By Lawrence G. McMillan

This article was originally published in The Option Strategist Newsletter Volume 4, No. 9 on May 11, 1995.

Much is written about strategy and about establishing positions. If you're bullish, buy calls, buy bull spreads, or even backspreads. If you're bearish, opposing strategies will work. Then breakeven points are calculated, rates of return are estimated, and the position is established. End of story; go calculate your P&L. Or is it? What about follow-up action? So little is written about it that many traders figure it's a sort of a seat of the pants affair.

In fact, many traders actually prefer unhedged positions because follow-up action is so easy — you just set a mental stop and stick to it. In all of our strategies, we outline a plan of follow-up action and stick to it. The most interesting (and complicated) situations occur in hedged positions where one needs to make adjustments to lock in profits or to re-adjust to a neutral position. That sort of adjustment is what we want to cover in this feature. And we have an excellent example right in our own portfolio — the OEX backspreads that we established back in late February. An in-depth look at how that position has evolved will illustrate several important points about trading neutral positions.

We first established the position as follows on 2/24/95 with OEX at 455, for a total debit of 3¾ points:

- Bought 10 OEX May 460 calls at 7

- Sold 5 OEX May 445 calls at 16½

- Bought 5 OEX April 445 puts at 3¼

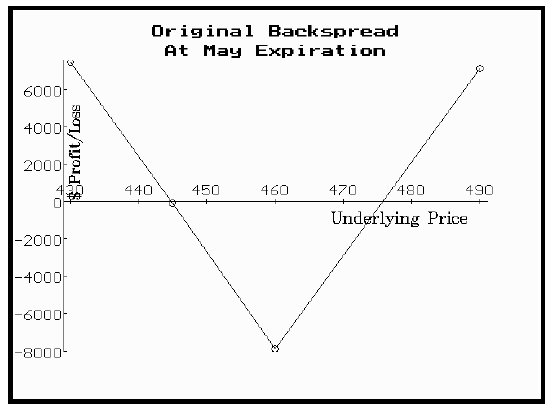

The puts were added to give additional downside potential to the position in case the market collapsed. The profit graph on the top of the next page shows the initial profitability of the spread. Breakeven points (at parity) were 444.25 on the downside and 475.75 on the upside. Profit potential was large and virtually unlimited outside of that range, while the maximum loss of 78¾ points would have occurred if OEX were at 460 at expiration.

As things developed, OEX rose quickly and within a little over a month, was trading at 471. At that point in time, the position had a nice unrealized profit, but had become very delta long. The prices at that time were:

May 460 call: 15¼

May 445 call: 23½

April 445 put: 0 (expired)

Thus, we could have sold our 10 May 460 calls and bought back the 5 May 445 calls for a total credit of 35 points. Hence our total profit was that 35 points, less the initial 3¾ debit, for a $3125 unrealized profit less commissions.

The owner of this backspread faces three choices at this point: 1) do nothing and remain long about 400 "shares" of OEX; 2) close the position and take the profit; 3) adjust the position to make it more market neutral. Since we initially had established the position to take advantage of "cheap" OEX options, we decided to re-neutralize the position. This was mainly because we didn't feel comfortable being so delta long in a market that had the potential to explode in either direction. So we did this trade:

- Sold 10 May 460 calls at 15½

- Bought 13 May 475 calls at 5½

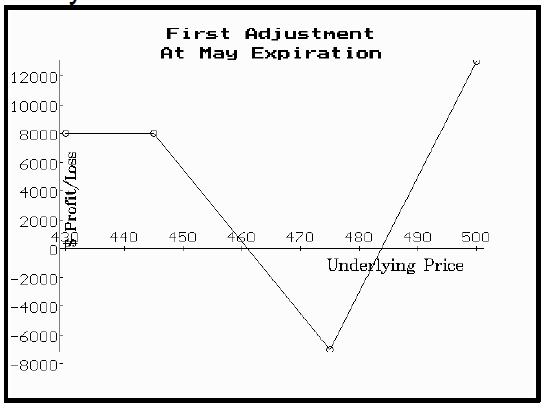

This brought in a credit of 83½ points, to go with the initial debit of 3¾, meaning the overall position had a net credit of nearly 80 points. The revised profit picture then looked like the above graph. Notice that the downside breakeven is 461 and the upside about 484 — pretty much neutral about the current OEX price of 471.

Once this decision to remain neutral was made, it was a rather simple matter to continue to remain neutral on further OEX price increases, as long as OEX options continued to have low implied volatility. If implied volatility were to rise dramatically, then we would consider removing the position. Two more adjustments were made as OEX skyrocketed to the upside. Each time OEX moved about 10 points higher, another adjustment was made. We chose to keep the quantity of long calls constant as we rolled up, which is a slightly bearish adjustment. If one were to retain the 13-to-10 ratio in his rolls, as we did in the first adjustment, then he would be keeping the position almost perfectly neutral. In any case, these were the adjustments that we made:

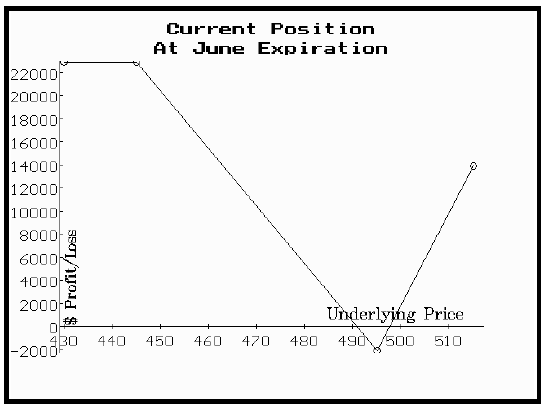

4/21/95: Sold 13 OEX May 475 calls at 13½

Bought 13 OEX June 485 calls at 9

Credit: 58½ points

5/5/95: Sold 13 OEX June 485 calls at 14½

Bought 13 OEX June 495 calls at 7½

Credit: 91 points

Note that these are bear spreads in the classic sense, so what we were doing each time was adding a bear spread to a very bullish position (it was bullish because the calls were well intothe- money).

The above credits bring the net credit for the position to date to just over 229 points ($22,900) less commissions. The profit graph on the right shows the effect of all these adjustments. So many profits have been taken that there is virtually no longer any risk of loss. Moreover, the position is once again quite neutral, as can be seen by the V-shaped profit potential, centered now at 495. Of course, the unrealized profit has now grown as well — to over $8000. Thus, it would still be costly if OEX were to go into a tight trading range near 495, for we could lose all of that unrealized profit.

We do not expect OEX to become docile. In fact, we expect even more market volatility in the near future. However, should our profit begin to dissipate due to a stagnant market, we will have to make a decision as to when to realize our final profits (before they become losses).

One final note: we have now rolled the May 445 calls to June 445 since May expiration is approaching. Some subscribers asked us about the possibilities of early exercise. This possibility is relatively small until the last couple of days before expiration, but should you ever get assigned, you should immediately replace the short calls with other deep-in-themoney calls that have some time value premium in them. This is mandatory because those short calls are providing the downside profit potential.

This article was originally published in The Option Strategist Newsletter Volume 4, No. 9 on May 11, 1995.

© 2023 The Option Strategist | McMillan Analysis Corporation