By Lawrence G. McMillan

This article was originally published in The Option Strategist Newsletter Volume 18, No. 06 on March 26, 2009.

We have written about this topic many times in the past, but the $VIX futures’ ability to predict broad market movements has been called into question recently. For example, at the recent CBOE Risk Management Conference in Laguna Niguel, California, there was some discussion that the $VIX derivative products had lost their ability to “predict” movements in $SPX. That is not entirely true. What has spurred this sort of thinking is the fact that $VIX did not spike up to a peak and snap back down again when $SPX most recently declined sharply into what is so far a “V” bottom at 670. Also, discrepancies in the term structure, which at one time resulted in immediate movements in $SPX, have taken much longer to materialize in recent months than they used to.

For example, prior to September 2008 (the demarcation line between “normal” bull and bear markets and the current “crisis” market), if the $VIX futures were at a discount to $VIX, there would typically be a good rally in $SPX within a matter of a day or two.

Conversely, if the $VIX futures were trading at a premium to $VIX, it wouldn’t be long before the broad stock market sold off sharply.

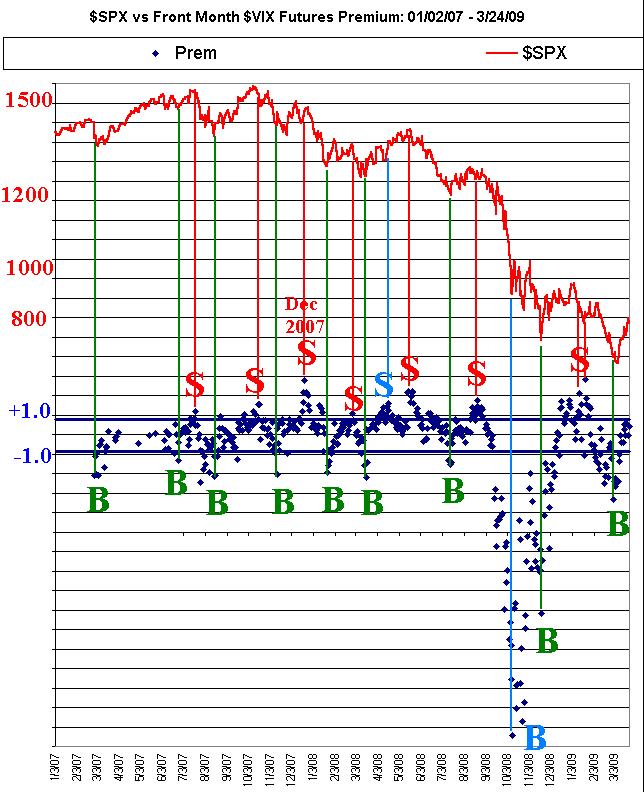

Figure 1 shows a scatter diagram of the daily discount or premium on the blended $VIX front-month futures. By “blended,” we mean a smoothing of the two f r o n t - mo n t h fu t u r e s contracts, in line with the formula used to calculate $VIX; if you don’t use the “blended” futures price or premium, then you have discontinuities when one contract expires and the next one becomes the front month.

“B” for buy has been placed on the graph where large discounts occurred. “S” for sell shows where p r e mi u m s e x i s t e d . Moreover, lines from the extreme discount or premium reading are drawn up to the $SPX chart, so that you can see where the buy and sell signals actually occurred, basis $SPX.

Anything between the two parallel lines is irrelevant, as the discount or premium in those cases was too small to be considered predictive. From the red line ($SPX) on the top of the graph, you can see that the buys and sells presaged some very large movements in the broad market. The reliability of the signals has been very good. Only the two marked in light blue were premature (one buy and one sell).

Notice that, prior to September 2008, only a few dots below the lowest parallel line constituted a buy signal. But with the crash in September/October 2008, the discounts not only magnified but persisted for quite a while. Finally, when the magnitude of the discounts began to shrink, the market rallied.

More recently, notice the series of discounts that began to appear in February 2009, as the stock market collapsed in the wave of selling that took $SPX down from 800 to 670. This series also persisted for a large number of days. But when the discounts began to shrink (about 2 weeks ago), the market rallied.

A similar feature can be seen with the sell signals associated with large premiums on the $VIX futures. At first, it only took a few dots above the highest parallel line to generate a sell signal. Then as the bear market got more severe, the premiums would build up for a longer time. The one in December 2007 was perhaps the first and most noticeable series. It is clearly marked on the chart At that time, $SPX had rallied into Christmas, 2007, and traders were expecting positive things from the Santa Claus rally, January Effect, and the like. However, the large premium began to build up on the $VIX futures about December 18th and persisted through Christmas. $SPX turned south before the end of the year and January was a disaster with $SPX falling 200 points in less than a month. That was the first time that the power of a series of premiums or discounts was discernible.

