By Lawrence G. McMillan

This article was originally published in The Option Strategist Newsletter Volume 5, No. 8 on April 25, 1996.

When traders get overly pessimistic, they sometimes create trading opportunities for those who have the patience to wait for the pessimism to reach a peak. In fact, extreme pessimism often leads to panic. Panic doesn't occur too often in the marketplace, but when it does, if you can view things in a level-headed manner, you can find some great trades.

In the option markets, we have two ways to spot extreme pessimism: high levels of put buying and/or a sharp increase in implied volatility. In both cases, we treat the option readings as contrary indicators. When panic sets in and too many puts are being bought, that is a buy signal. Many traders are familiar with this approach. However, the implied volatility approach is less well-known, because it is useable in only a certain, specific set of circumstances: when a market is declining (be it a stock, index, or futures contract) precipitously, the bottom is often coincident with a peak in implied volatility readings. There are some well-known occurrences of this phenomenon in the past. For example, as the stock market began to crash in 1987, implied volatility roared to the upside, ultimately culminating in implied volatility readings of over 40% in late October of 1987 before peaking out. Of course, that was actually an excellent buying opportunity

Less extreme examples are shown by peaks in the CBOE's Volatility Index (symbol:$VIX). Most extreme peaks in the VIX are good buy points for the stock market.

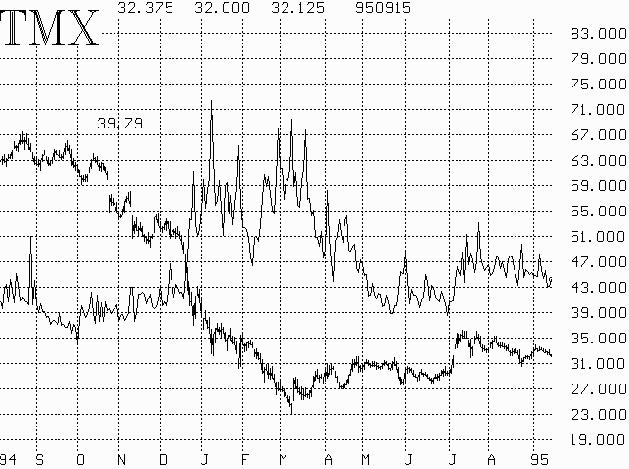

The phenomenon works for stocks, too (above). When IBM dropped from above $100 a share to its extreme lows under $50, in early 1993, implied volatility rose to extremely high levels. Eventually, IBM rallied after a peak in implieds. We saw a similar effect in Telefonos de Mexico (TMX) stock in 1995 when it was being heavily sold off as the Peso was devalued. The bottom in stock price coincided nicely with the peak in implied volatility.

The scenario works in the futures markets, too, and sometimes it is more significant there, because implied volatilities of futures options don't normally increase when the price of the underlying future is declining. For example, Platinum is currently in a bear market, but implied volatilities there are declining (see table, page 7). It's only when an extremely pessimistic mood is prevalent that futures option implied volatility increases in a bear market.

Strategy

In large extremes — IBM, TMX, and the crash of 1987 — the underlying market didn't necessarily make a V-bottom and roar away to the upside. Rather, a nice initial rally gave way to sideways movement for an extended period of time, before prices eventually worked their way higher. During much of the sideways movement, implied volatility remained high. Thus, a good strategy during that time period would have been to sell naked puts (or do covered writes, which is the equivalent strategy) or perhaps to sell credit put spreads, until implied volatility returned to its previously low levels.

This is distinctly different from the approach that is often taken when implied volatility is high. In a "normal" market, one would attempt neutral option selling strategies when implied volatility was extremely high. However, in the case of a severely declining market, a more bullish posture is warranted, but not until after implied volatility has peaked.

Cattle

This is all fine as a theoretical discussion, but let's bring it into reality. In our list of extreme volatility situations (page 7), we have seen Feeder Cattle appear for several weeks. Now, Live Cattle has joined in as well. The chart of June Live Cattle and August Feeder Cattle are shown at the top of page 3. Overlaid on the chart is the 21-day moving average of implied volatility of the options over the past two years. Note how the peak in implied volatility in May, 1995, corresponded very nicely with a bottom. Also, note how implied volatility is skyrocketing again now, as the length of the bear market in these futures begins to weigh more and more heavily on traders' psyches. Based on implied volatility, we are very near to a good trading bottom in these two markets. This buy signal is not confirmed by the put-call ratios (see charts in insert), so you may want to factor that into your trading decision.

Of course, we don't want to jump in before implied volatility peaks. So, we will establish the following method for entering a position in Live Cattle (a similar method would work, of course, for Feeder Cattle). Call the HOTLINE after the close on Tuesday (as well as the normal Friday morning) for the specific entry point.

This article was originally published in The Option Strategist Newsletter Volume 5, No. 8 on April 25, 1996.

© 2023 The Option Strategist | McMillan Analysis Corporation