could be quite large in many circumstances. On the other hand, the yellow (middle) area shows where the covered call write outperforms the “put purchase for protection” (between 40 and 55, at expiration). While this area may seem quite small in comparison to the blue area, it is more probable that the stock will remain in the yellow area than traverse out to one of the blue areas. For example, suppose that in this example, the historical volatility of XYZ stock were 50% (which gives 2-month options approximately the prices shown on page 2), and the historical (actual) volatility were 60%. Thus, we need to ask, “What is the probability that the stock, which is currently at 48, is above 55 or below 40 at expiration, (using the 60% volatility in the projection)?” Using a simple probability calculator, the answer is 60%! That is, there is a greater chance that the stock will be outside of the target prices than inside; i.e., the put purchase is “better.” Why would the put purchase be favored? Intuitively, it seems as if someone would want to sell option premium rather than buy it. Actually, that would only be true if options were expensive. In fact, if they are cheap, then the put purchase for protection will often be the favored strategy.

Now consider another case, where the options are valued at an implied volatility of 90%. Then the prices might look like this:

XYZ: 48

July 50 call: 6

July 45 put: 5

In this case, the call covered write would be earning a lot more money because of the extra premium received. Moreover, the put purchase costs a lot more, so the stock would have to move farther to overcome the cost of the put in the “put purchase for protection” strategy. In essence, the covered write will outperform if XYZ is between 34 and 61 – a much wider range, but one would have to assume that the stock has also become more volatile if the options are so expensive. Furthermore, let’s assume that the historical volatility is only 80% when these option prices exist. The probability calculator now yields a different result (using 80% as the volatility input for the calculator): only a 45% chance the stock will finish outside of the range (34 to 61). Thus, in this light, the covered write is slightly more favorable than the put purchase for protection.

For those with a keen eye, you might have noted that just determining the probability of the stock being inside or outside of the indicated range isn’t sufficient analysis for comparison of the two strategies. What we really need to compute is the expected return – a measure that takes into account not only the probability, but also the profits generated at each price. In other words, the unlimited profit potential of the “put protection” strategy and the relatively large loss potential of the covered call write are both important and can only be accounted for by using expected return analysis.

Without going into a lot of messy detail, the expected profit of the first covered write is 1.18 points, while the expected profit of the first put protection strategy is 3.52 points. Hence this confirms what we saw with probability analysis – the put protection strategy is better when the options are relatively cheap. The second example, using more expensive options, results in about equal expected returns from both strategies, just as the probabilities were about 50- 50. Hence, the use of expected returns doesn’t change our conclusions, it just solidifies them.

Summary

When one is looking for some downside protection for his stocks, he needs to analyze the current status of the options before deciding whether to use a covered call writing strategy or a put protection strategy. When options are expensive – selling not only in a high percentile of implied volatility, but also preferably selling with an implied volatility in excess of the underlying vehicle’s actual volatility – then a covered call write may be preferable to buying a put. This is what was shown by the second example, where the options were more expensive. While the covered write has limited profit potential, the “math” says that the expensiveness of the call will generally make up for that.

On the other hand, if options are relatively cheap – selling for a low percentile of implied volatility, and also perhaps having implied volatility lower than the underlying’s actual volatility – then the covered call write is inferior to the purchase of a put as protection for the stock. This is what the first example showed. Currently options are quite cheap, and thus if one were looking to protect stocks, he should be buying puts on them rather than selling covered calls.

Of course, this analysis assumes that the stock owner is neutral or perhaps even a little bearish on his stock holding. Or at least he is worried about the downside consequences should a bearish market unfold. However, if he were outright, short-term bullish, neither strategy would be called for.

This article was originally published in The Option Strategist Newsletter Volume 12, No. 10 on May 22, 2003.

© 2023 The Option Strategist | McMillan Analysis Corporation