Since then, there have been several series of premiums, all of which were followed by sharp market declines. The most recent was the buildup of premiums from late December 2008 throughout most of January 2009. Once those premiums peaked, $SPX soon cracked support and went into the free-fall that ended just a couple of weeks ago.

So, addressing the topic at hand – whether the $VIX futures have lost their predictive power – we say they have not lost it. It is manifesting itself in a slightly different way, with longer and longer times during which the premiums or discounts persist, before the eventual signal takes effect.

For example, the series of premiums in December 2008 presaged the January decline. Moreover, when the first part of the decline took place (right at the beginning of 2009), the premiums persisted and even grew in size. That led to the much more severe decline in February.

Even as that decline was taking place, a series of discounts began to appear. Eventually, the size of those discounts reached its deepest level – resulting in a buy signal just two days before the actual March bottom. Admittedly, these discounts persisted for so long while the market was continuing to decline, that they lulled observers into not fully embracing the eventual buy signal.

So the futures’ relationship to $VIX is still a valid predictor, but its application has become slightly different. Rather than taking the first instance of a premium or a discount as a trading signal, it has become necessary to wait for an outlier – a maximum premium or minimum discount – as the actual signal.

In real time, this is a bit difficult of course, as one does not know where tomorrow’s premium level will be. One could just begin building the appropriate position, figuring that the market will eventually react to the signal. That type of approach can be a bit dangerous, though. For example, if one had started buying the market in February, he would have lost a lot of money before the market eventually turned higher in March.

It would be better to use some techniques for attempting to determine the maximum or minimum point. A simple approach such as waiting a fixed period, such as two days, say, might be useful. Alternatively, a short moving average, such as 3 or 5 days, might be helpful too; one would buy when the moving average rolled over and changed directions.

At the current time, the discounts persist in the back months, but in terms of the blended front-month calculation, a slight premium has arisen. As of now, it’s not big enough to exceed the higher horizontal blue line on the chart, but it could soon be. That would be a warning sign of the next decline.

In summary, it is evident that the $VIX futures blended front-month premium is still a valuable guide to the fortunes of the broad market, as measured by $SPX movements. A series of large premiums is a bearish warning, while a series of large discounts is bullish. Keep that in mind as you try to guide yourself through the treacherous waters of this market.

$VIX Spike Peak Buy Signal

The other, and more common, use of $VIX as a market predictor is to watch for a spike peak in the index as the market is collapsing. That usually signifies a maximum of fear and, as a contrary indicator, is a buy signal for the broad market. This is a very common signal – one that many people are now familiar with (as opposed to the previouslydiscussed $VIX futures premium signals – known to far fewer traders).

As the market declined in February, and especially as it fell from 800 to 660 (basis $SPX), $VIX barely rose at all. Eventually the bottom was reached and the market rallied and there never was a spike peak in $VIX. This is the reason that you may have heard traders say that $VIX is “broken.”

Part of the explanation for what happened at the early March bottom has to do with actual or historical volatility of $SPX during the decline. Despite the fact that the $SPX decline was steep and swift, it was orderly.

And “orderly” makes for low volatility, due to the quirky way that it is calculated. You may recall that actual volatility is the standard deviation of daily percentage price changes. In other words, if the market were to change by the same percentage every day – whether it is rising or falling, and whether that percentage is large or small – volatility would approach zero!

Usually, a declining market has very high actual volatility because there are sharp rallies mixed in with large down days. Large counter-trend moves increase actual volatility. But in the February decline, the decline was onerous and fairly orderly. So actual volatility of $SPX remained near 40%.

It seems that $SPX options traders were thus reluctant to pay up for the options when actual volatility was that low. Hence, $VIX remained near actual volatility – trading between 40 and 50 during that time.

Another reason that has been put forward regarding the relatively non-responsive $VIX at the March bottom is a belief that most traders who wanted protection already had in it place prior to the February decline. Therefore, there wasn’t the usual panicky buying of out-of-the-money $SPX puts as the index fell nearly 200 points in a month.

Whatever the reasons, it is clear that $VIX didn’t spike up – nor has it fallen much during this rally. So, the traditional interpretation of a $VIX buy signal did not work most recently, and that has caused many to discard $VIX as a useful market predictor. But its futures are still a useful tool. Also see the article on page 9 regarding the predictive nature of the $VIX ETN’s (VXX and VXZ).

This article was originally published in The Option Strategist Newsletter Volume 18, No. 06 on March 26, 2009.

© 2023 The Option Strategist | McMillan Analysis Corporation