By Lawrence G. McMillan

This article was originally published in The Option Strategist Newsletter Volume 2, No. 24 on December 22, 1993.

We have often stated that one can reduce the risk of stock ownership by buying call options instead. This, of course, is contrary to what many consider to be "conventional wisdom", in which option purchases are viewed as extremely risky things. As with most investments — and a lot of other things in life — it's a matter of application; every strategy can't be painted with a broad brush. We'll go over the way to make call option buying a lower-risk alternative to buying common stock, and then we'll apply it to a currently popular strategy involving the purchase of the highest-yielding Dow-Jones stocks at year-end.

- Buying call options can be a reasonable alternative to stock ownership if:

- you buy an in-the-money call with little time premium, and

- you place the difference in proceeds between the stock purchase and the call option purchase in an interestbearing instrument

Example: Suppose that an investor has $5000 to invest. Assume that XYZ is trading at 50, and pays $1.00 annually in dividends. Furthermore, assume that LEAPS calls that expire in one year are available on XYZ. The 1-year LEAPS call with striking price of 45 is selling for 7 points. If one were to purchase the LEAPS call, he would be spending only $700, plus commissions, instead of the $5000, plus commissions, that would be required to purchase 100 shares of XYZ common stock. Therefore, he has $4300 in funds that he can place in an interest-bearing instrument — perhaps a one-year CD. As an owner of the call option instead of the common stock, one is not entitled to any dividends on the common. However, at an assumed 3% rate of interest, one would earn $129 on the CD, which would more than offset the $100 of dividends that one forgoes by buying the call instead of the stock.

In this example, the profit potential from owning the call option is slightly less than that of owning the common stock. The difference is that one paid 2 points of time value premium in order to buy the call option (time value premium = strike + call – stock = 45 + 7 - 50 = 2, in this case). This two points, or $200, will be dissipated by the time the call expires in a year. So, if the stock rises, the call owner will have $200 less profit than the stock owner.

Offsetting this slight decrease in profit potential is the fact that the call owner has a significantly lower risk than the stock owner in this example. The most that the call owner can lose is the $700, plus commission, that he paid for the call (and he even gets $129 of that back from his CD interest). However, the stock owner has much more risk than that. A fifty dollar stock could drop 20, 30, or more points in a bad year in the stock market. Thus, the call buyer is only sacrificing $200 of upside profit potential for the safety of knowing that his maximum loss is about $600 when all factors are considered.

Stated alternatively, at the end of the year, the call owner knows that he will have $4429 in the bank when he goes to redeem his CD. This will be true no matter how low the stock falls during the year. Since he started with $5000, the most that he could lose is the difference, or $581, plus the commission for buying the option in the first place. The stock owner's risk is much larger and totally undetermined.

There is an additional advantage to owning the call: one need not worry about liquidating his position at a most unfortunate time. We all know that one shouldn't panic out of his holdings at the bottom, but in a roaring downtrend, that is difficult advice to follow. Suppose that there is a bearish trend during most of 1994, lasting into the fall. The example XYZ stock might fall to 30. A holder of the stock might be tempted to sell, taking his loss before it gets any worse. If a large rally should ensue, he would then be out of his stock and couldn't participate. The call holder doesn't have to worry about any of this since his risk is predetermined and limited. He would not be tempted to sell out his call if XYZ fell to 30, for it would be of little avail to him. Thus, he would still be "in" the stock if it rallied back by year-end, after a sustained downward move during the year.

Bear Market Strategy For Current Stock Owners

This strategy of owning an in-the-money call instead of owning the stock can be equally well applied to one's current stock holdings. With the current market seemingly overvalued and some "seers" predicting dire things ahead, it would cost little to adjust one's portfolio by buying in-the-money LEAPS calls — on stocks where they are available — to replace current stock positions. If the net proceeds are placed in an interest-bearing instrument, the investor who switched from stock holdings to call holdings will have greatly reduced his risk in a bearish market, without having significantly harmed his profit potential. Of course, the sale of stock could incur a tax consequence, so each investor has to evaluate the applicability of the strategy for his own needs.

"High-Yielding Dow Stocks" Strategy

A strategy that has had quite a bit of publicity in recent years, including the cover article of Barrons last week, is a relatively simple one: each year at the beginning of the year, buy the 10 highest-yielding stock out of the Dow-Jones 30 Industrials and hold them for the year. This strategy has significantly outperformed the S&P 500 and the Dow itself in most years. According to Barrons, the strategy would have made money in 17 of the last 20 years, with an annual average gain of over 18%, which beats 99% of all mutual funds. There are variations on the strategy, one of which is to only buy the 5 lowest-priced out of these 10 highest-yielding stocks. It is claimed that this simple modification increases the profitability of the strategy even further. In general, the strategy has been a stellar performer because one is forced to buy high-quality (large industrial) stocks that are depressed in price; i.e., one is "buying at the bottom", theoretically.

Since the strategy has been receiving such public notice lately, it is almost certain that a large number of people are going to try it this year. That in itself should be enough to make one nervous about the strategy's prospects for 1994. In addition, if 1994 turns out to be a bearish year — as the middle year of a presidential term often is — then that might be another reason for caution. Therefore, if you are considering using this strategy this year, we urge you to implement it with call options instead. At least this will limit your risk while still leaving you with good profit potential.

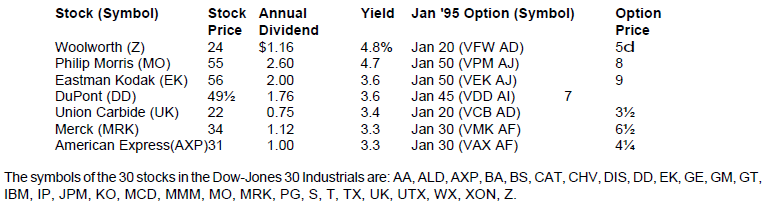

The following table shows the current 7 lowest-priced of the 10 highest-yielding Dow-Jones 30 Industrials. At year-end, only the 5 lowest priced would apply to the strategy, but since Kodak and Philip Morris are nearly equal in price, it is unclear which one will be in the "bottom 5". Also, if American Express exceeds Merck in yield, then AXP will be in and the higherpriced of either Kodak or Philip Morris will be out. You can verify for yourself which are the highest-yielding by perusing the newspaper with 12/31/93 prices (and yields) in it. The oneyear LEAPS call (expiring in January, 1995) is listed for each stock. If 1994 turns out to be a bearish year (or even contains a medium-sized correc-tion), this strategy is best implemented with calls for 1994.

© 2023 The Option Strategist | McMillan Analysis Corporation