Feb, 16, 2024

By Lawrence G. McMillanOn Tuesday (February 13th), there was a negative CPI report, and the market fell sharply in two heavy waves of selling. But late in the day, buyers came in and they have been...

Feb, 15, 2024

By Lawrence G. McMillanThis article was originally published in The Option Strategist Newsletter Volume 3, No. 23 on December 8, 1994. One of the most important features of options is...

Feb, 12, 2024

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on February 12, 2024.

Feb, 12, 2024

By Lawrence G. McMillanThere is a developing divergence between Cumulative Volume Breadth (CVB) and $SPX. That is, $SPX is making new all-time highs, but CVB is not. CVB is merely the running daily...

Feb, 09, 2024

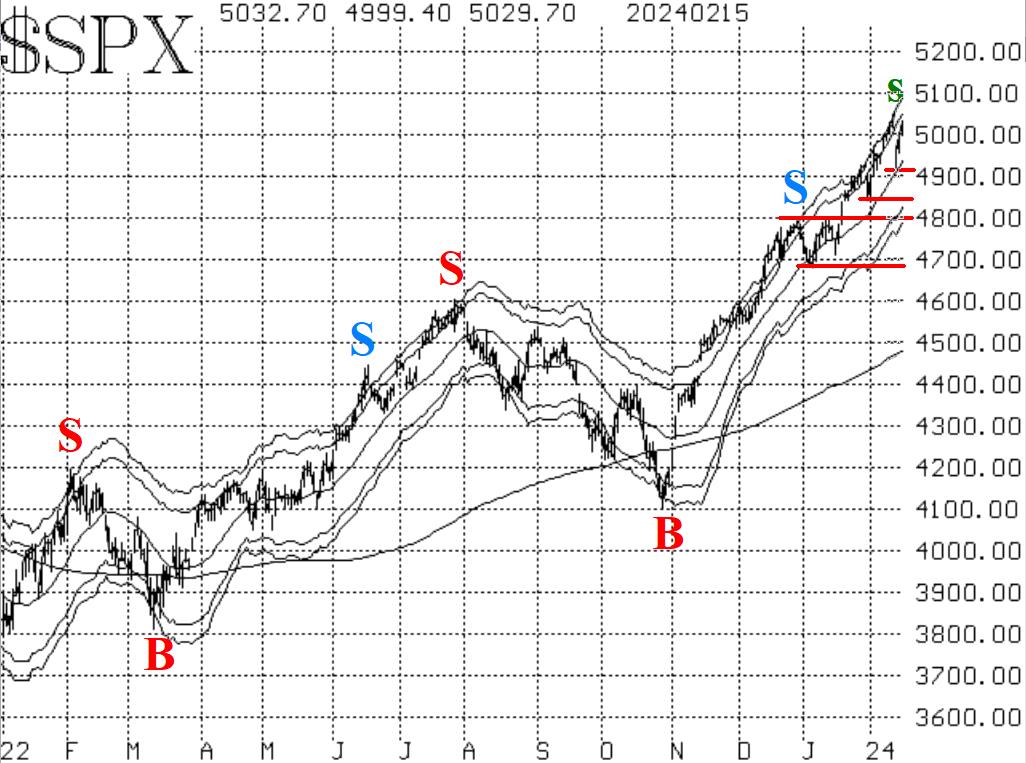

By Lawrence G. McMillanThe major indices are making new all-time highs with regularity. This includes $SPX, of course (as well as $NDX and the Dow), so we are still maintaining our "core" bullish...

Feb, 05, 2024

By Lawrence G. McMillanFebruary has been a big problem for the stock market in recent years. The table below shows the $SPX results for February going back to 2002.There were gains in 12 of the years...

Feb, 05, 2024

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on February 5, 2024.

Feb, 02, 2024

By Lawrence G. McMillanAfter roaring ahead after breaking out to new all-time highs a week ago, $SPX finally had a setback of sorts. Poor earnings from some of the high-fliers (AMD, GOOG, MSFT) and...

Jan, 31, 2024

By Lawrence G. McMillanThe full track record, including 2023, is now available on our website. The information for 2023 is going to be presented in this article. 2023 was a profitable year for our...

Jan, 29, 2024

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on January 29, 2024.

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation